Unbelievable Neiman Marcus Financial Statement

Posted on May 11 2020.

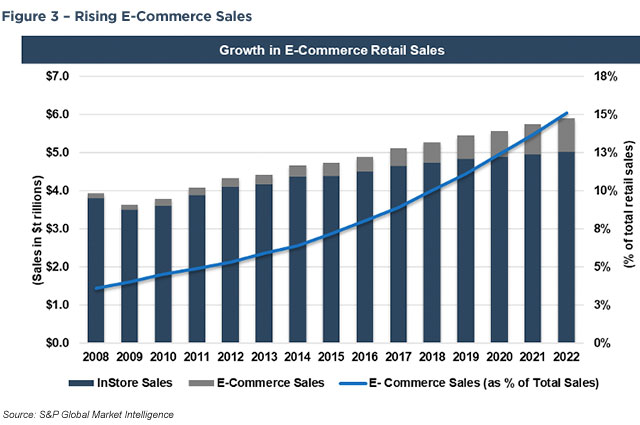

Neiman marcus financial statement. The above is a comparative analysis of the financial position and performance of the company. It comes as no surprise that Neiman Marcus is leaving Hudson Yards. Securities and Exchange Commission SEC through the Electronic Data Gathering Analysis and Retrieval system EDGAR about 10000 largest publicly traded companies.

The timely and accurate reporting of consolidated financial statements which include balance sheet variance analysis divisional profit analysis and comparisons to current and previous forecasts and plans. NMG and our brandsNeiman Marcus Bergdorf Goodman Last Call and Horchoware relationship businesses that lead with love for our customers associates brand partners and communities. Responsible for expense analysis corporate forecasts and periodic valuation analyses.

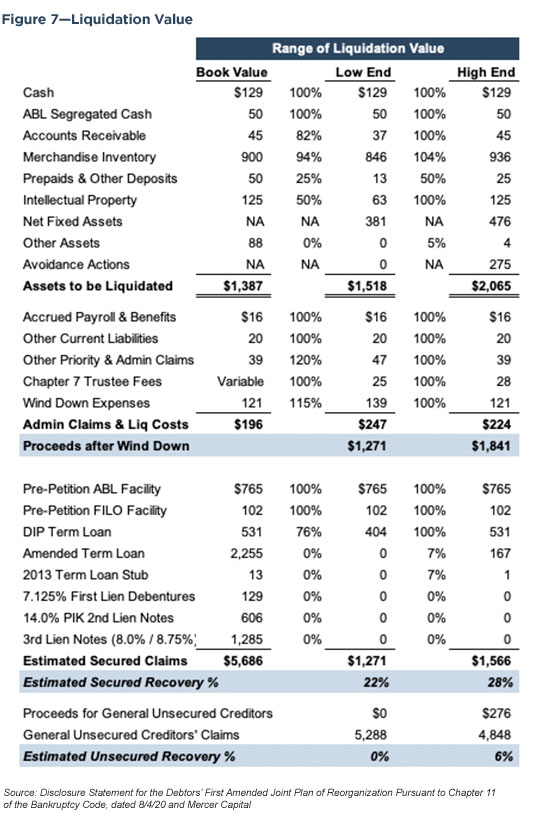

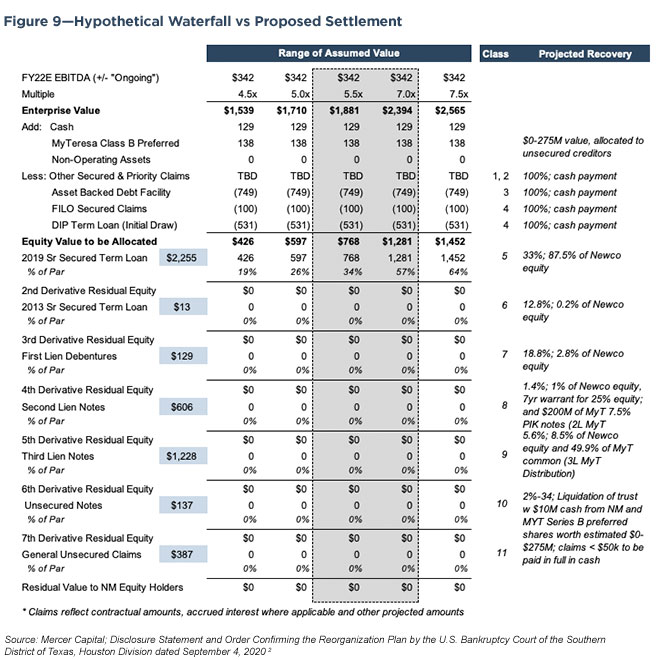

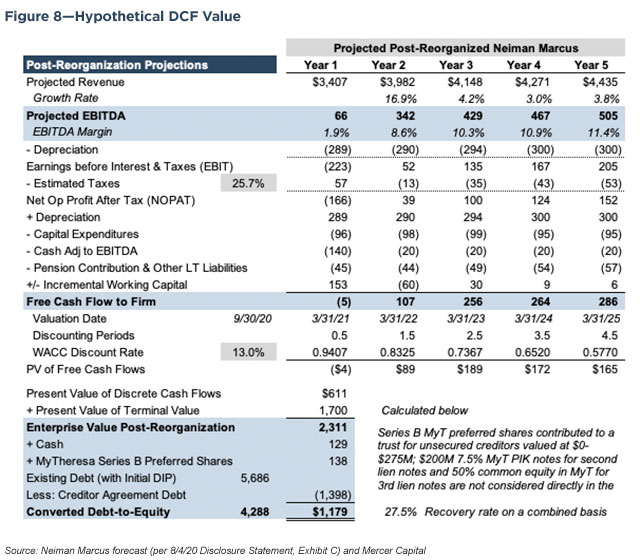

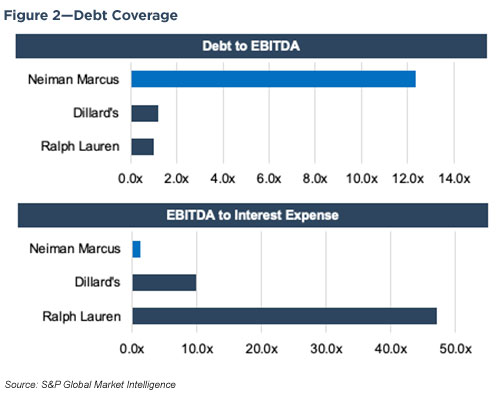

Anticipate will project plan and similar expressions in connection with any discussion of future operating or financial. Other revenues net. Neiman Marcus plans to eliminate about 4 billion of over 5 billion of debt and 200 million of annual interest expense in a reorganization plan that was approved by US.

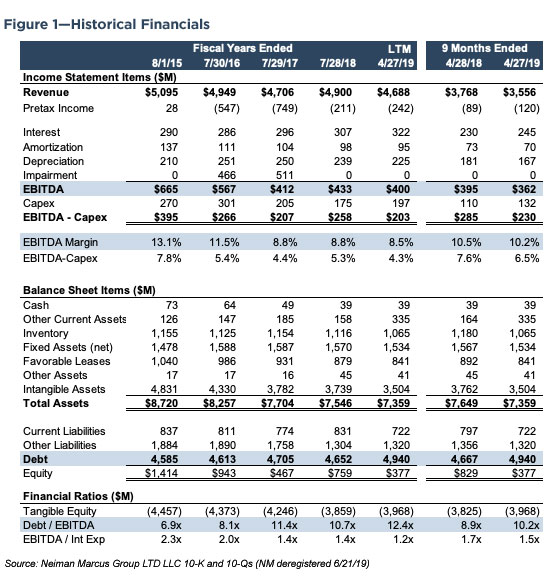

April 27 2019. Financial data source and analysis principles. NEIMAN MARCUS GROUP LTD LLC.

In a move that reportedly allows for business continuity Neiman Marcus Group said in a statement. Quarter a year ago. Neiman Marcus refinanced 11 billion in debt after emerging from Chapter 11 last fall buying the company time and adding funds for a turnaround.

Net sales 1049418 1155304 3522525 3731032. Neiman Marcus exited Chapter 11 in late September at just a 2bn valuation. Log in to manage your Neiman Marcus Credit Card Online.