Outstanding Rent Paid In Advance Accounting Equation

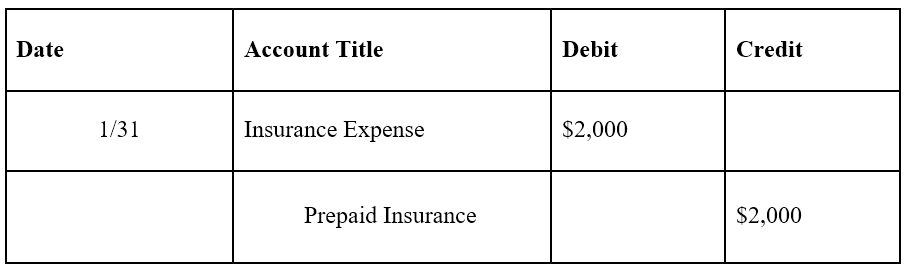

The income received in advance is not income.

Rent paid in advance accounting equation. Rent received in advance liability600. To recap the above the monthly rent payment keeps the sole proprietors accounting equation Assets Liabilities Owners Equity in balance because it reduces the companys assets and it reduces the companys owners equity. Iv Sold goods for cash 8000 costing 4000.

Assets 30200 Cash 13900 Supplies 500 Prepaid Rent 1800 Equipment 5500 Truck 8500. Journalize the entry for this transaction. Iv Sold goods for cash 8000 costing 4000.

To Rent Received in Advance Ac. The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business This is true at any time and applies to each transaction. Ii Paid rent in Advance 300.

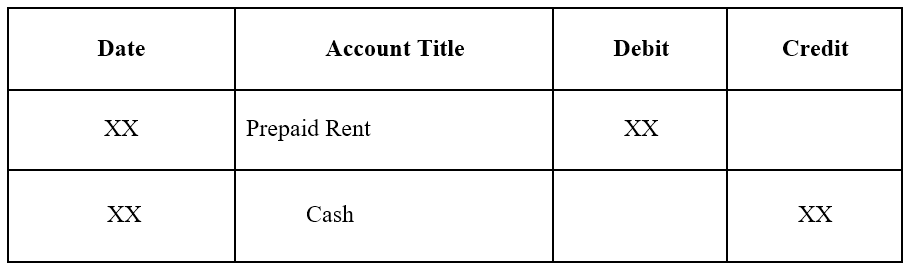

The Accounting Equation and Prepaid Rent. Ii Paid rent in advance 300. Rent paid in advance ie.

I Harish started business with cash Rs 18000 ii Purchased goods for Cash Rs 5000 and on credit Rs. Accounting equation for rent received in advance Rent received in advance makes one asset cash and one liability unearned rent on the balance sheet increase in the same amount. Journal Entry for Rent Paid in Advance.

Rent paid in advance accounting equation In the accounting equation we can see that the transaction of the rent paid in advance increases one asset while decreasing another asset at the same time. 10000 Profit 59500 500 30000 20000 70000 v. Such an intake of money belongs to the future accounting period.