Peerless Commission Received In Accounting Equation

Commission received in advance Rs1000 v.

Commission received in accounting equation. Iii Purchased goods for cash 5000 and credit 2000. Ii Rent received 2000. Accounting Equation for Received Cash on Account Journal Entry.

Started business with Cash Rs 60000. Iv Commission received in advance 1000. Accounting for Commissions Revenues Under the accrual basis of accounting the commissions do not have to be received in order to be reported as revenues.

This means that their account balances are transferred to a permanent account. Accounting Treatment of Commission Received. Accrued interest Rs 500 Commission received in advance Rs 1000.

Example of a Commission Calculation The commission plan of Mr. Rent received Rs 2000. V Amount withdrawn 5000.

This amount received in such way shall be treated as Commission Received. I Started business with cash 10000. Under the cash basis of accounting you should record a commission when it is paid so there is a credit to the cash account and a debit to the commission expense account.

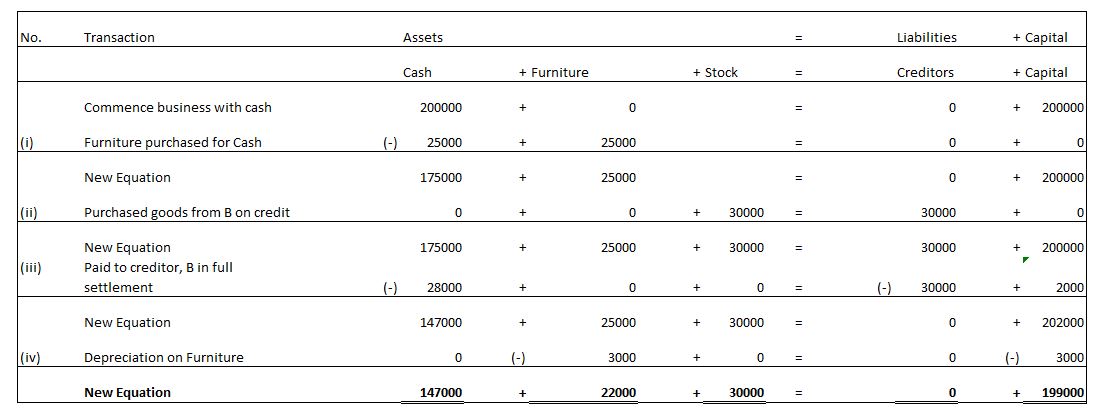

Q12 Prove that the Accounting Equation is satisfied in all the following transactions of Sameer Goel. You can classify the commission expense as part of the cost of goods sold since it. The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business.