Exemplary Deferred Tax Balance Sheet Approach

An emphasis on the audit of accounting for income taxes is expected.

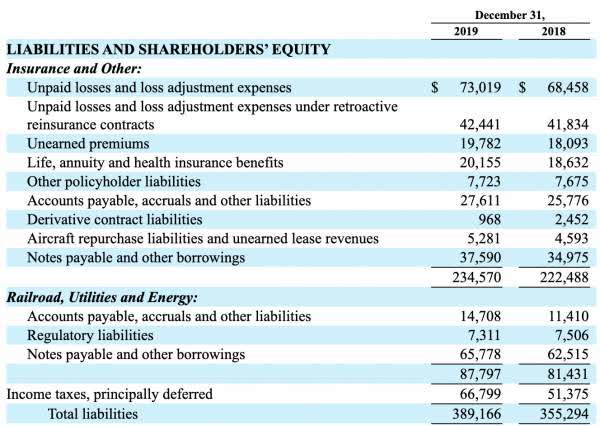

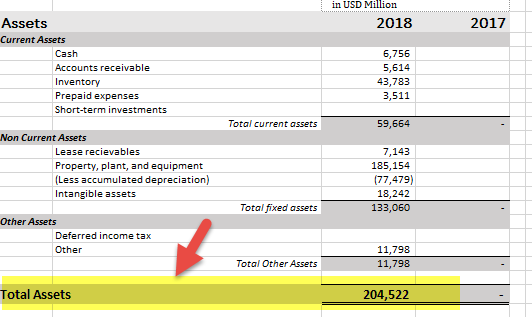

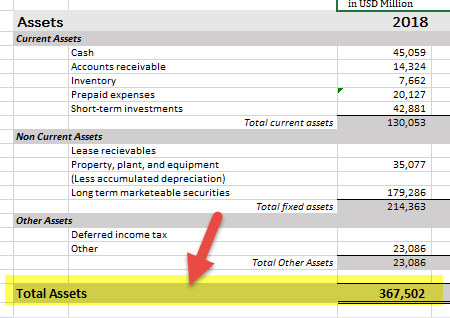

Deferred tax balance sheet approach. The balance sheet liability approach with separate recognition of deferred tax assets and deferred tax liabilities in IAS 12 is based on Financial Accounting Standard 109Accounting for income taxes FAS 109 its US GAAP equivalent. A deferred tax asset is recognised for an unused tax loss carryforward or unused tax credit if and only if it is considered probable that there will be sufficient future taxable profit against which the loss or credit carryforward can be utilised. Deferred tax liability is a tax assessed or due for the.

The Balance Sheet Approach and the Benefits of Maintaining a Tax Basis Balance Sheet. Accounting Standard AS 22 Taxes on Income advocates income statement approach. Deferred tax is a balance sheet line item which is recorded because the Company owes or pay more tax to the authorities.

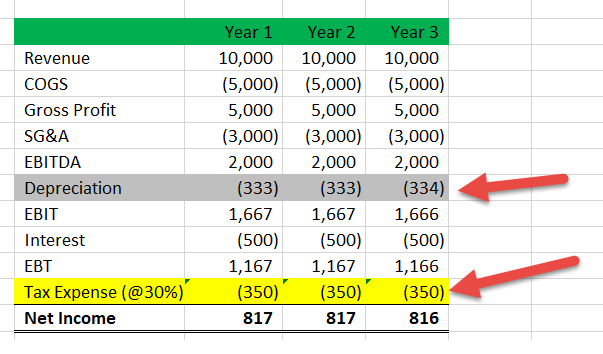

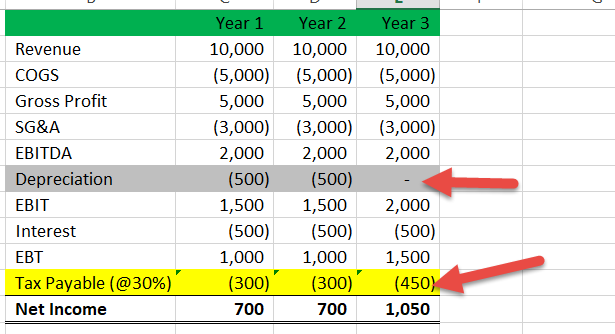

Example of a deferred tax liability. When the amount is less than the estimated tax an entry is placed on the balance sheet in the form of a liability. The proof brings the Book v.

IAS 12 defines a deferred tax liability as being the amount of income tax payable in. The deferred tax represents the negative. The resultant amount will be Deferred Tax Liability.

This guide summarises the approach to calculating a deferred tax balance allocating the deferred tax charge or credit to the various components of the financial statements sets out disclosure requirements and provides examples of the disclosures required by the. A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes. In FR deferred tax normally results in a liability being recognised within the Statement of Financial Position.

Giving rise to deferred tax liability on the companys balance sheet. Deferred tax is accounted for in accordance with IAS 12 Income Taxes. The Deferred Tax Proof form and report computes the tax effect of the difference between the book and tax basis balance sheet in accordance with IFRS requirements under the Balance Sheet approach.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)