Outstanding Deferred Tax Calculation Format In Excel

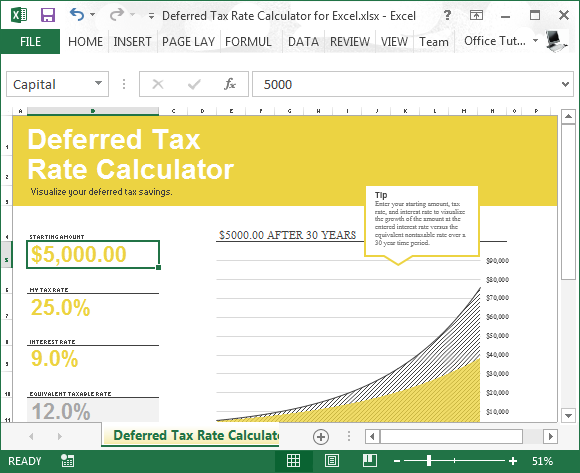

Deferred Tax Calculation Download Preview.

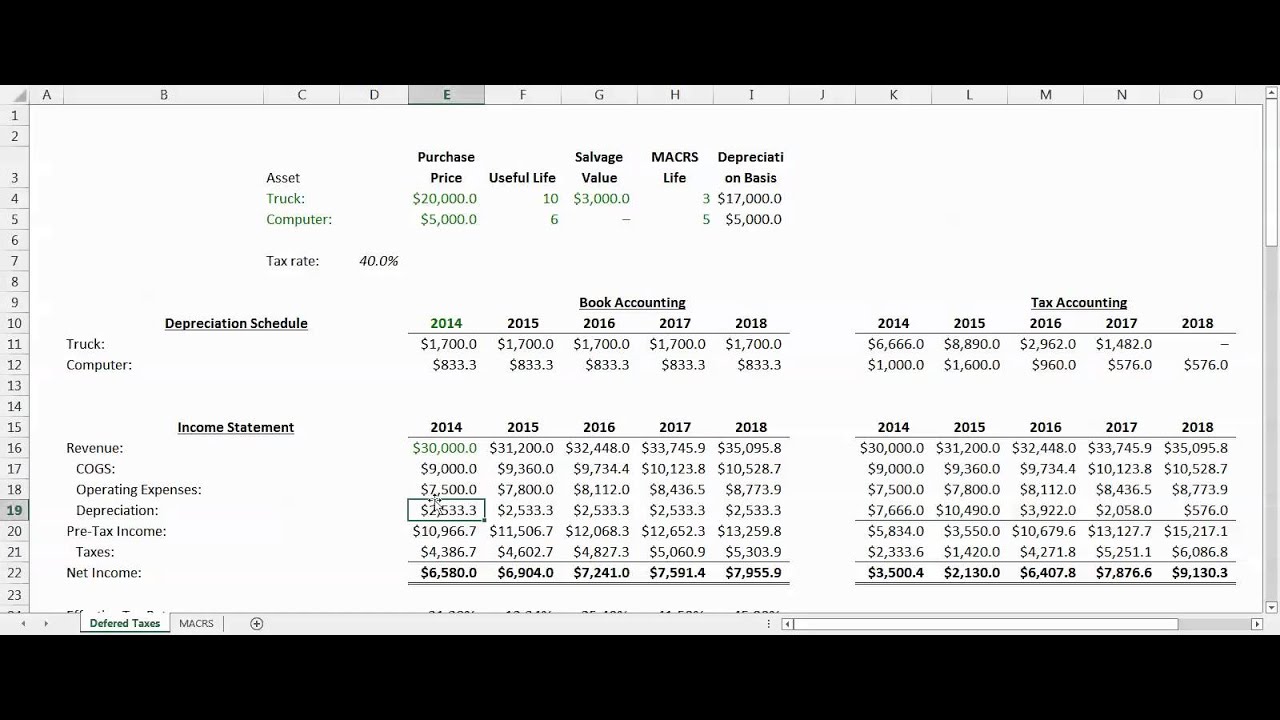

Deferred tax calculation format in excel. Deferred Tax Calculation-an easy way out in Excel. Sum of the digits depreciation. Exemption for initial recognition of leases under IFRS 16.

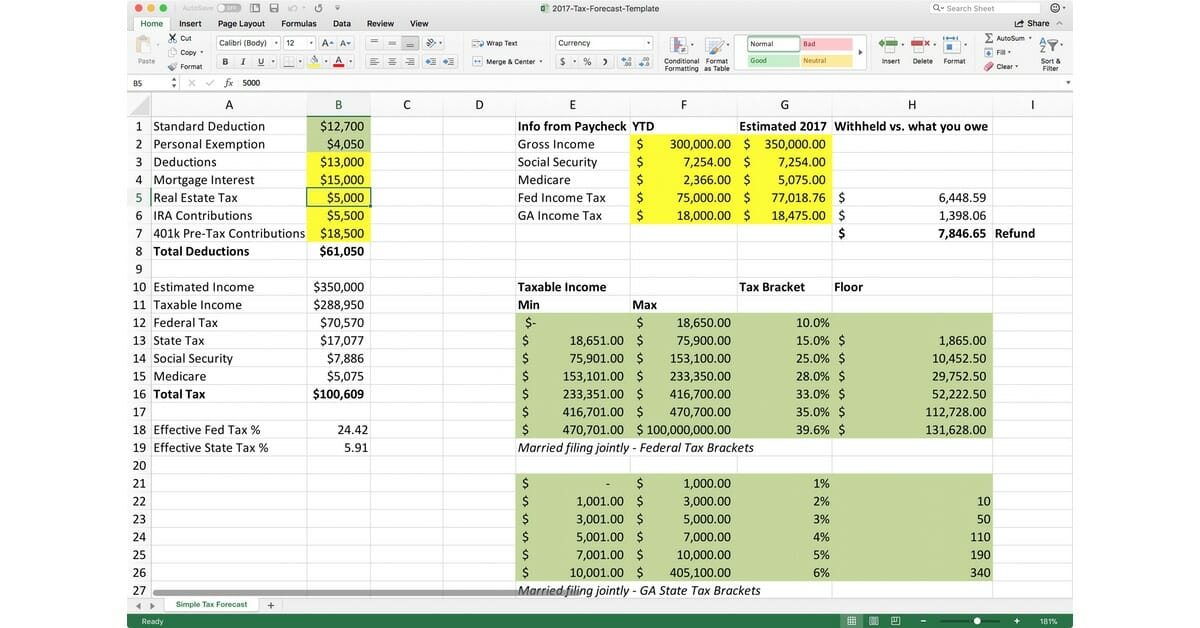

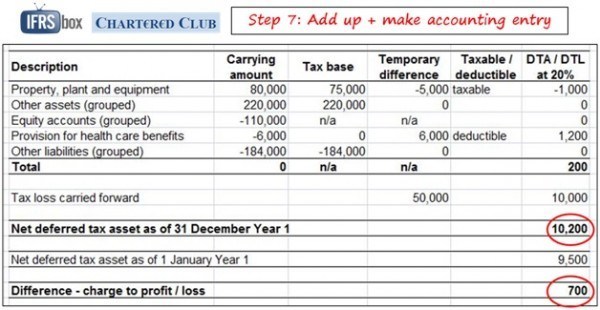

Lets prepare the tax return first. Also we can say that Deferred Tax LiabilityAsset arises due to the difference between. Purpose of deferred tax.

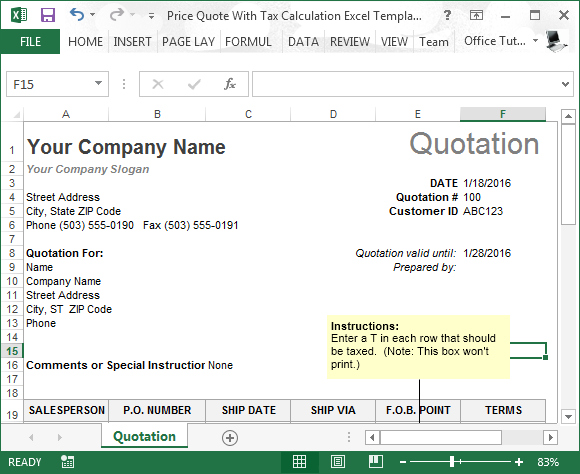

These columns are included for the detailed income tax calculations from the tax brackets and the formula in this column basically just combines the monthly calculations and the tax on the annual bonus so that the tax on the bonus is not spread over the remaining months in the tax. Tax adjustments include non-deductible expenses non-taxable receipts further deductions and capital allowances. Diminishing balance depreciation without residual value.

We have n. Download AS 22 Deferred Tax Calculator in EXCEL file in xls format- 25653 downloads. Deduct total C-106 100Taxable profit ABC62 300Tax rate30Current income tax18 690.

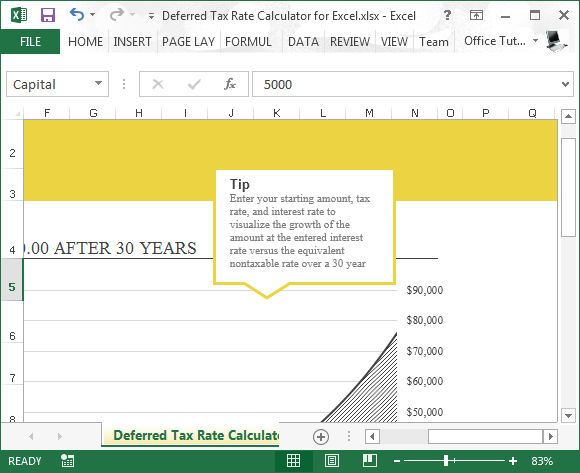

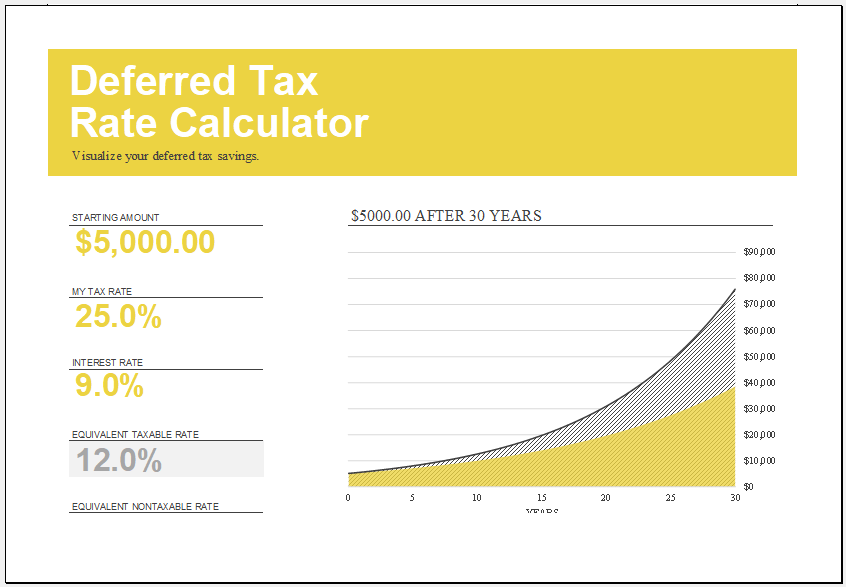

Calculate income tax with Vlookup function in Excel Frequently you can get the tax table with cumulative tax for each tax bracket. An excel sheet to better understand the deferred tax calc. An excel sheet to better understand the deferred tax calc.

Current income tax calculationWe will start with the accounting profit and then we will make all the necessary adjustments. Next the cell directly below the Starting Amount allows you to enter your current tax rate. 1 and n2 in our hands but we dont have tax return and deferred tax calculations.