Outstanding Deferred Credits Will Appear On The Balance Sheet With The

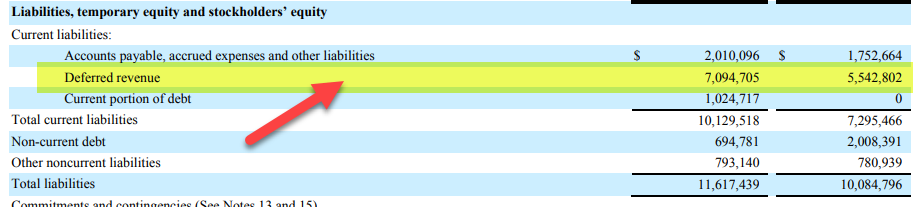

Deferred long-term liability charges appear on a companys balance sheet as line items with other long-term debts.

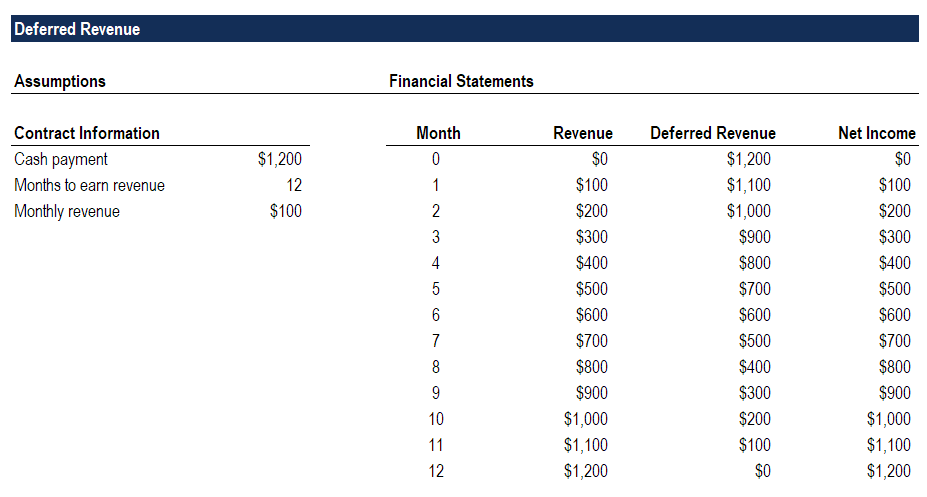

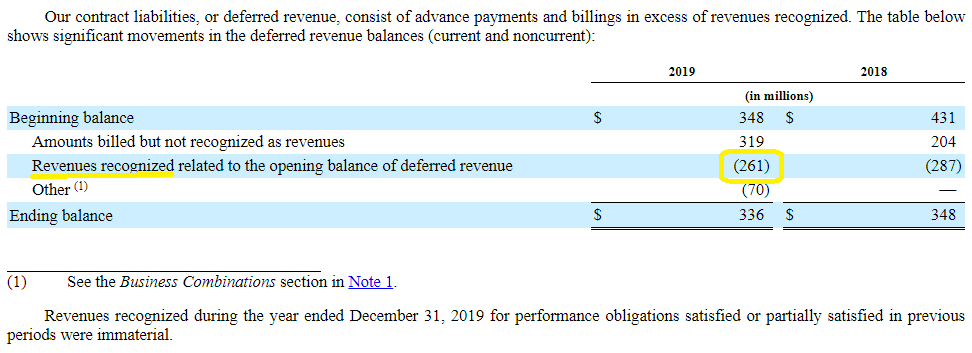

Deferred credits will appear on the balance sheet with the. Current assets most commonly used by small businesses are cash accounts receivable inventory and prepaid expenses. In most cases a deferred credit is caused by the receipt of a customer advance. Depending on the specifics the deferred credit might be a current liability or a noncurrent liability.

Advertising expense will appear on which section of the worksheet. In a balance sheet deferred credit is reported as a liability and is divided into current liability and non-current liability. A decrease on the asset side of the balance sheet is a credit.

This is a situation where a customer pays the seller before the seller has provided it with an offsetting amount of services or merchandise. Deferred revenue appears on the balance sheet and the cash flow statement. Deferred tax asset vs.

A deferred credit is cash received that is not initially reported as income because it has not yet been earned. Deferred creditalso known as deferred revenue deferred income or unearned incomeis recorded on the balance sheet as a liability. In other words any difference in the tax basis of accounting income and taxable income.

How to Present Deferred Tax Assets Liabilities on a Balance Sheet. The reason for deferring recognition of the cost as an expense is that the item has not yet been consumed. If the balance sheet entry is a credit then the company must show the salaries expense as.

In the past it was common to see a noncurrent liability section with the heading Deferred Credits. After all the company hasnt actually earned that money yet. Deferred tax liability Depending on the nature of your tax it can be a deferred tax liability or a deferred tax asset both of which will appear on your companys balance sheet.