Beautiful Balance Sheet Approach Using Asset's Net Of Liability

The latter is also known as the book value and is the difference.

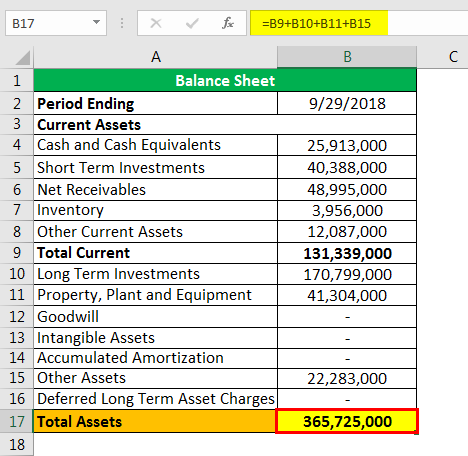

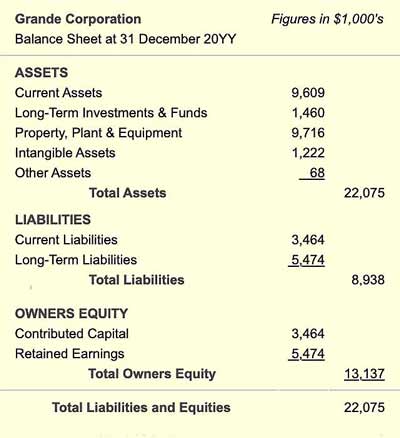

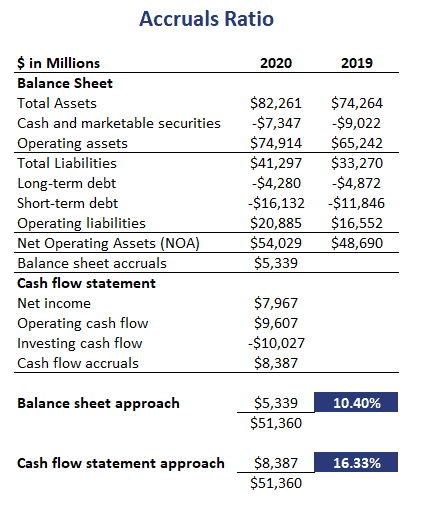

Balance sheet approach using asset's net of liability. Assets Liabilities Asset Approach Value. There is another quite a good liquid asset namely money at call and short notice which is about 12 per cent of the total assets. The net asset on the balance sheet is defined as the amount by which your total assets exceed your total liabilities and is calculated by simply adding what you own assets and subtract it from whatever you owe liabilities.

Every balance sheet must balance. 8 Own Funds. Heres how to do it under three circumstances.

This is a very rough view but still a way in which someone could begin to gauge the value of a company through the asset approach before beginning a deeper look into each of the line items of the balance sheet. Assets liabilities and shareholders equity. It is commonly known as net worth NW.

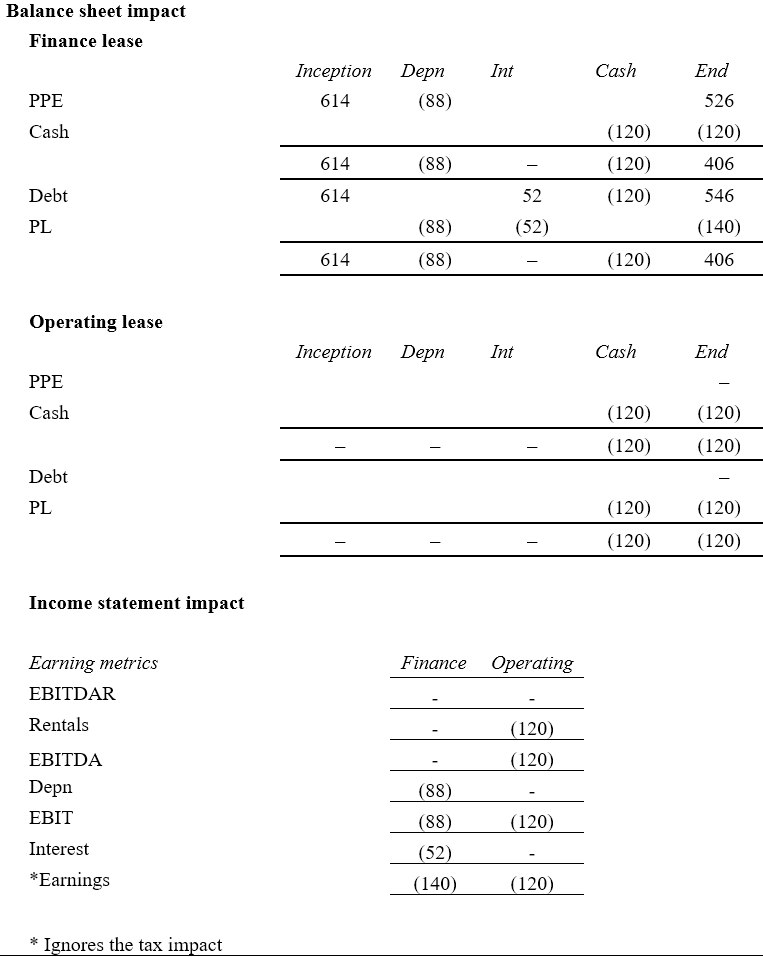

2 The balance sheet equation also known as the accounting equation is Assets Liabilities Equity. The asset-liability approach presumes the primacy of the determination of net assets equity at the balance sheet date. Under this method the assets and liabilities of the company are adjusted from book value to their fair.

This also equals Equity on the balance sheet. In other words the balance sheet looks at what the company owns how much it owes to debtors and how much is invested. For instance lets say a lemonade stand has 25 in assets and 15 in liabilities.

Lets assume that Company Zs balance sheet reported 10500000 in assets and 5000000 in total liabilities. This balance sheet-focused method is used to value a company based on the difference between the fair market value of its assets and liabilities. A balance sheet is also called a statement of financial position because it provides a snapshot of your assets and liabilities and therefore net worth at a single point in time unlike other financial statements such as profit and loss reports which give you information about your business over a period of time.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)