Beautiful Work Balance Sheets Uk Tax Example

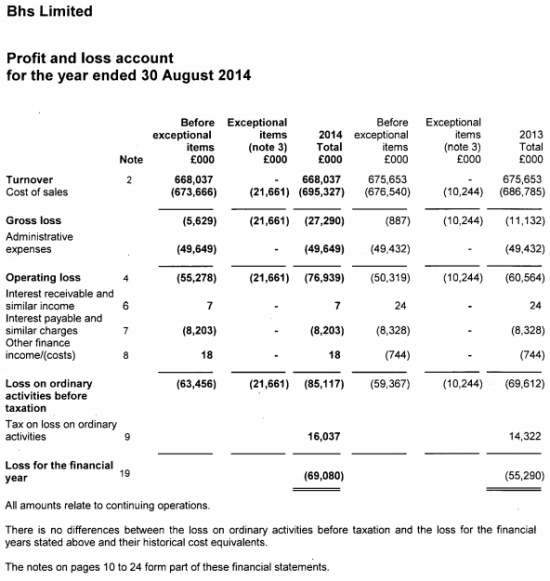

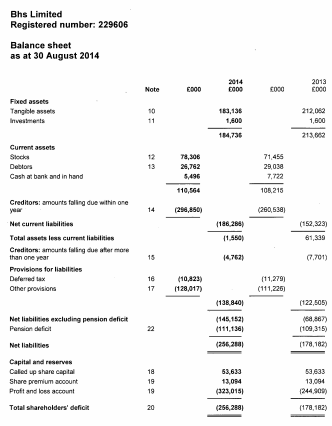

The balance sheet is so-called because there is a debit entry and a credit entry for everything but one entry may be to the profit and loss account so the total value of the assets is always the same value as the total of the liabilities.

Balance sheets uk tax example. Weve put together an example and format of a balance sheet. Enter Your Reg Plate To Access Your Vehicle Information Plus Ways To Renew. On the balance sheet net income appears in the retained earnings line item.

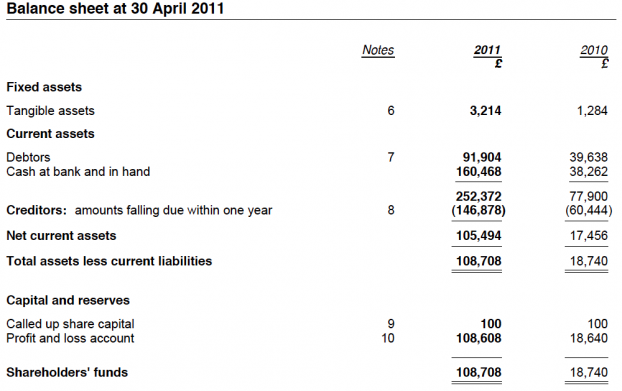

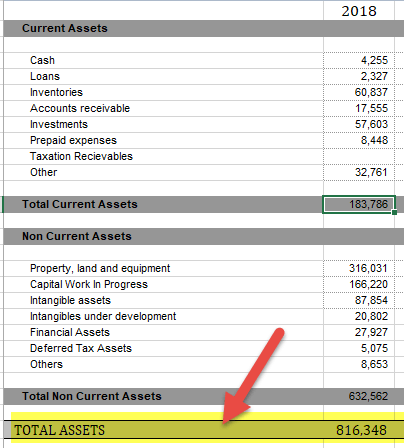

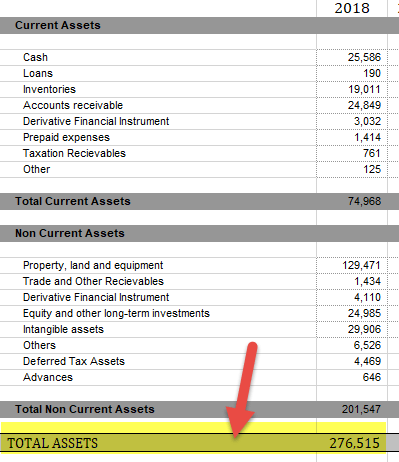

Youll note that the sheet uses current and non-current categories and total assets 185000 equal total liabilities and equity. The heading includes the business name and date. 60522 Turnover 9783 Staff costs 269 Depreciation and other amounts written off assets 693 Other Charges 9901 Tax 39876 Profit or loss MicroEntity Balance sheet.

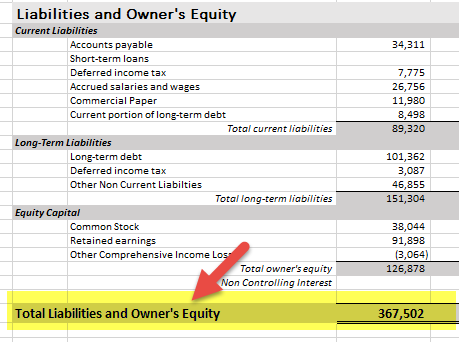

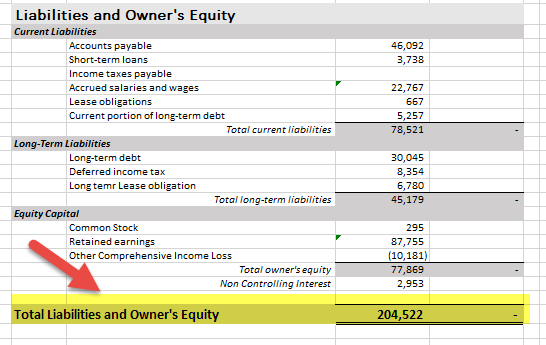

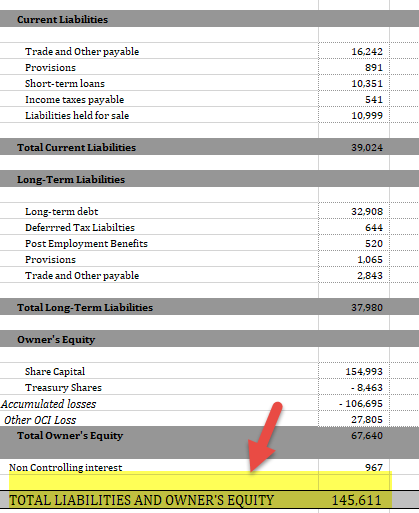

The following Balance Sheet example provides an outline of the most common Balance Sheets of US UK and Indian GAAP. Directors loan from me to the company 250 none of which is repaid yet Zero sales over the first year. The net assets figure is the total of fixed.

The profit and loss shows what has happened over a certain period of time whilst the balance sheet is a snapshot of the. Our balance sheet example - Read a balance sheet. It shows the standard headings and the notes for further analysis.

Corporation tax in our example the business is a limited company so this is the balance of corporation tax owed to HMRC at the balance sheet date. Example of a balance sheet using the account form. Each example of the Balance Sheet states the topic the relevant reasons and additional.

The balance sheet on the other hand isnt so obvious for the average non-finance savvy small business owner. Assets Liabilities Equity As the assets of a company are split up between those who are owed liabilities and those who own equity we can further simplify the accounting equation. A balance sheet is a snapshot in time.