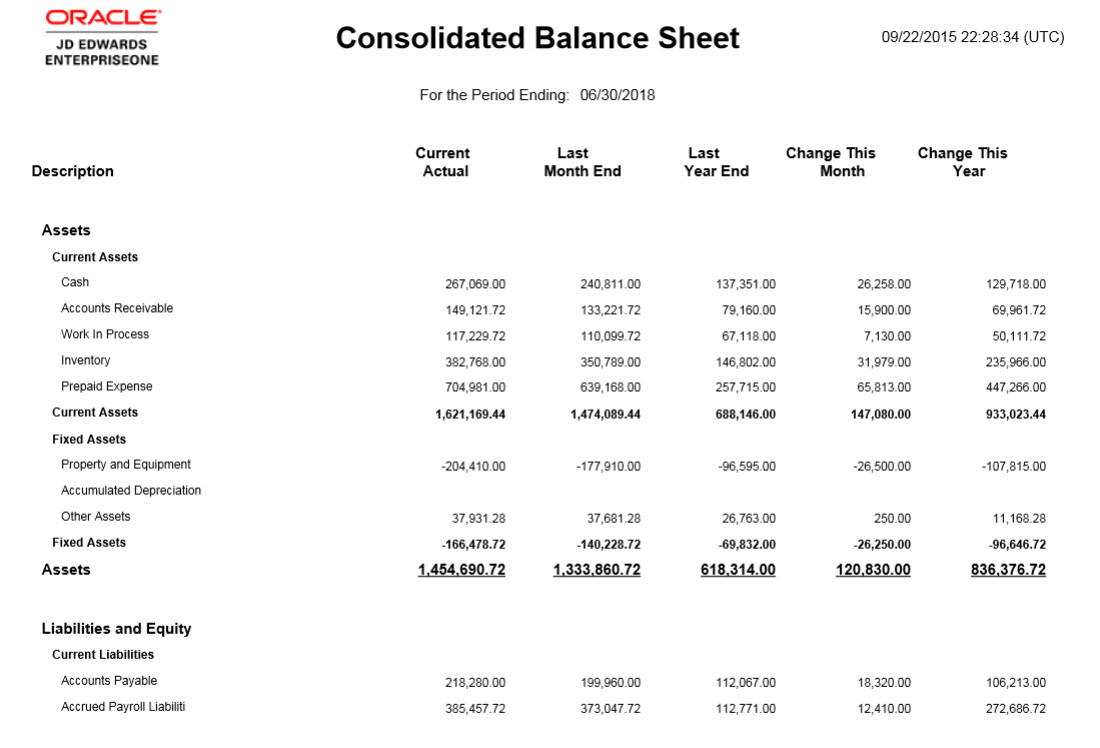

Amazing Consolidated Balance Sheet Example Solution

Cross sale effects are correctly accounted.

Consolidated balance sheet example solution. Example and format of consolidated financial statement. Under this theory subsidiarys fair values are considered and non-controlling interest is disclosed as a part of shareholders equity. P Ltd acquired Q Ltd on 112018.

Pre acquisition profit and reserve of subsidiary company will be shown as capital reserve in consolidated balance sheet but the value of minority interests profit or reserves deducts from it and add in minority interest value. This video shows how to make a consolidated balance sheet when one company acquires 100 of another company. Say you have 450000 in total assets between your parent company and your subsidiary.

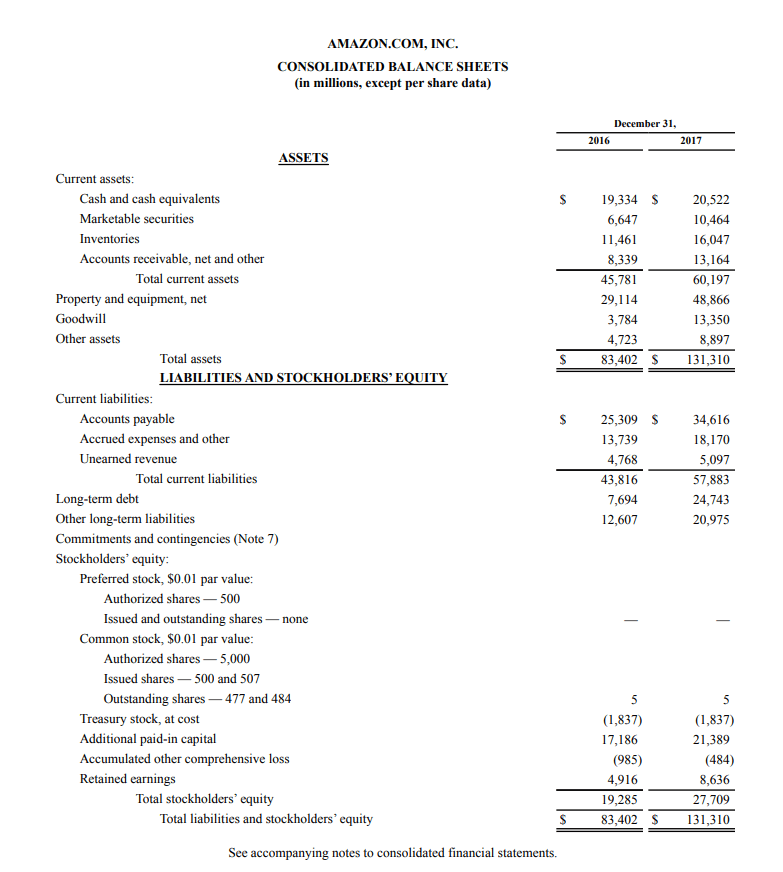

Book value 360000 Consolidated Goodwill 240000 Objective. Prepare balance sheet for F. Consolidated financial statements are prepared by combining the parents financial statements with the subsidiarys.

Green as at 31 March 2015 in both horizontal and vertical style. Consolidated numbers are simply sum of Mommys balance Babys balance and all adjustments or entries Steps 1-3. 100s of additional templates are.

P Ltd acquired Q Ltd on 112018. Mommys investment in Babys shares is 0 as we eliminated it in the step 2. Using this let us prepare a consolidated balance sheet.

In 2012 subsidiary paid 5000 dividend to parent o In 2013 elimination is as follows. Consolidated financial statements are the financial statements prepared by a company the parent which has investments in more than 50 of the common stock of other companies called subsidiaries. Format and example of consolidated balance sheet.