Simple How To Calculate Net Income/loss With Owners Equity

Fun time International Ltd.

How to calculate net income/loss with owners equity. For example suppose you spend 1 million investing in company B which gives you a 25 ownership claim. This means the company lost half of total. Examples to Calculate Owners Equity Example 1.

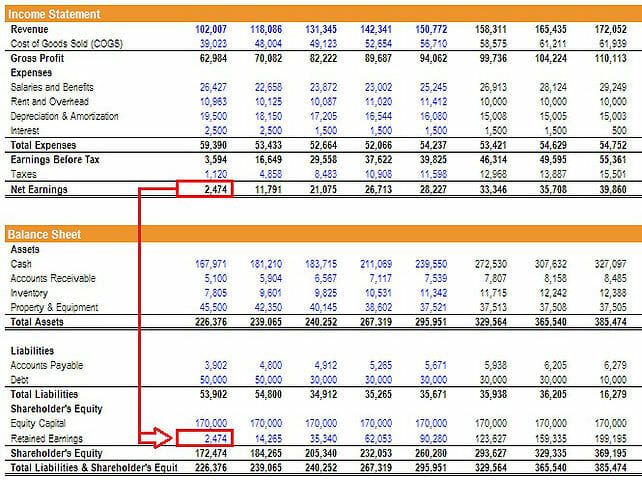

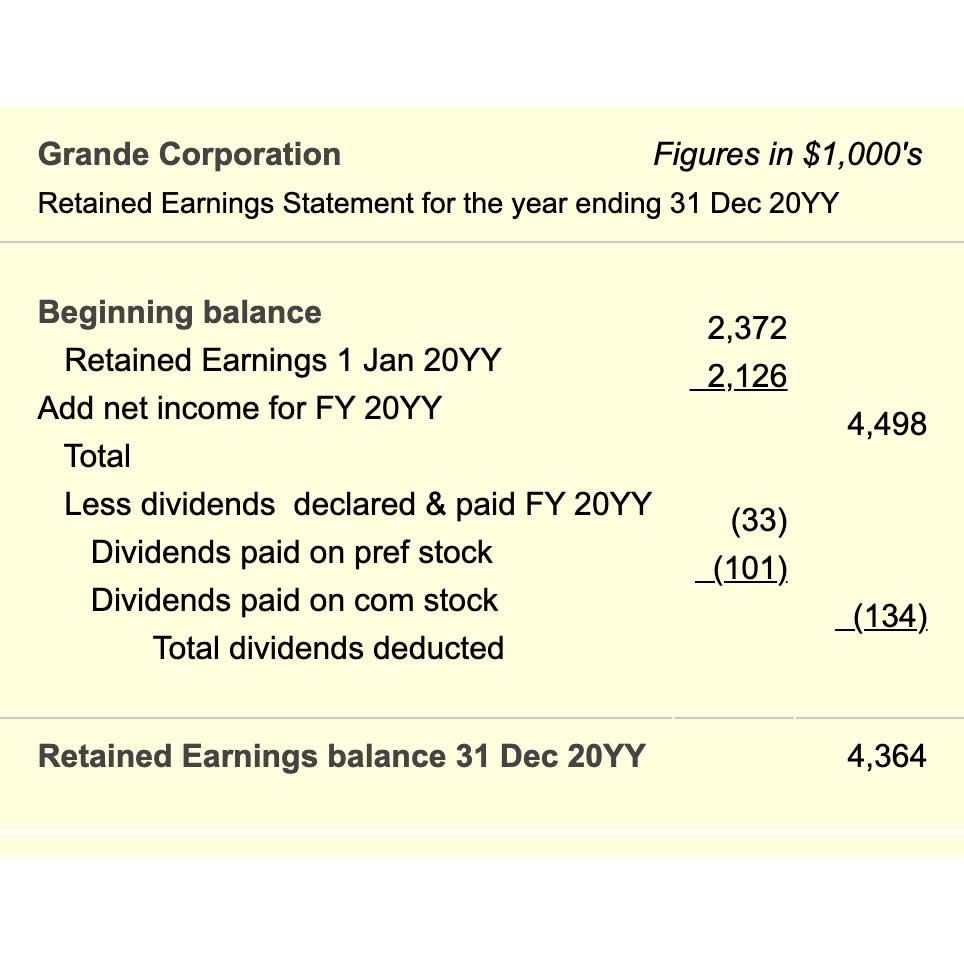

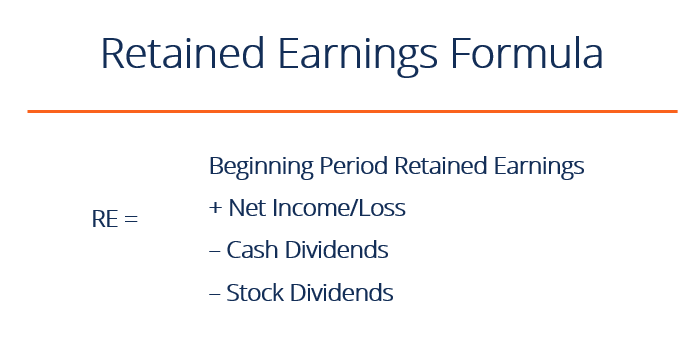

The relationship between net income and owners equity is through retained earnings which is a balance sheet account that accumulates net income. What Is Net Income. Net incomeloss 23000 10000 - 29000 - 12000 -8000.

Liabilities 500000 800000 800000 21 million. You will see the owners beginning equity additional investments and withdrawals as well as the ending equity. Equity income accounting is fairly simple and is based on your ownership percentage.

Owners equity Assets Liabilities. Net incomeloss Ending equity - Starting equity. Therefore owners equity can be calculated as follows.

A companys net income therefore plays a significant role in determining owners equity. Accounting Principles - How to Determine Net Income or Loss About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features. The company had a net loss of 100 for.

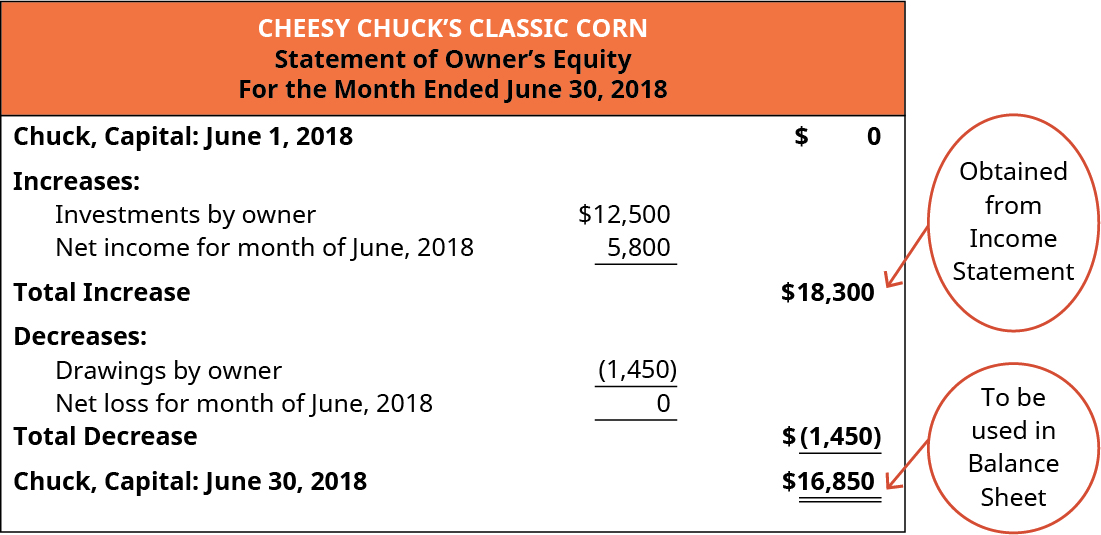

An owners equity presents the business owners capital plus additional investment minus owners withdrawals. Subtract the amount of beginning owners equity from your Step 3 result to calculate the withdrawals on the statement of owners equity. The Subtotal can be calculated by adding the last two numbers on the statement.