Favorite Deferred Tax Calculation Example Excel

Disallowing Depreciation as per Companies Act Deferred Tax Basics Difference between DTA and DTL Permanent Difference And Timing Differnce Deferred tax computation format You are here Income Tax Computation Format For Companies Amendment.

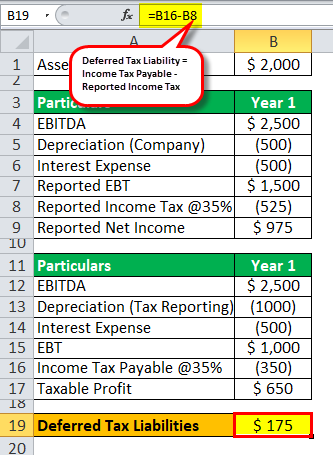

Deferred tax calculation example excel. Scroll down and download Deferred Tax Calculation an easy way out in Excel format Manual calculation mode means that Excel will only recalculate all open workbooks when you request it by pressing F9 or Ctrl-Alt-F9 or when you Save a workbook. IAS 21 excel examples. Friends most of us face the challenge of calculating tax as per Income tax and AS 22.

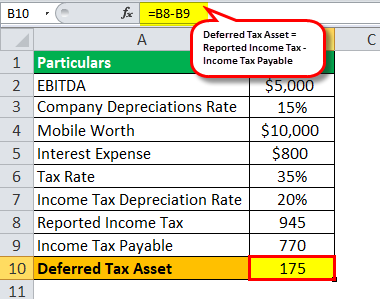

Diminishing balance depreciation with residual value. This calculator calculates everything with complete accuracy and ensures that it does not mislead you with wrong or inaccurate results. Thus the Company will record deferred tax assets DTA in the balance sheet.

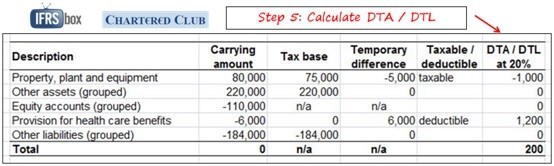

Deferred Tax Calculation-an easy way out in Excel. This is done by adding a deferred tax charge to the mainstream tax charge. Would my deferred calculation be as follows.

An excel sheet to better understand the deferred tax calc. Tax base 2000 less 2000 Nil. Deferred tax is a balance sheet line item which is recorded because the Company owes or pay more tax to the authorities.

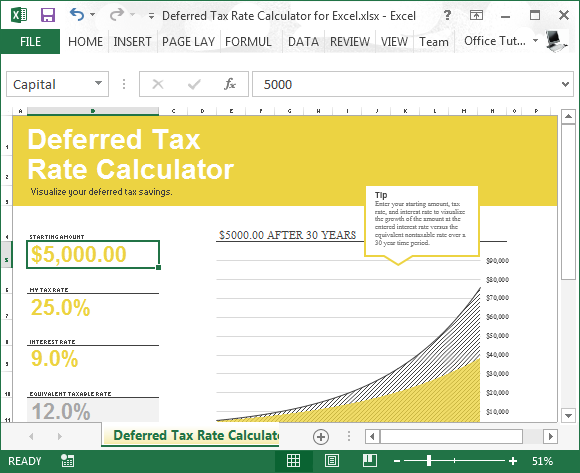

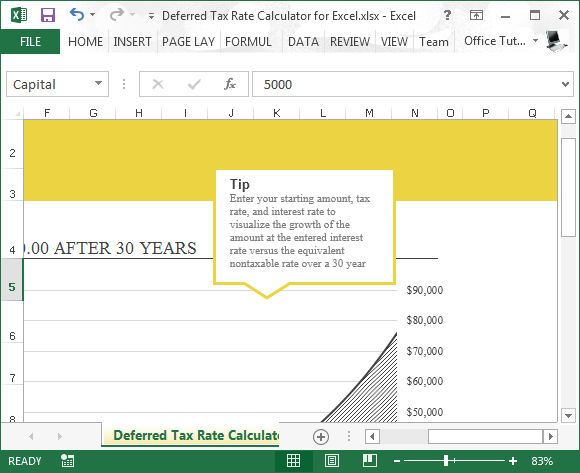

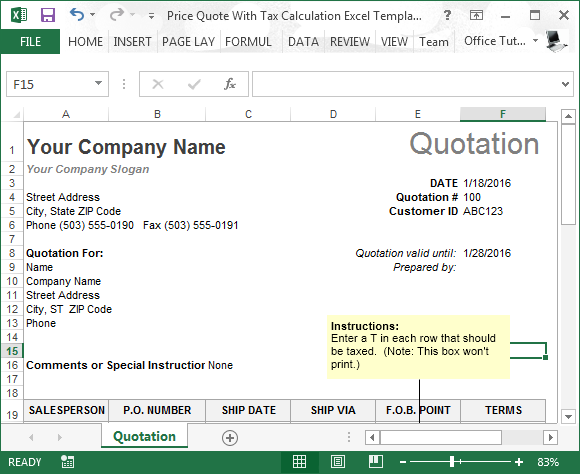

Excel Deferred Tax Rate Calculator Templates for ms excel file size is 62896484375 kb. Sum of the digits depreciation. I assume they can claim FYA on the equipment.

The deferred tax rate calculator is a great tool to be used for all those people who dont have any clue about how to calculate the deferred tax rate. This Excel Deferred Tax Rate Calculator Templates is for microsoft office Excel 2013 or newer so you can have it under xls xlx or xltx extension. Depreciation calculation sheet is created for Companies using WDV method and not for SLM method.