Wonderful T How To Explain The Hoa Balance Sheet

Wire the balance sheet so that it always balances by making Retained Earnings equal to Total Assets less Total Liabilities less all other equity accounts.

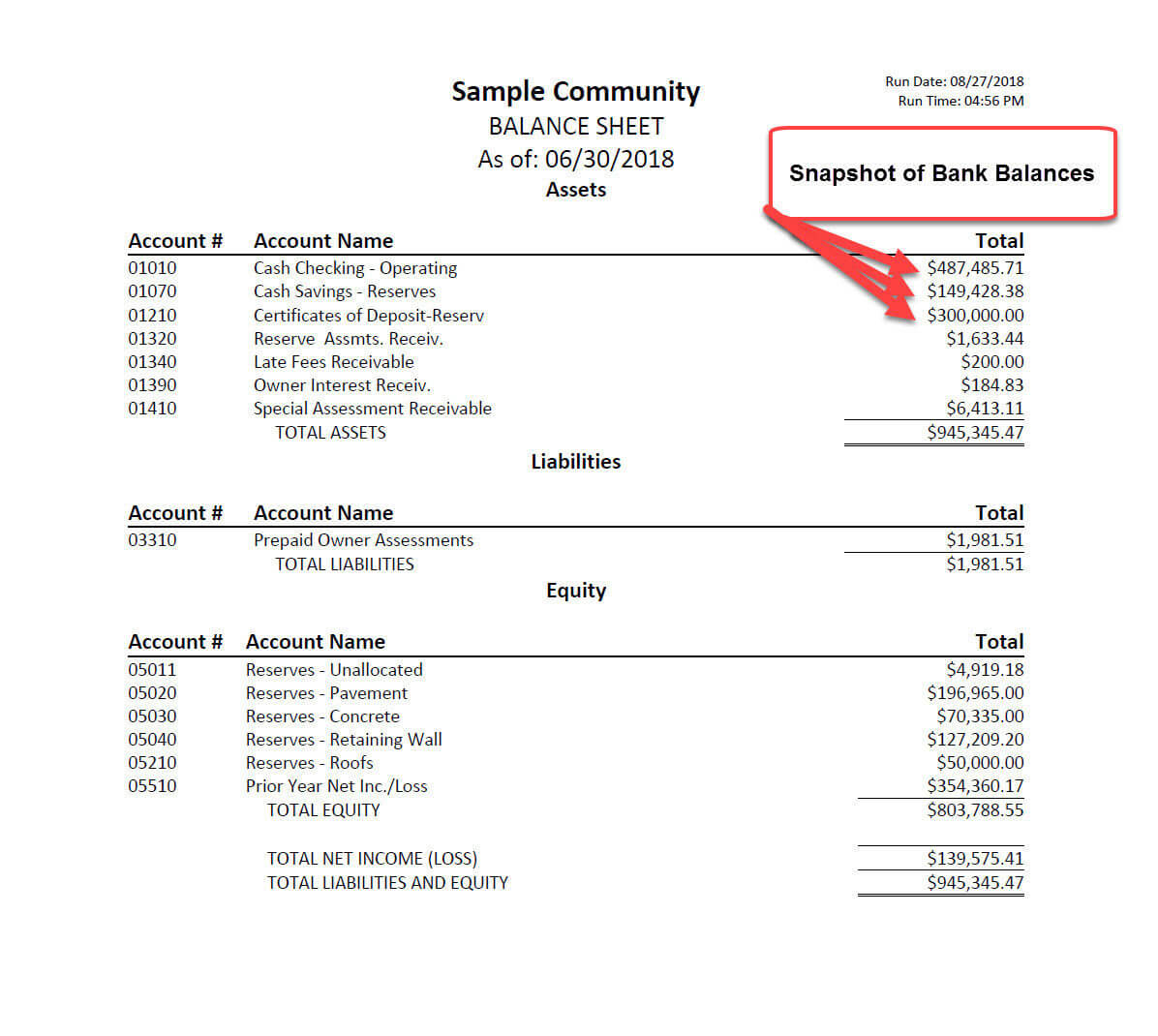

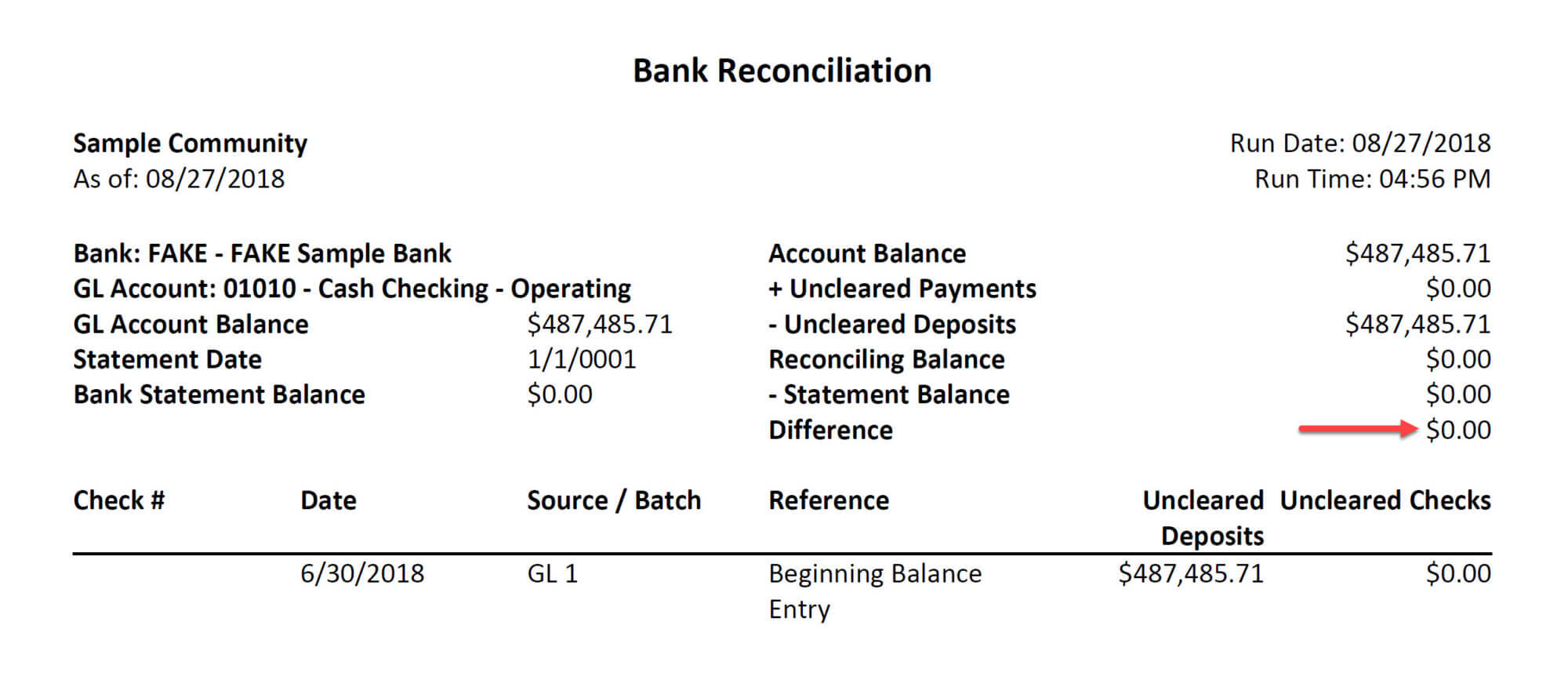

T how to explain the hoa balance sheet. The balance sheet is a recording of the monthly liabilities subtracted from the monthly assets of the association. As the HOA settles its balances the association reduces its Accounts Payable and Cash balance. This one unbreakable balance sheet formula is always always true.

The idea behind your HOAs balance sheet is that it should always balance with no exceptions. In other words the balance sheet illustrates a businesss net worth. The balance sheet is separated with assets on one side and liabilities and owners equity on the other.

It lists the associations total assets and members equity. A balance sheet is meant to depict the total assets liabilities and shareholders equity of a company on a specific date typically referred to as the reporting date. Plug the balance sheet ie.

A balance sheet is a statement of the financial position of a business that lists the assets liabilities and owners equity at a particular point in time. Assets go on one side liabilities plus equity go on the other. It tells where the association stands with their asset liability and reserves at a particular point in time.

Balance sheets show what you owe what youre owed and what you have invested. Simply put a balance sheet should reflect positive equity and should balance. The Balance Sheet will have an Accounts Payable liability section.

The balance sheet is a reflection of the assets owned and the liabilities owed by a company at a certain point in time. The two sides must balancehence the name balance sheet. For different accounts debits and credits can mean either an increase or a decrease but in a T Account the debit is always on the left side and credit on the right side by convention.