Awesome Dispensary Tax Basis Balance Sheet

Kevan contributed the following assets.

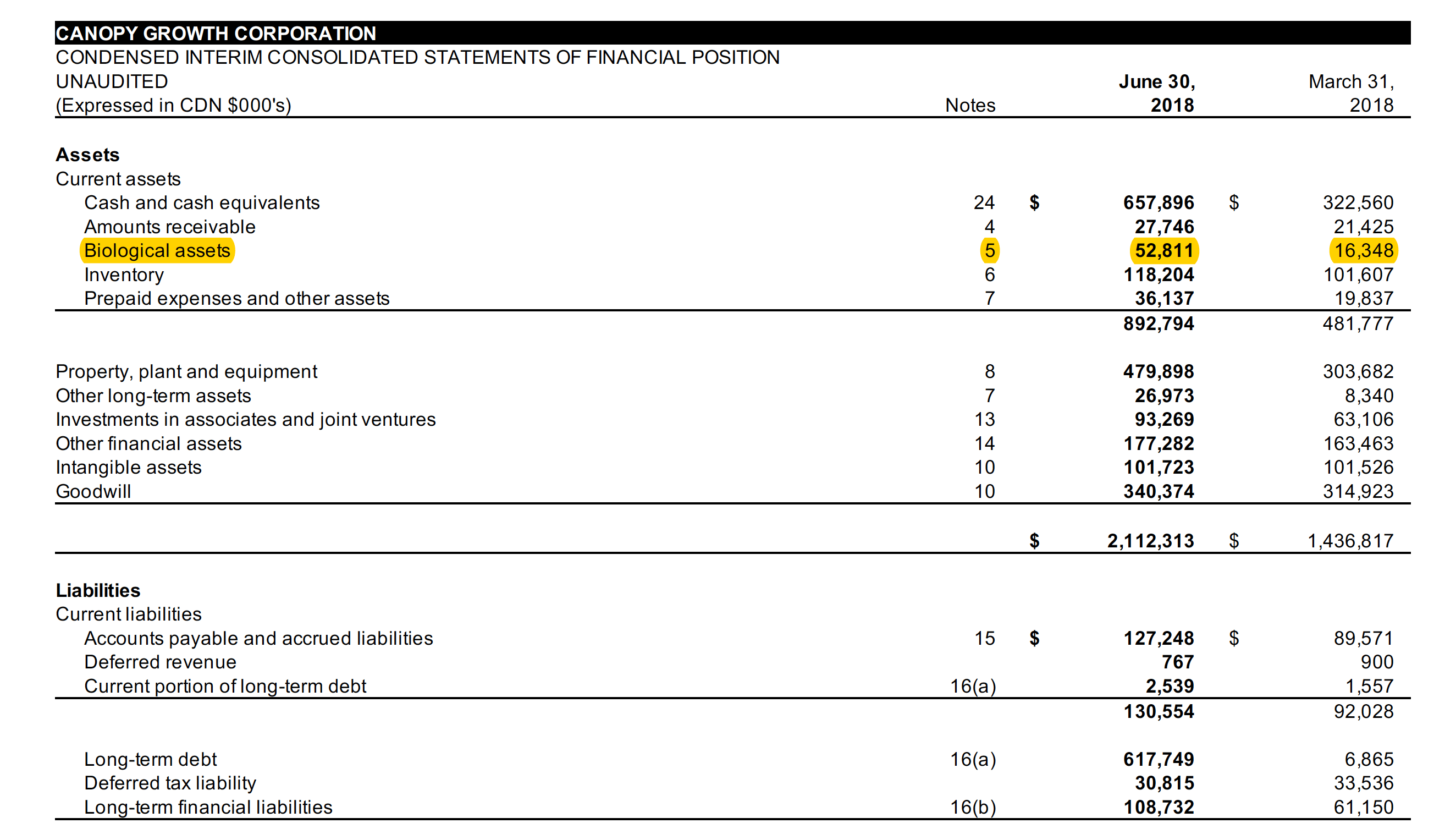

Dispensary tax basis balance sheet. Balance sheet has not changed. The assets are the net plant of the partnership less the 50 ITC basis adjustments. Tax Provision automatically loads the book basis assetsliabilities and the end of period gross temporary differences to create the Tax Basis Balance Sheet.

Each member received a one-third capital and profits interest in the LLC. The balance sheet only includes liabilities with cash outlay requirements. However per the general rule inside basis is transferred to the new.

Trial Balance Closing Balance. The balance sheet should balance. Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with GAAP the tax basis balance sheet represents the tax basis of assets and liabilities in accordance with tax rules and regulations by tax jurisdiction.

In a tax basis balance sheet the liabilities of a. Description of the Tax Basis Balance Sheet columns based on the provided configuration. If you use the income tax basis accounting it will not include adjustments for impairment or closure of stores.

The key here is to have your business situated for tax season long before youre even on the IRSs radar. The balance sheet contents under the various accounting methodologies are. That changed when the M-3 came into being.

Cash Land 15000 120000 135000 15000 440000 455000 Totals Nonrecourse debt secured by the land equals 210000. 16-24 2019 Tax Year Premium Quickfinder Handbook Partners Adjusted Basis Worksheet Name of Partner Jerry Taxit TIN 359-00-0000 Tax Year Ending 123119 Name of Partnership Shout and Jump EIN 41-1234567 1 Adjusted basis from preceding year enter zero if this is the first tax year in which the taxpayer is a member of the partnership. Cannabis accounting will provide you with the financial or legal guidance you need.