Beautiful Work Accretion Accounting Example

Generally accretion is recognized as an operating expense in the statement of income and often associated with an asset retirement obligation.

Accretion accounting example. Lets assume Company XYZ decides to buy Company ABC. While accretion is a gift bestowed on landowners by Mother Nature land can also decrease in size through erosion and avulsion. The term accretion is used in real estate law to refer to an increase of land due to the accumulation of soil on the shoreline of a lake stream or the sea.

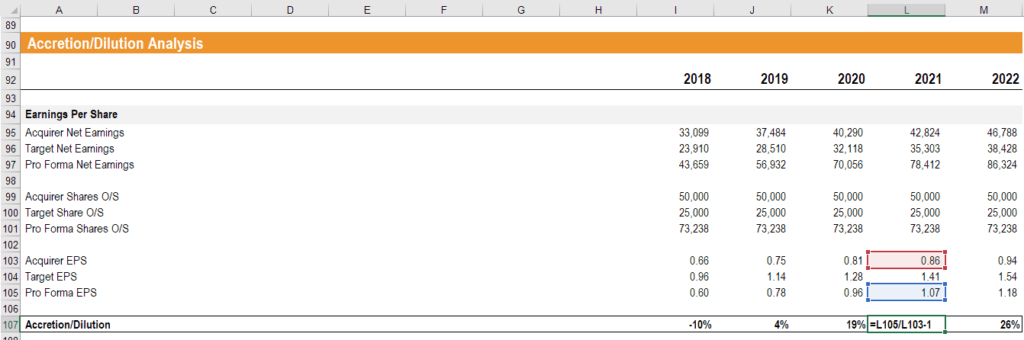

Divide the total net income for the company by the number of shares outstanding. The step-by-step guide to perform Accretion Dilution Model is presented with a quick example like below. The EPS ratio is 2.

For example after year 2 the accrual can be calculated as. Determine the acquirers EPS the target companys EPS. How Does Accretion Work.

By holding the bond until its maturity the investor gradually earns a profit on the difference between the discounted purchase price and the face value of the bond. Accretion of Discount Example Now lets take an accretion example here. To explore this concept consider the following accretion real estate definition.

Accretion is growth typically in earnings usually after an acquisition or other significant event. Numbers of acquirers EPS and targets EPS are projected numbers. Youll see this entry outlined in our example below.

Accretion and Dilution refer to a simple test that determines the impact of an acquisition or merger on the buying firms Earnings per Share EPS Earnings Per Share Formula EPS EPS is a financial ratio which divides net earnings available to common shareholders by the average outstanding shares over a certain period of time. Accretion which involves adjusting the cost basis price paid of the bond toward par each year that the bond is held increases both the cost basis of the bond and the reported interest income. Accretion for an Acquisition Determine the earnings per share EPS for a company that is buying another company.