Perfect Companies Act 1956 Schedule Vi

Public financial institutions 5.

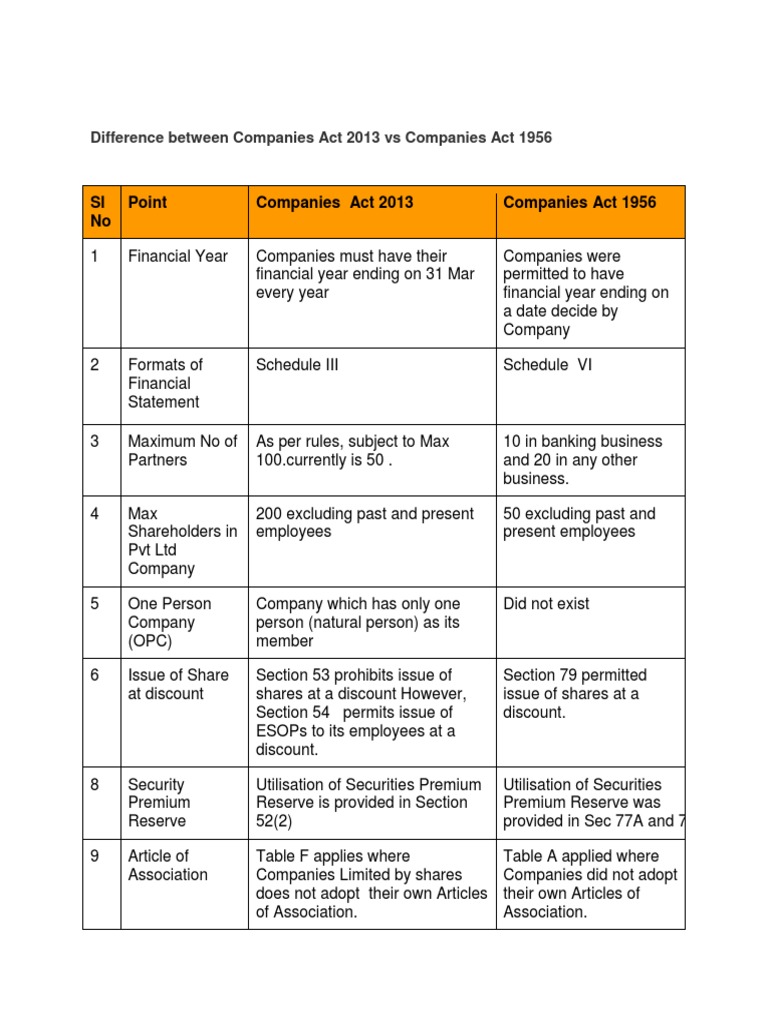

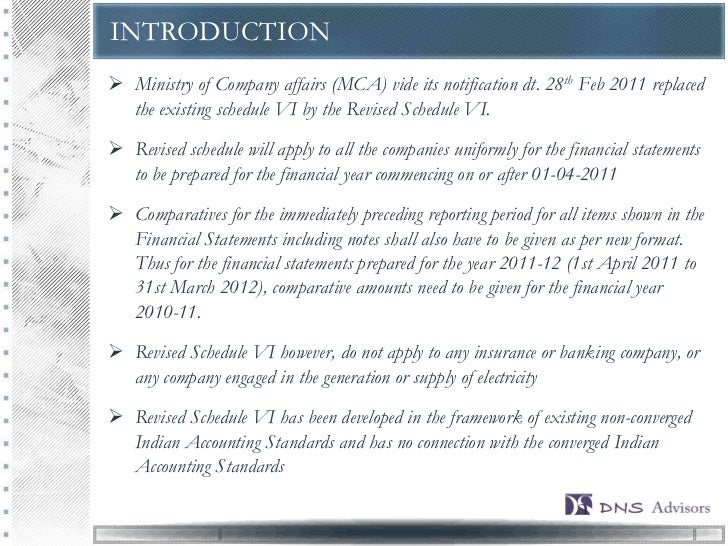

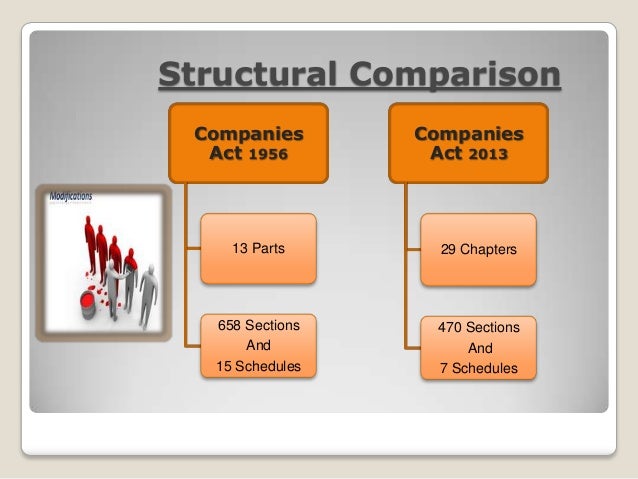

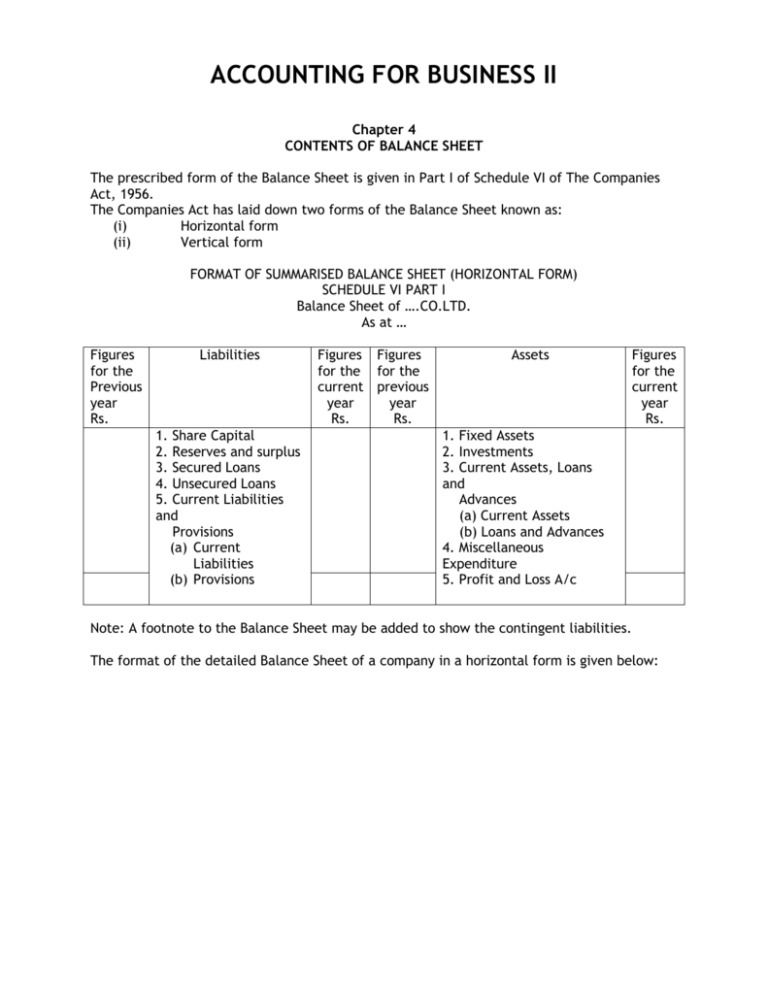

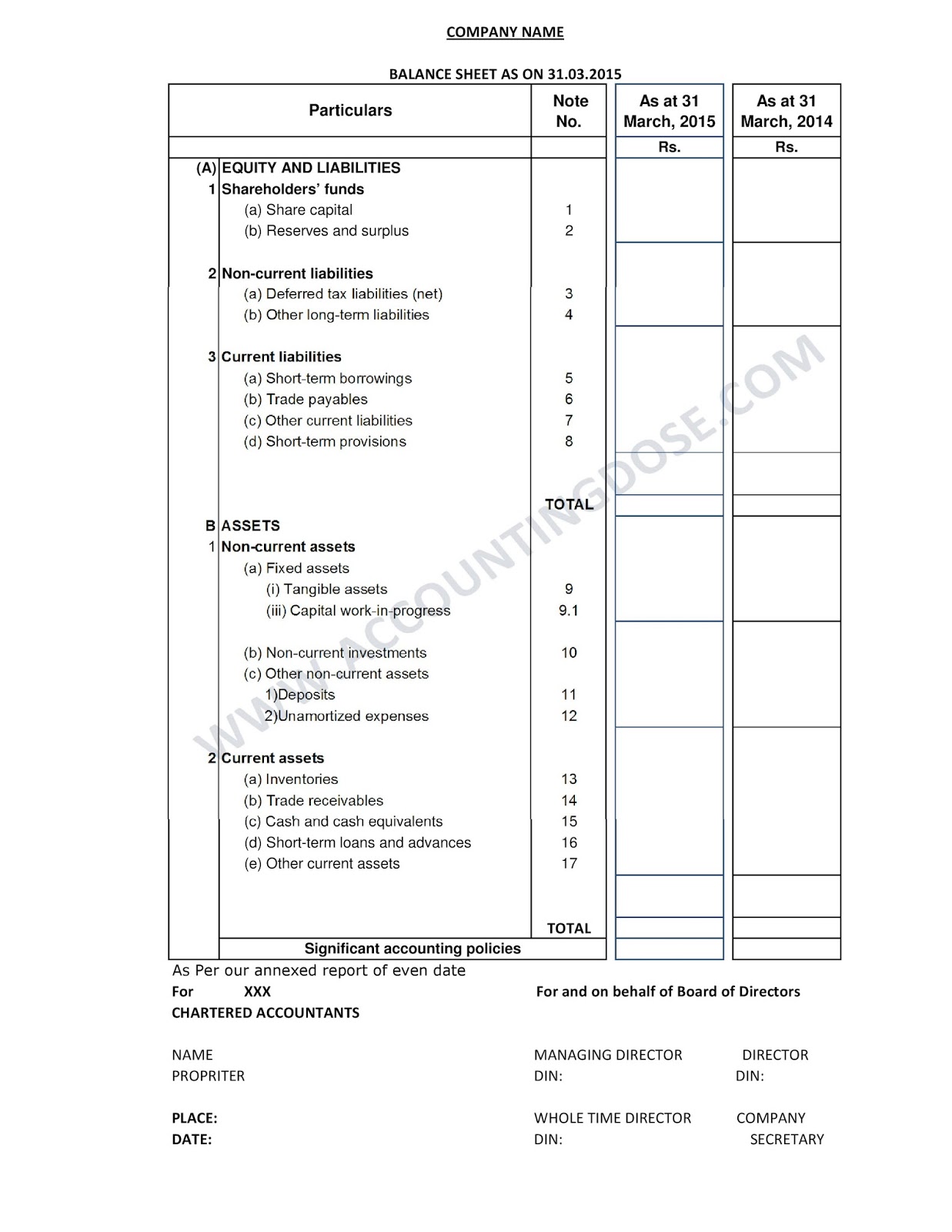

Companies act 1956 schedule vi. It is a major step and members of the profession have a greater role and responsibility in its preparation. It is also imperative to note at the very outset that like its predecessor Revised Schedule VI doesnt apply to banking or insurance companies. The revised Schedule VI has been framed.

It requires companies to disclose gross profit in the profit and loss account. The proposed revision of schedule VI to the Companies Act 1956 stipulates multi-step format for the presentation of profit and loss account. Form of Proxy.

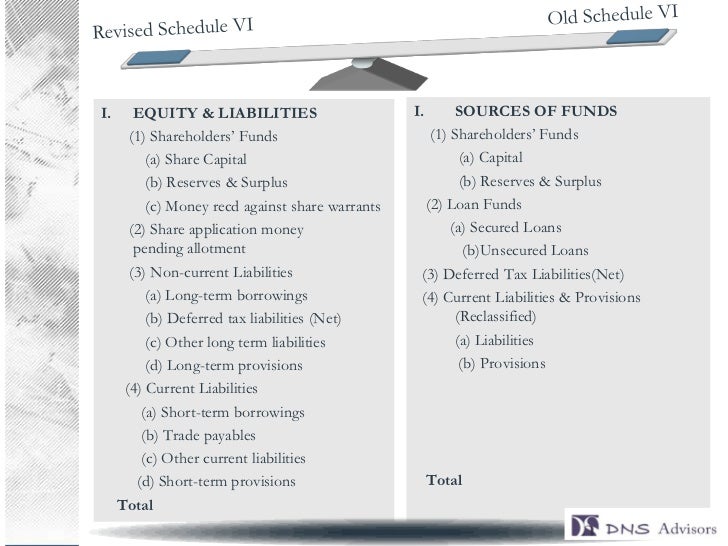

Revised Schedule VI of Companies Act 1956 1. To facilitate the preparation. 100 Crs - Roff to the nearest Hundreds thousands or decimal thereof Turnover of Rs.

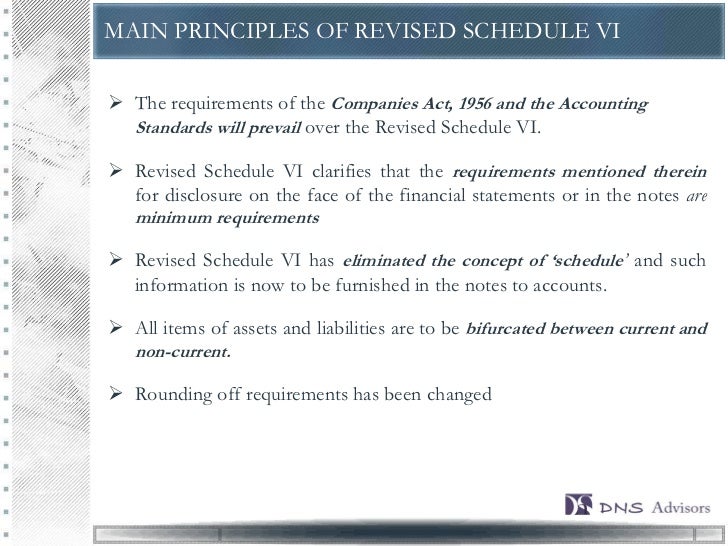

Definitions of company existing company private company and public company 4. Revised Schedule VIto The Companies Act 1956 Features Concepts Disclosures A revised schedule is to business what a new season is to an athlete or a new canvas to an artist. Old vs Revised 2011 The Ministry of Corporate Affairs MCA on Tuesday the 1st day of March notified Schedule VI Revised.

Click hereto get an answer to your question As per Schedule VI of the Companies Act 1956 forfeited shares account will be. Short title commencement and extent 2. Particulars Old Schedule VI Revised Schedule VI Rounding off of Figures appearing in financial statement Turnover of less than Rs.

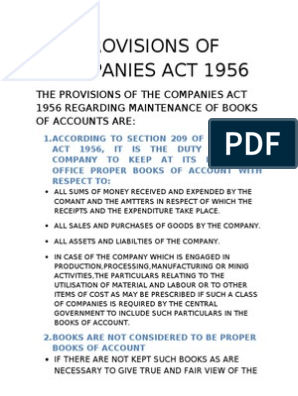

The Ministry of Corporate Affairs MCA has prescribed a revised Schedule VI to the Companies Act 1956 vide Notification dated 28022011 which is applicable for the financial statements prepared for all financial periods beginning on or after 1 April 2011 by Indian Companies. It is a major step and members of the profession have a greater role and responsibility in its preparation. Section 2111 of the Companies Act 1956 requires the companies to draw up their financial statements as per the form set out in Revised Schedule VI.