Best How To Analyze Income Tax Return

If the combined income and dividend income exceeds 1500 the detail of the sources of interest and dividends can generally be found on Schedule B attached to the tax return.

How to analyze income tax return. Courses also cover the components of CRE cash flow and the drivers of cap rates. It contains information about the companys assets liabilities income and expenses that can be useful to an investor or business associate. Farid Tayari PhD Instructor Department of Energy and Mineral Engineering The Pennsylvania State University.

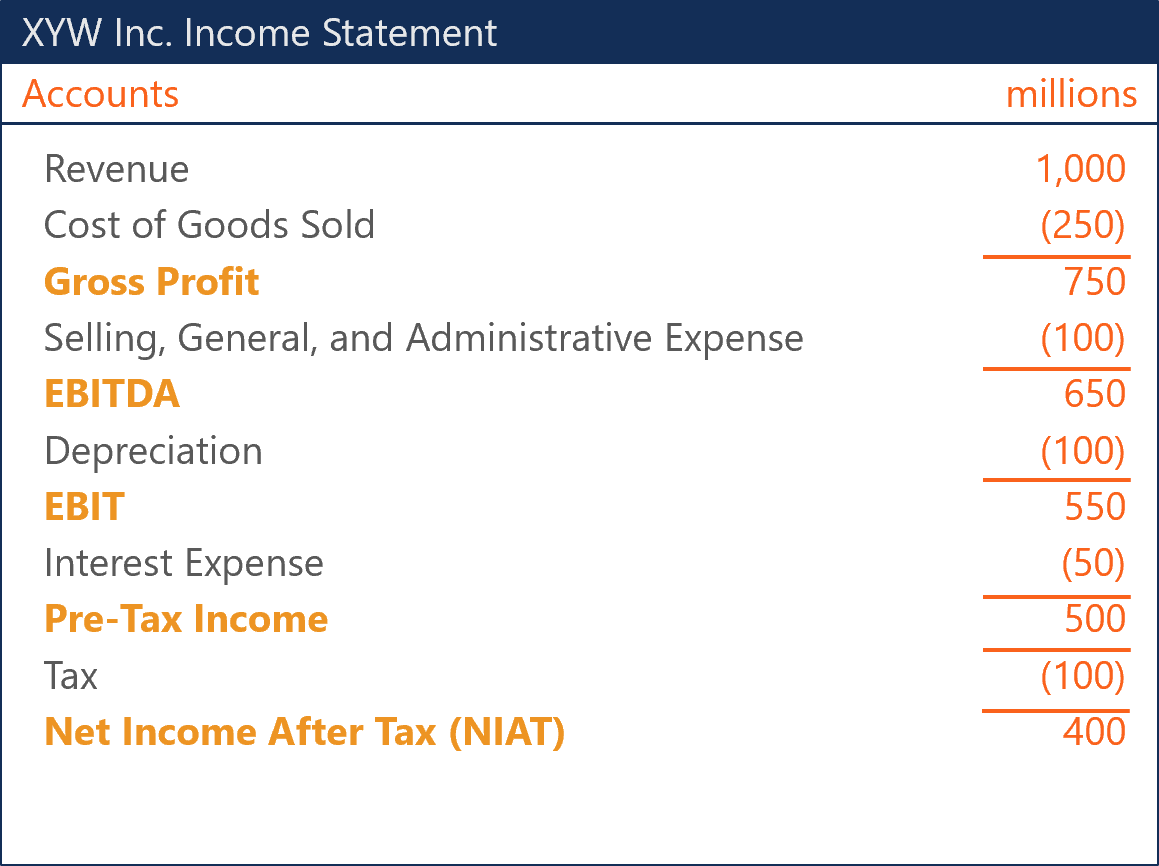

Rental income and expenses are found on Schedule E page 1 of the individual income tax return. SCHEDULE ANALYSIS SA METHOD. Numerous other analyses can be performed as part of any comparative company analysis using the income statement.

These seven courses explore how to analyze and interpret business financial statements and tax returns including cash flow statements. I would like to e-Verify later within 120 days from date of filing. Depending on your income level up to 85 of your Social Security income can be taxed yes another tax on a tax.

This courseware module is part of Penn States College of Earth and Mineral Sciences OER Initiative. To file your tax return please log into myTax Portal using your Singpass. Next we have any subtractions from your Income on lines 23-35.

Comparisons are often made to other businesses in the same industry to ascertain the businesss performance according to industry benchmarks. In this method you build cashflow item-by-item. You look at each source of income.

Dividends are found on Line 9A on the individual income tax return. I would like to e-Verify. If this tax return is the first 1120S form for your company you need to fill out and attach the IRS Form 2553 with this return.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)