Stunning Bank Overdraft In Profit And Loss Account

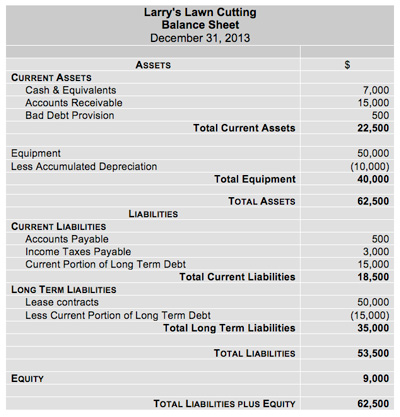

If your bank overdraft shows a debit balance it means it is a normal bank account and shall be presented as an Asset under Cash Cash Equivalents.

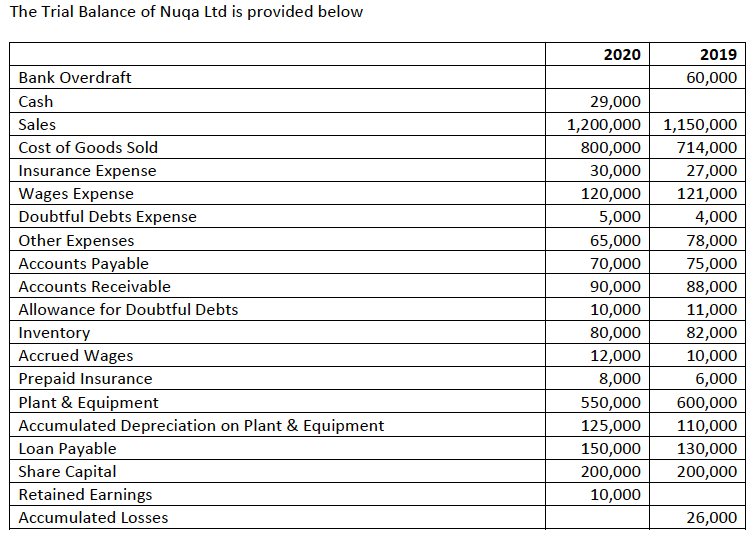

Bank overdraft in profit and loss account. Dividends for incorporated entities. A bank overdraft will always be negative or as other people pointed out a credit balance. This facility is provided by bank to their customer to meet short-term financial needs.

Bank overdraft definition. Saying Bank Overdraft itself means that it is a balance that has been overdrawn from your bank account. A bank overdraft differs from a normal bank loan.

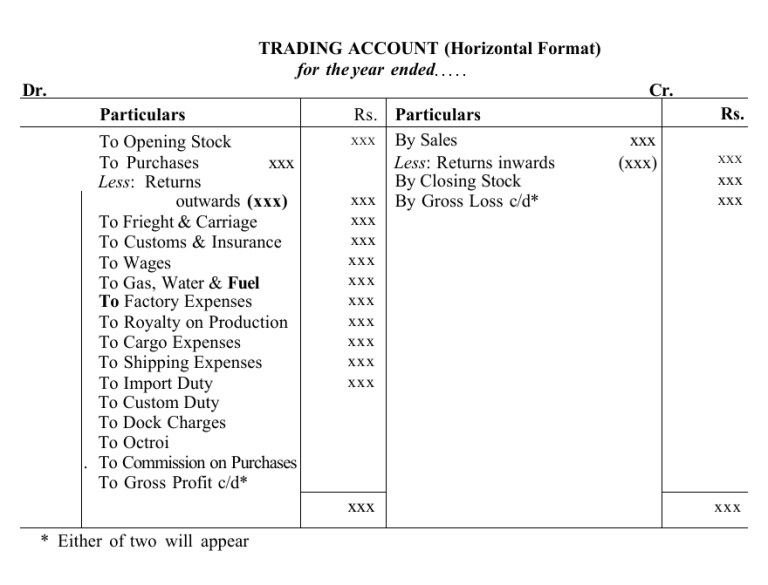

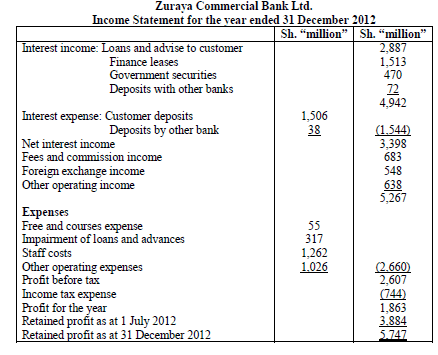

B Profit and loss account. Format for Profit and Loss account of a bank. Share capital or cash.

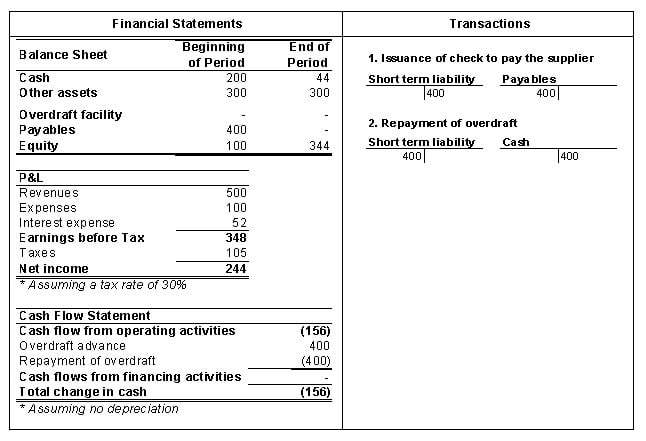

Profit and Loss account for the year ended date Current Year Previous Year Sh 000 Sh 000 Sh 000 Sh 000 Income Interest on advances loans overdrafts etc Interest on government securities Interest on placement and bank balances with other Less. In other words overdraft facility is a loan from bank for short-term. You can overdraw your bank account up to that level.

The net profit is calculated using the profit and loss account formula. The implication is that the overdraft charges and interest then relate to. 3 Loss on disposal - Admin expenses whether its a profit or loss on the disposal.

It is calculated by deducting indirect expenses from the Gross ProfitLoss. The financial expenses that include interest on the loan loan interest on bank overdraft bank charges etc. Banks do charge interest rate on the money withdrawn in form of overdraft.