Perfect Where Does Unearned Seevice Rwvenue Show On Trial Balance

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

This is a current liability account that should be on the post-closing trial balance.

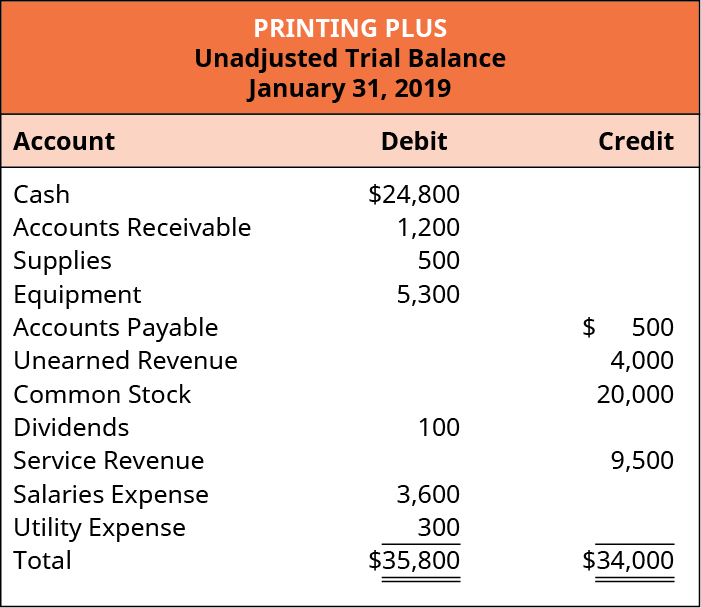

Where does unearned seevice rwvenue show on trial balance. Service Supplies is credited for 900. The main difference from the general ledger is that the general ledger shows all of the transactions by account whereas the trial balance only shows the account totals not each separate transaction. Reporting Unearned Revenue.

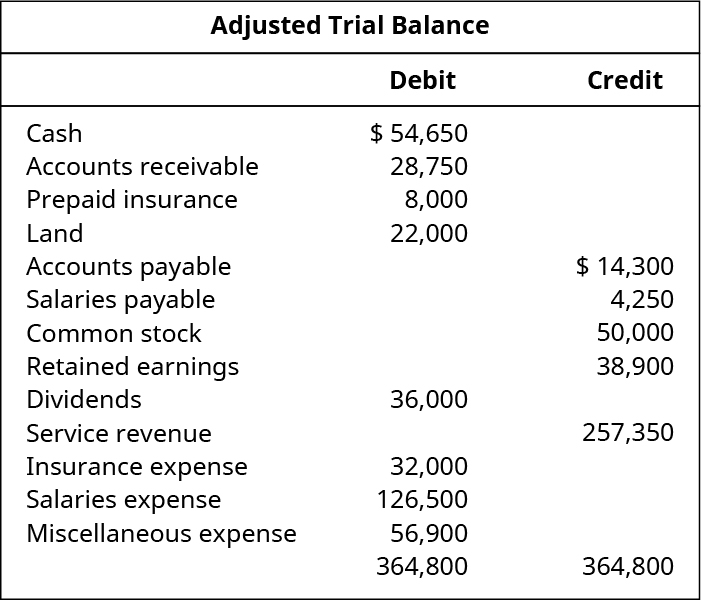

Unearned Revenue 1500 Service Revenue 1500. For Amazon Freds payment 79 is unearned revenue since the company receives the full payment in advance while none of the services have been provided to Fred yet. If a company were not to deal with unearned revenue in this manner and instead recognize it all at once revenues and profits would initially be overstated and then understated for the additional periods during which the revenues and profits should have been recognized.

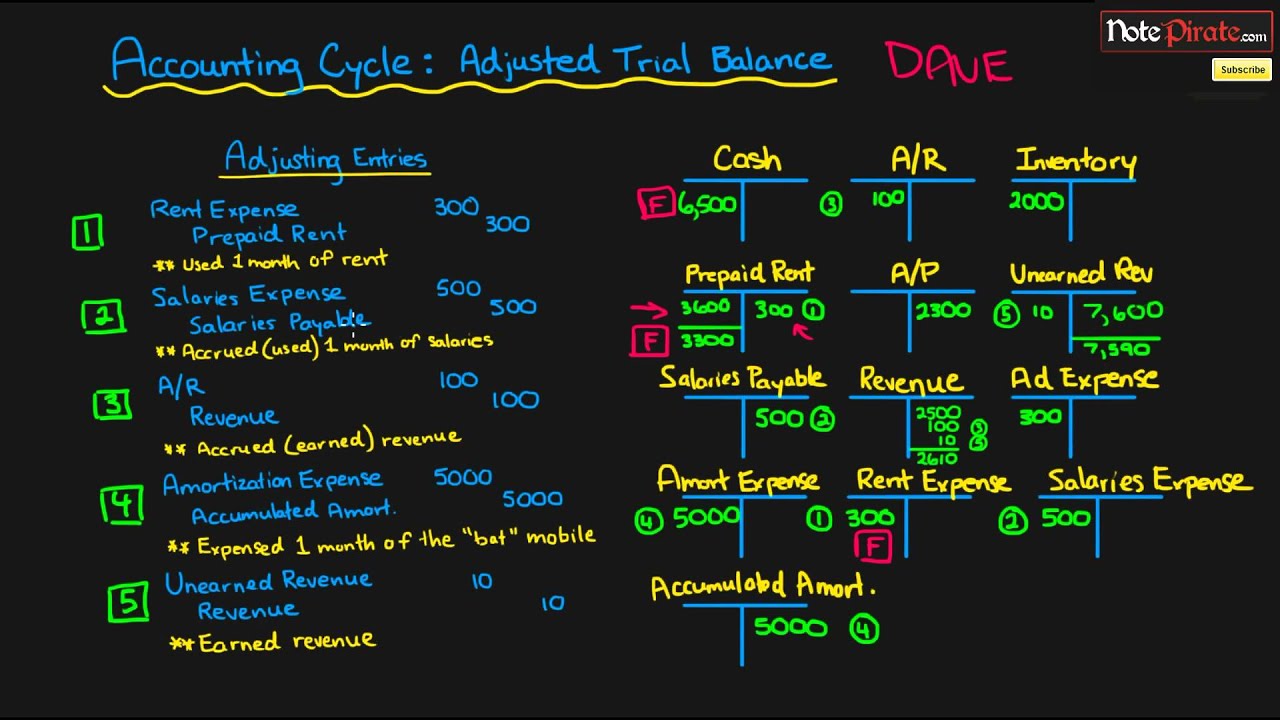

These credit balances would transfer to the credit column on the unadjusted trial balance. The normal balance of unearned rent is typically a liability credit entry. To record salaries earned but not paid.

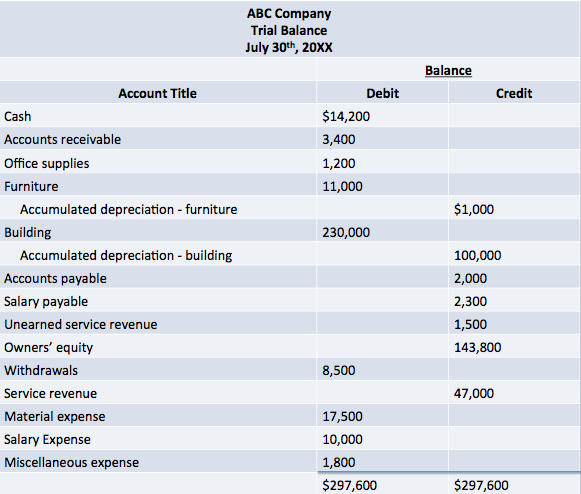

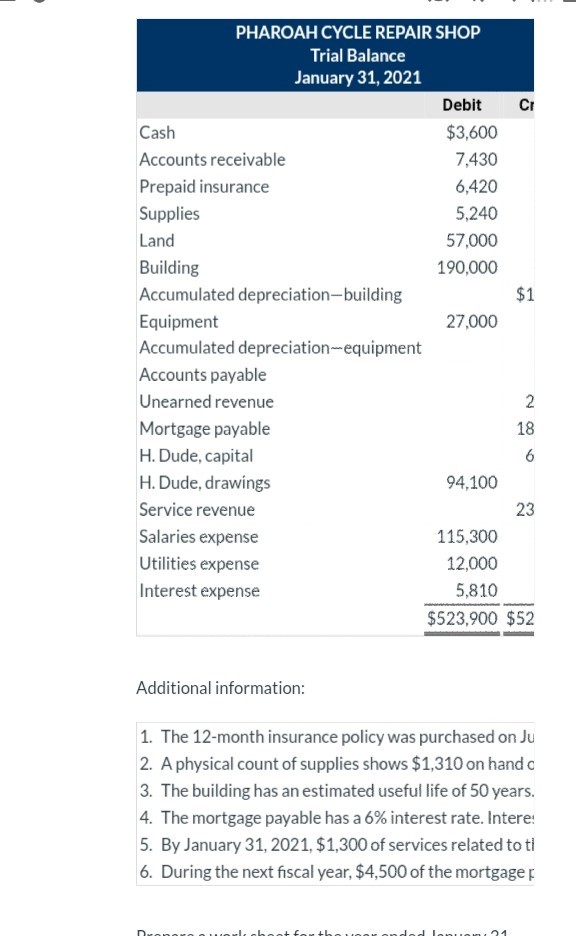

The amount received would be recorded as unearned income Unearned Income Unearned income refers to any additional earnings made from the sources other. After posting the above entries they will now appear in the adjusted trial balance. Interest Receivable 600 Interest Revenue 600.

Unearned Revenue Journal Entry Examples. After incorporating the 900 credit adjustment the balance will now be 600 debit. The Greener Landscape Group Post-Closing Trial Balance April 30 20X2.

The unearned revenue account is usually classified as a current liability on the balance sheet. Initially the full amount will be recognized as unearned revenue on Amazons balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. Since the company considers unearned revenue as a liability it appears in the liabilities section of the balance sheet.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)