Top Notch Give A Specimen Of Balance Sheet Statement And Profit And Loss Account As Per The Company Act 2013.

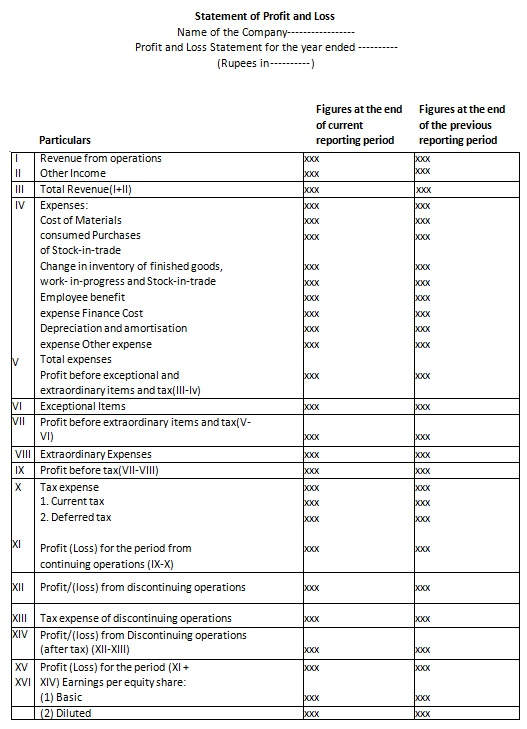

Profit and Loss as per Schedule III for Trading Companies and Service Providers.

Give a specimen of balance sheet statement and profit and loss account as per the company act 2013.. We reproduce the form of Balance Sheet as prescribed under the Act. SCHEDULE III The presentation of financial statements of companies registered under the companies Acts is now governed by schedule III of companies Act 2013The format is same as per schedule VI of the companies Act. Balance sheet is a statement of financial position of a company at a specified moment of time.

The Act also requires compliance with Accounting Standards The objective of US GAAP is fair presentation in accordance with US GAAP which is more restrictive than the requirement under IFRS. The Companies Act 1985 requires Financial Statement to give true and fair view of state of affairs and its P L Account. 6 2016 by Teachoo.

Profit and loss account shows the net profit and net loss of the business for the accounting period. In India there are basically two formats of PL statements. The balance sheet used to sometimes be shown in a horizontal format instead of the vertical format shown above.

The provision for depreciation of fixed assets is inadequate. And it shall give a true and fair view of the state of affairs of the Company. And b In the case of the Profit and Loss Account of the profit of the company for the year ended on that date.

The credit entry of 145000 is the gross profit for the period. According to Section 210 of the Companies Act a Company is required to prepare a Balance Sheet at the end of each trading period. The balance sheet also called the statement of financial position is the third general purpose financial statement prepared during the accounting cycle.

Alsothere is no trouble of finding whether an expense is Direct or. A In the case of Balance Sheet of the state of the company as at 31032020. The provisions of this Part shall apply to the income expenditure AC referred to in sub-clause ii of clause 40 of section 2 in like manner as they apply to a statement of profit and loss.