Casual Net Assets Formula Balance Sheet

Example of Net Tangible Assets NTA For example Company A reports total assets of 1 million total liabilities of 500000 intangible assets of 200000.

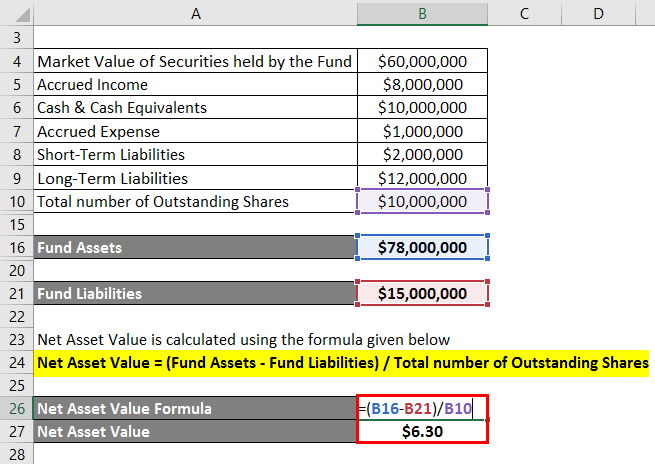

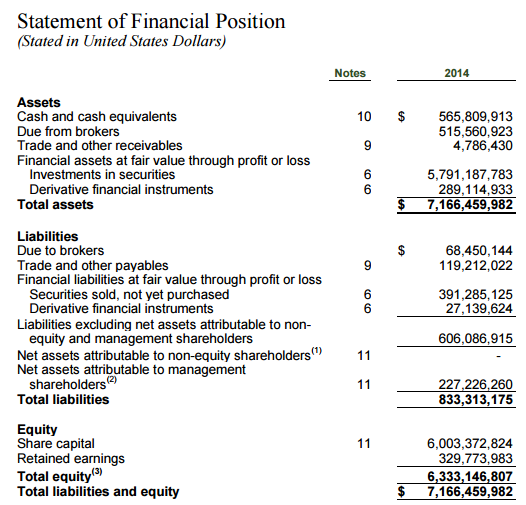

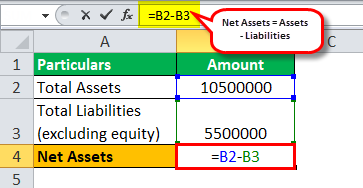

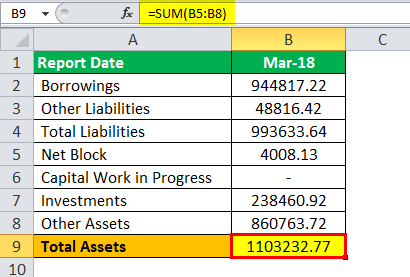

Net assets formula balance sheet. Formula to calculate net assets. Lets assume that Company Zs balance sheet reported 10500000 in assets and 5000000 in total liabilities. Asset turnover ratio Net sales Average total assets.

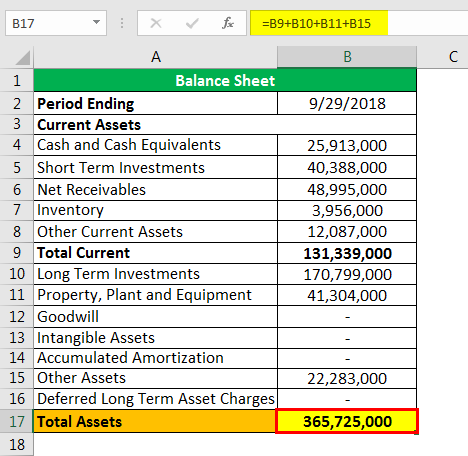

Cash and credit sales are treated differently during the month until figuring up totals for amount sold. Net sales can be found on the income statement and average total assets on the balance sheet. Some formulas are as follows.

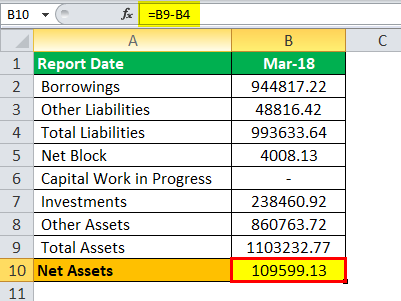

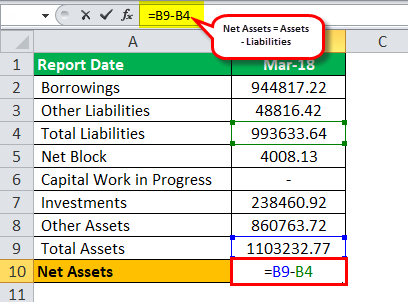

This figure can be computed relatively easily using information found on a companys balance. The net asset on the balance sheet is defined as the amount by which your total assets exceed your total liabilities and is calculated by simply adding what you own assets and subtract it from whatever you owe liabilities. To calculate the NTA.

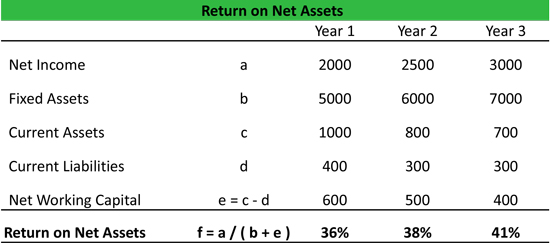

Net Current Assets is the difference between the total current assets and total current liabilities. Cash sales plus credit sales minus returns and allowances. To get the correct result you need the average value of assets during the period not the total value at the end of the period.

Net Assets Formula. The formula is. NCAV Current Assets - Total Liabilities - Preferred Shares Lets dig a little deeper into each of these elements A balance sheet is where all the magic happens with the net current assets formula.

The companys net assets would be. Net Current Assets Total Current Assets Total Current Liabilities 296000- 93000 203000. 10500000 - 5000000 5500000 Net Assets.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)