Awesome How To Calculate Trading Account

Between the purchase price and the sale price of a given asset at a given time.

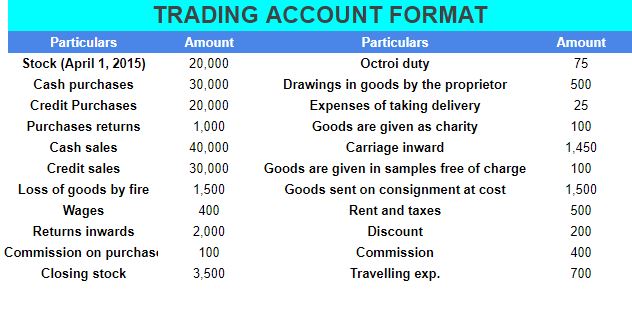

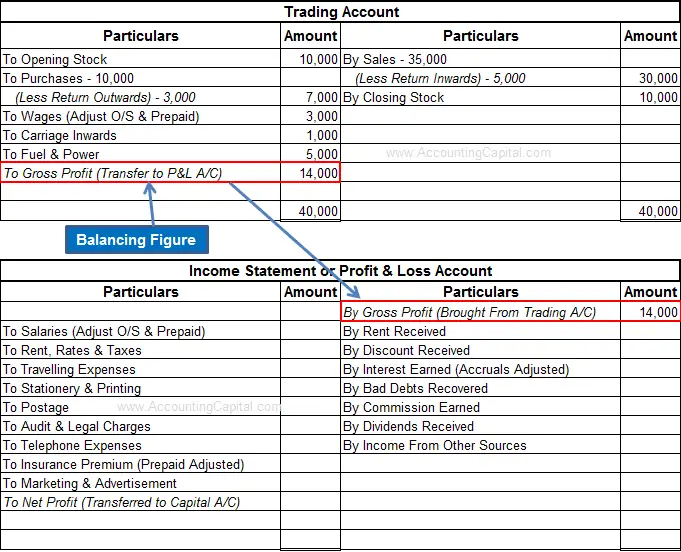

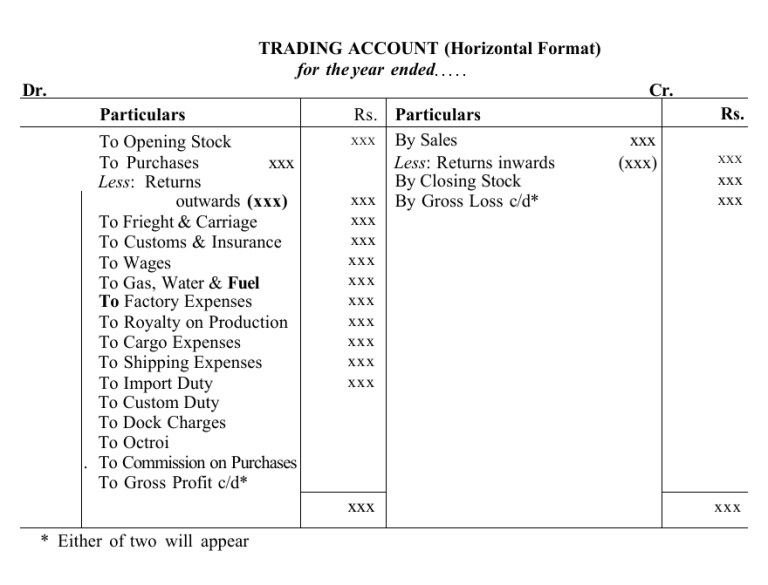

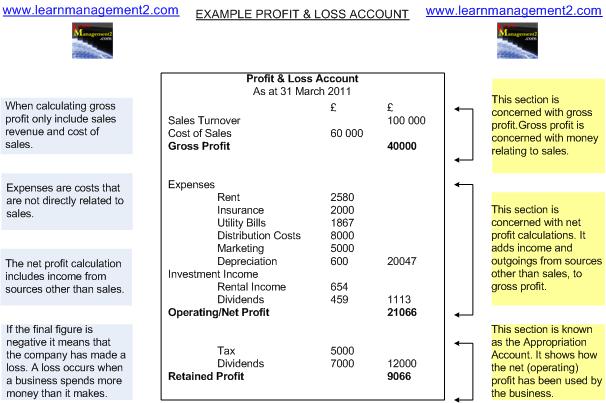

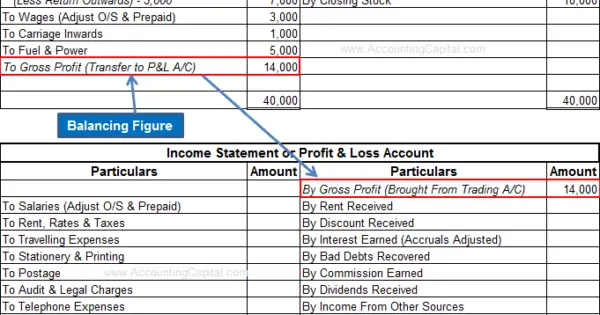

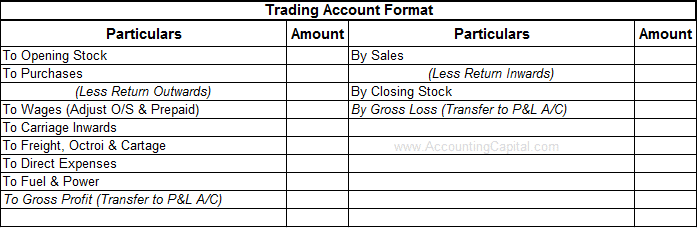

How to calculate trading account. In the trading account the cost of goods sold is subtracted from net sales for the period to calculate gross profit. The trading account shows the gross profit or gross loss during the accounting period. It deals therefore with a very different concept from that one become popular in the.

The spread how to calculate it and how much it weighs on the trading account. In income part we show the following details- Sales of goods Less Sales Returns. To calculate this amount in USD.

Enjoy 55 assets and free market strategies. Contract size Equivalent to the traded amount on the Forex or CFD market which is calculated as a standard lot size multiplied with lot amount. 6000 JPY 11445 5242 USD or 6000 JPY 111445 5242 USD.

Calculate dollars per pip. Instrument Also referred to as Symbol. Enjoy 55 assets and free market strategies.

Gross profit Net sales Cost of goods sold. The trade receivables figure will depend on the following. Maximum draw down represents how much money you lose from a recent account high before making a new high in your account.

In the first step we need to calculate risk in dollars then calculated dollars per pip and in the last step calculate the number of units. Pips at risk pip value lots traded amount at risk In the above formula the position size is the number of lots traded. The format of trading account after passing the closing entry is as follows.