Beautiful Work Is Petty Cash Retained Earnings Accounting

Investments - Money Market.

Is petty cash retained earnings accounting. Petty cash is a small amount of cash that is kept on the company premises to pay for minor cash needs. Retained earnings is the cumulative amount of earnings since the corporation was formed minus the cumulative amount of dividends that were declared. In cash registers 1020.

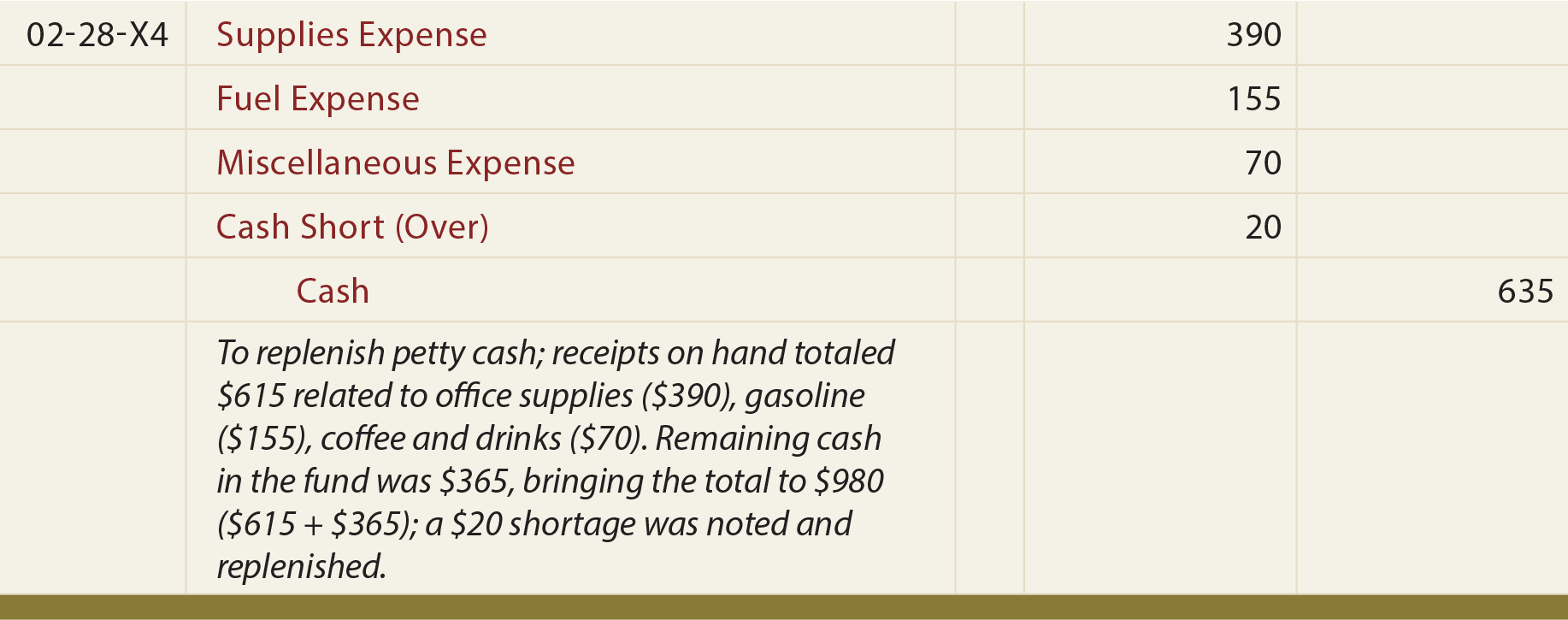

The reason for replenishing the fund at the end of the accounting period is that no record of the fund expenditures is in the accounts until the check is. A company started its operations in the year 2013. A company indicates a deficit by listing retained earnings with a negative amount in the stockholders equity section of the balance sheet.

The total petty cash expenditure is 60. Petty cash management is referred to as the system of keeping records in order to track issuance and use of petty cash funds. Require that employees maintain a running petty cash log for every transaction including receipts.

At the end of an accounting period a count of the petty cash shows that the fund contains cash of 240 and expense vouchers for supplies of 40 and postage of 20. This article will also discuss. Investments - Certificates of Deposit.

The entry simply records the movement of money in the business from cash to petty cash. Accumulated profitretained earnings is a component of shareholders equity and represents the cumulative amount of a companys profit since its inception after adjustments for dividend payments and transfer to other reserves. Retained earnings is the corporations past earnings that have not been distributed as.

Replenishing Petty Cash Companies replenish the petty cash fund at the end of the accounting period or sooner if it becomes low. Definition of Retained Earnings. Petty Cash is also the title of the general ledger current asset account that reports the amount of the companys petty cash.