Out Of This World Trading Profit And Loss Account With Adjustments Example

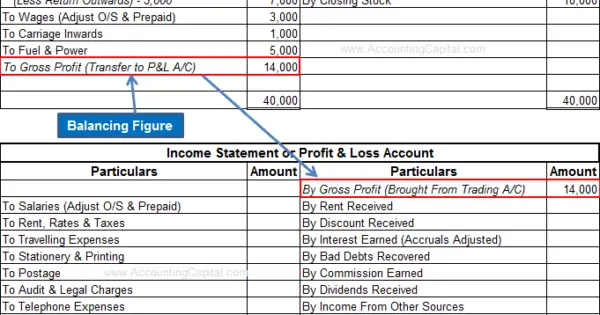

Trading account is the first step in the process of preparing the final accounts of a company.

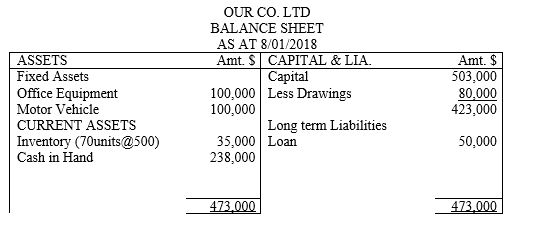

Trading profit and loss account with adjustments example. From the following balances extracted from the books of X Co prepare a trading and profit and loss account and balance sheet on 31st December 1991. The resultant figure is either gross profit or gross loss. So balances in the expenses and income accounts have to be transferred to Trading and Profit and Loss fPreparation of Final Accounts with Adjustments 131 Accounts.

Manager is entitled to receive commission 5 of net profit after providing such commission. From the following balances extracted from the books of X Co prepare a trading and profit and loss account and balance sheet on 31st December 1991. The carrying amount of the plant and machinery on the statement of financial position would be 130000 390000 260000.

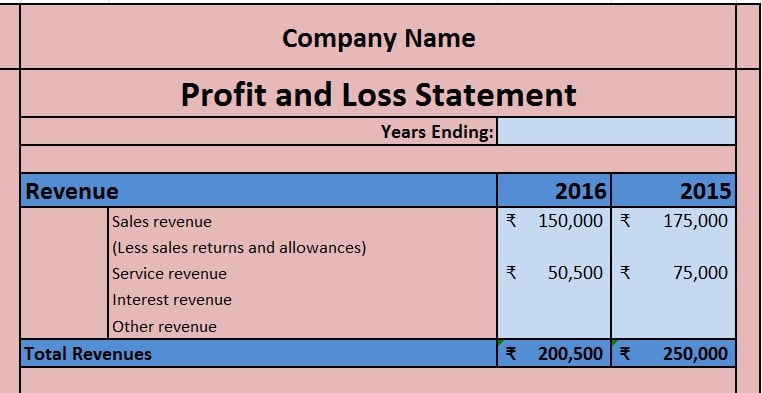

From the Adjustments to Trade ProfitLoss page you can adjust the companys profit or loss per accounts to arrive at the adjusted profit or loss figure. The 39000 depreciation charge for the year in the statement of profit or loss is reflected in the accumulated depreciation account. Trading Profit and Loss Account Income Statement for the year ended 3112X5 Sales 8000.

Turnover and ProfitLoss Per Accounts. The Trading Profit and loss account also known as income statement is used to access your business performance and financial performance. The motive of preparing trading and profit and loss account is to determine the revenue earned or the losses incurred during the accounting period.

Ad Free Demo Account For Practice. Salaries for 2011-12 due but not paid till 31-3-12 10000. Profit and Loss Account.

Ad Free Demo Account For Practice. The stock on 21st December 1991 was valued at 25000. As the name suggests it includes all the trading activities conducted by a business to ascertain the Gross ProfitLoss.