Glory Ikiban Inc Statement Of Cash Flows

Income statement items not affecting cash.

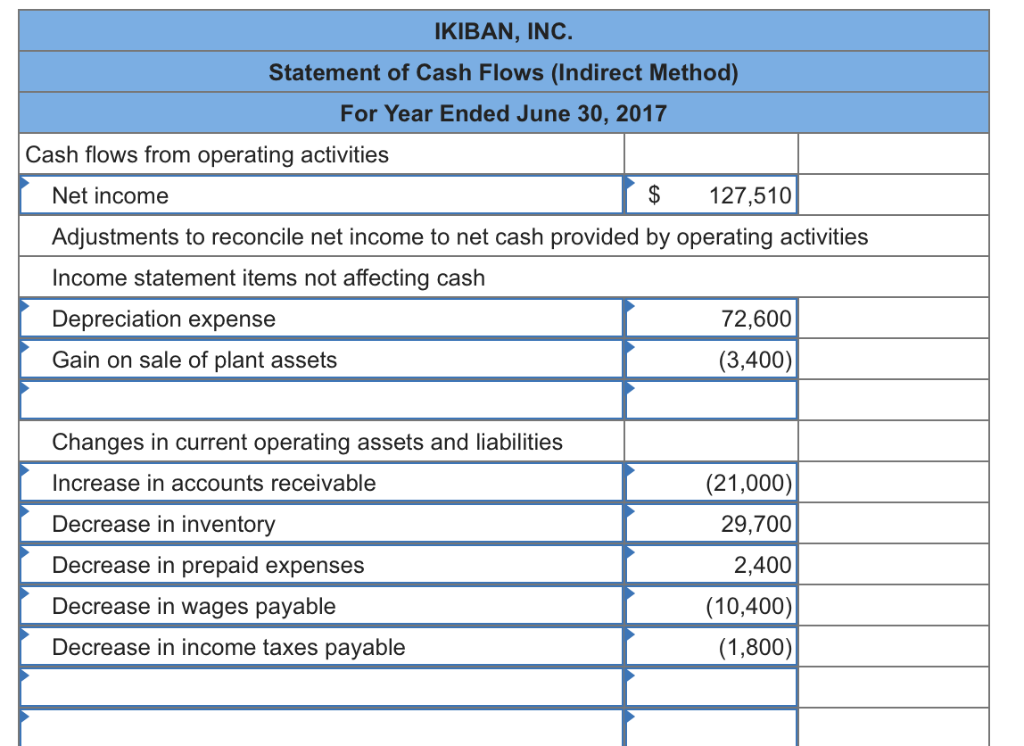

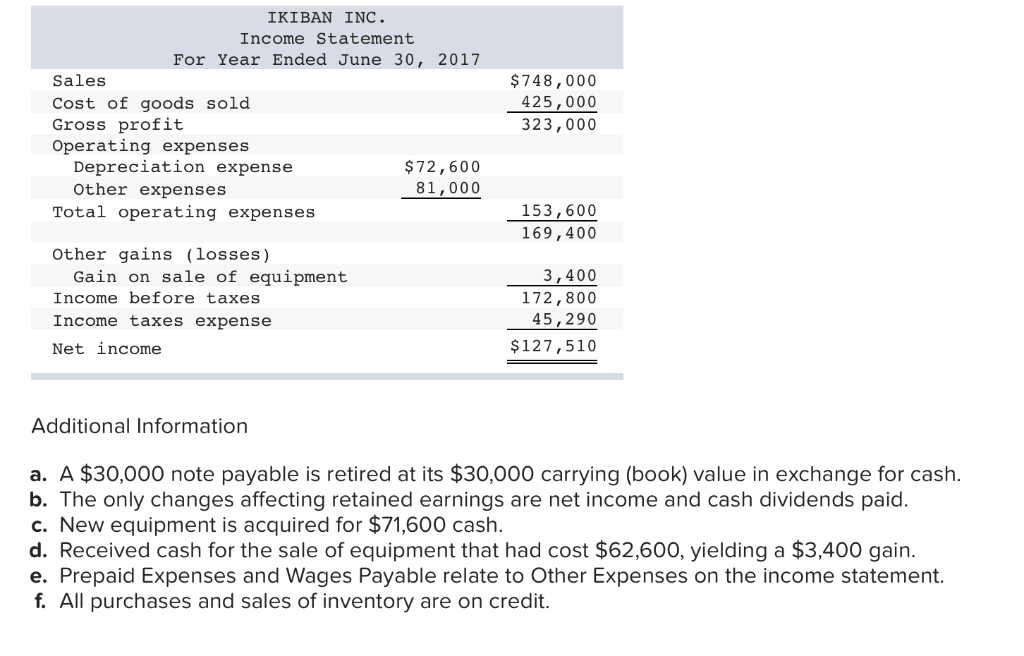

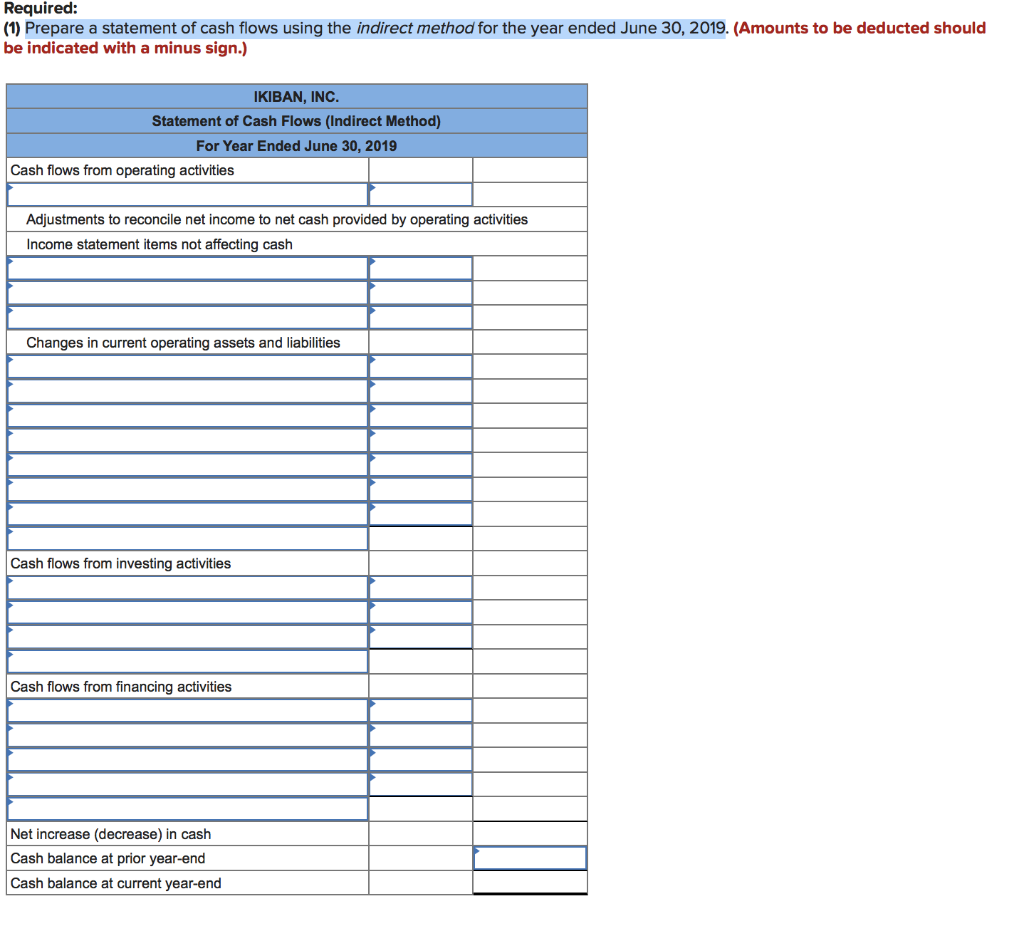

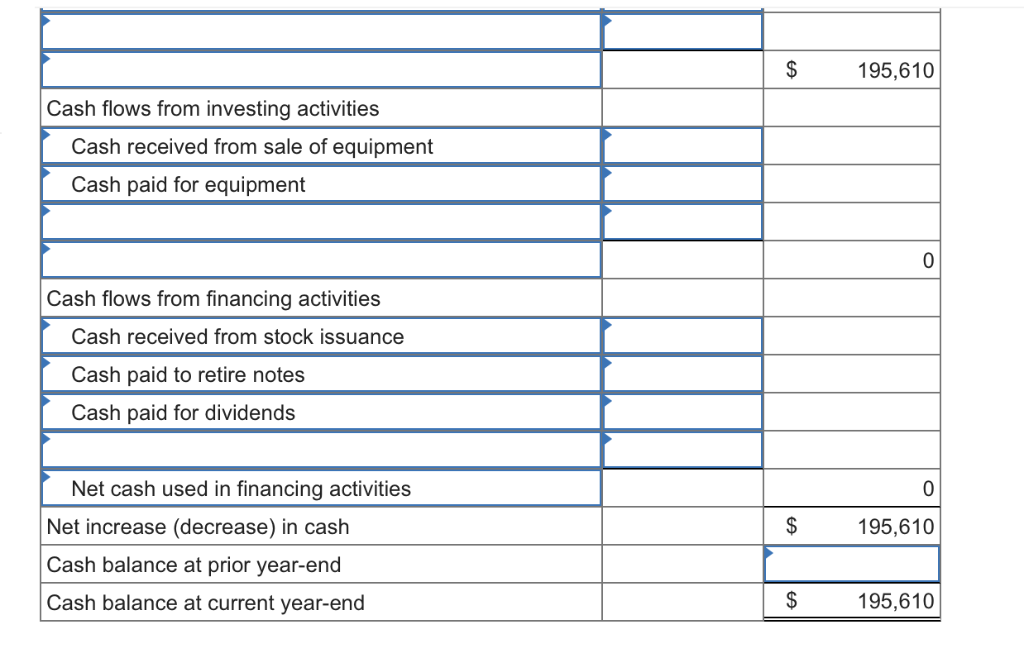

Ikiban inc statement of cash flows. Cash Flows from Operating Activity. Statement of Cash Flows Indirect Method For Year Ended June 30 2017 Cash flows from operating activities Adjustments to recancile net income to net cash provided by operating activities Income slatement items not affecting cash Changes in current operating assets and iabilities S Cash flows from investing activities 0 Cash flows. Depreciation expense 67600 Decrease in inventory 27200 Decrease in prepaid expenses 1900 Increase in accounts receivable 18500 Gain from sale of equipment.

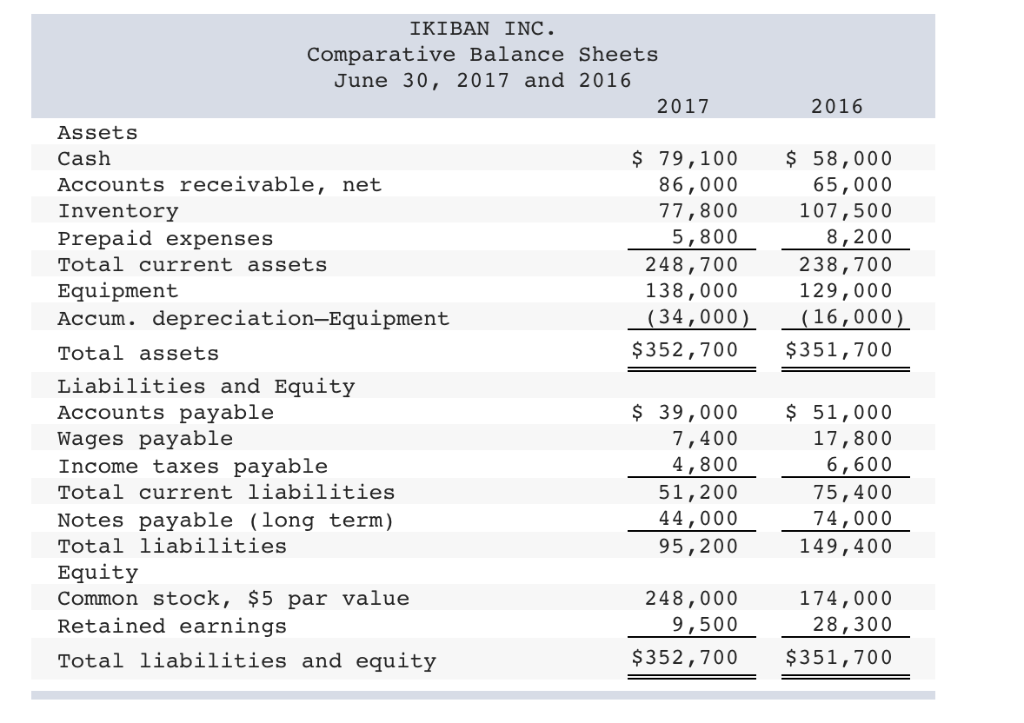

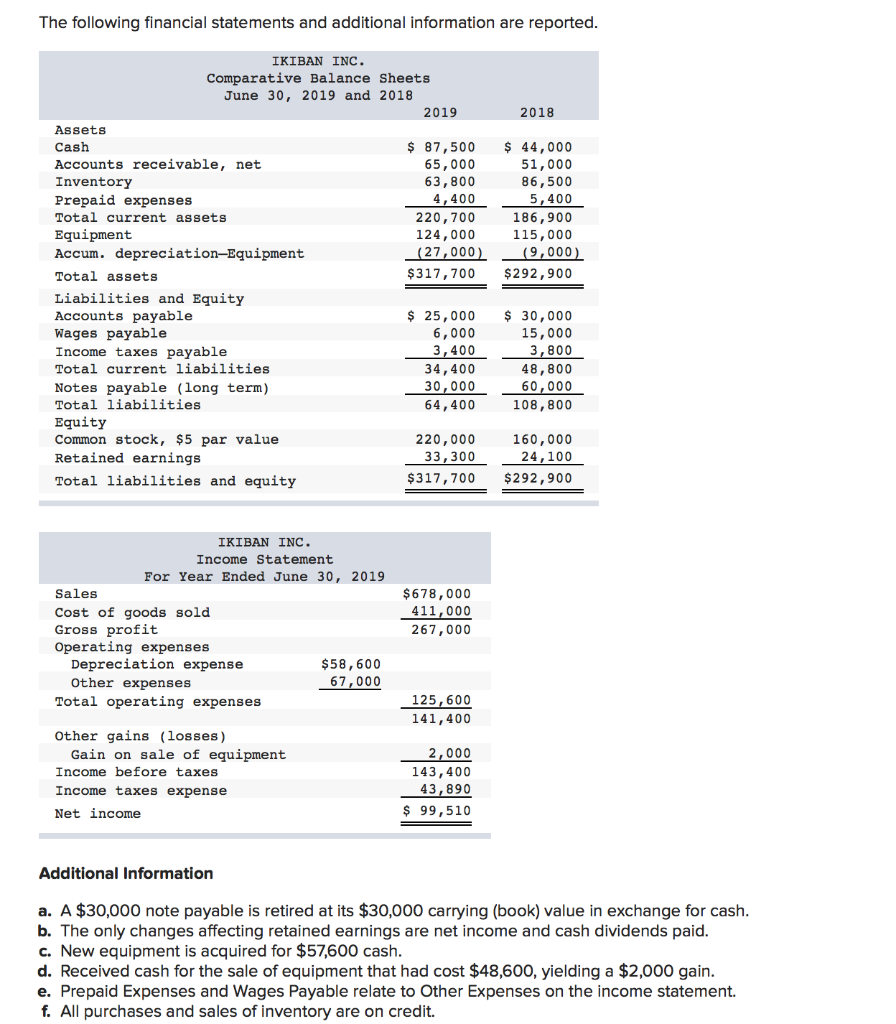

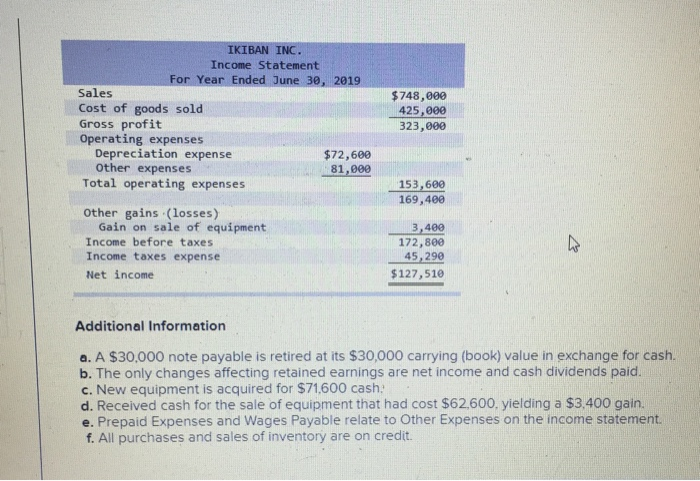

The following financial statements and additional information are reported. Gain on sale of plant assets 2000. Exercise 12-11B 40 minutes Part 1.

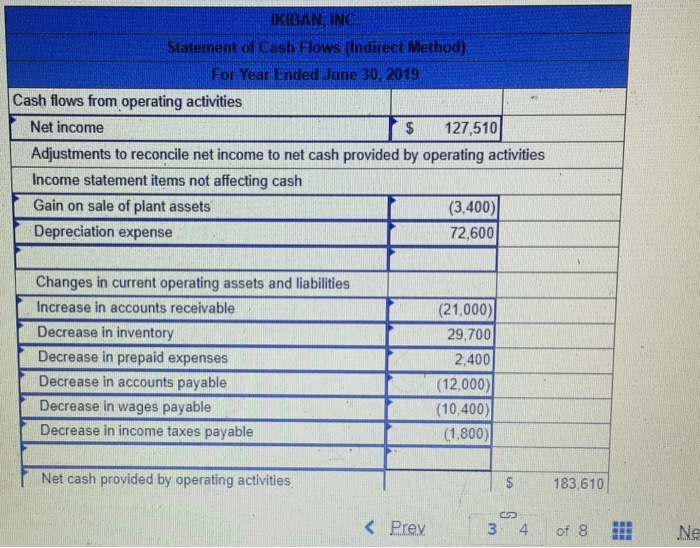

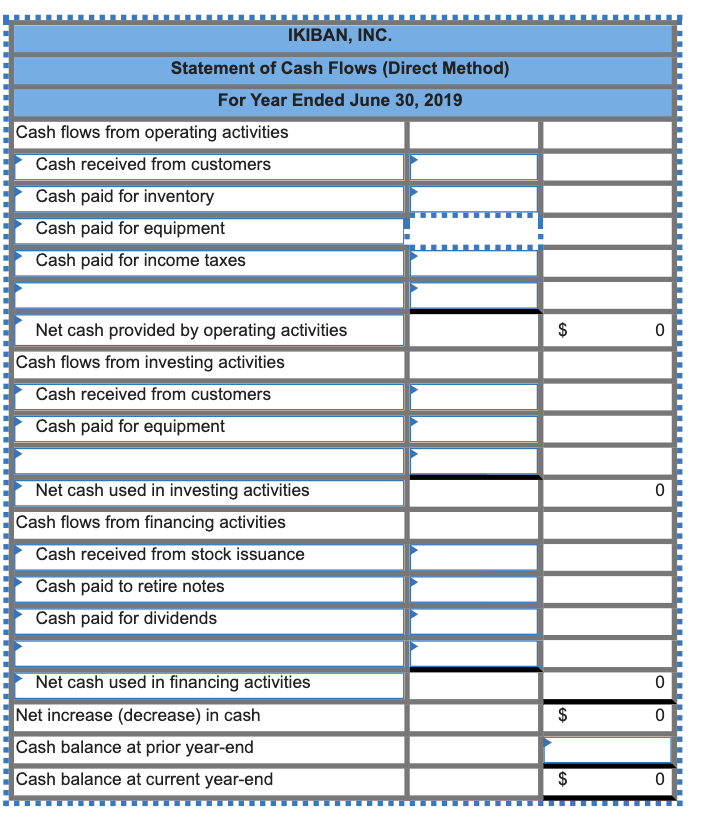

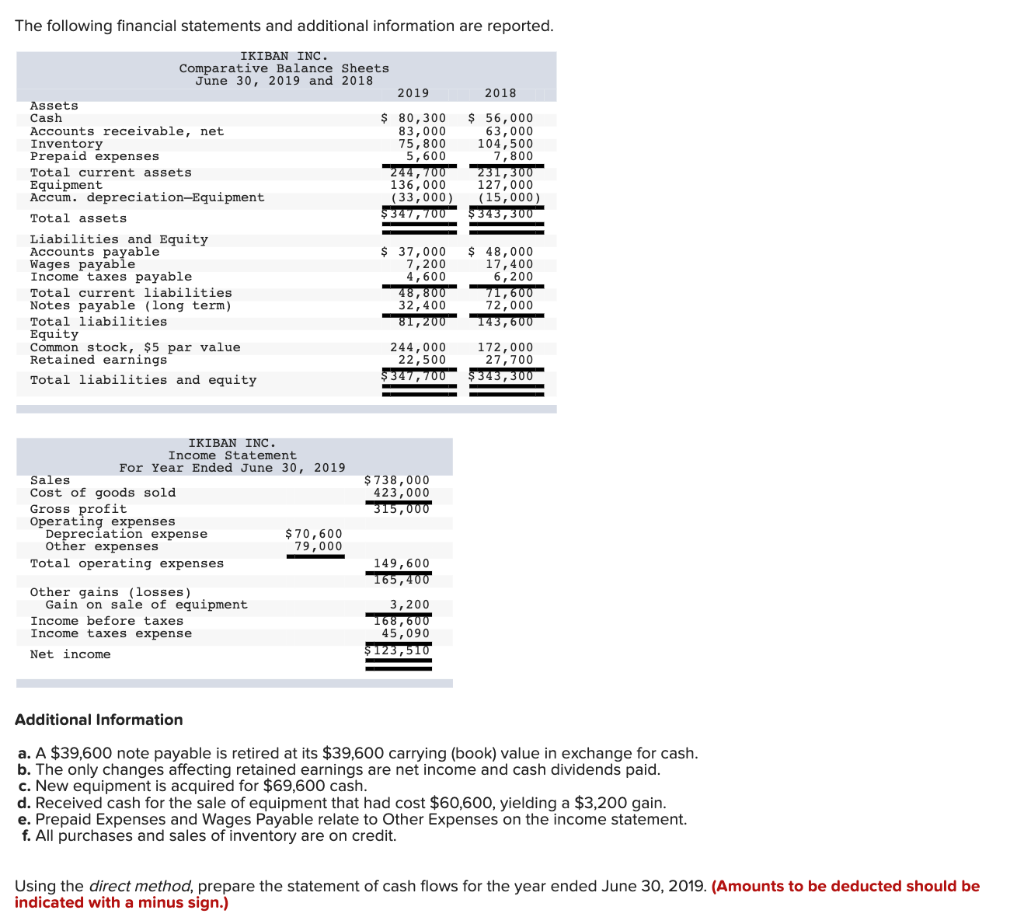

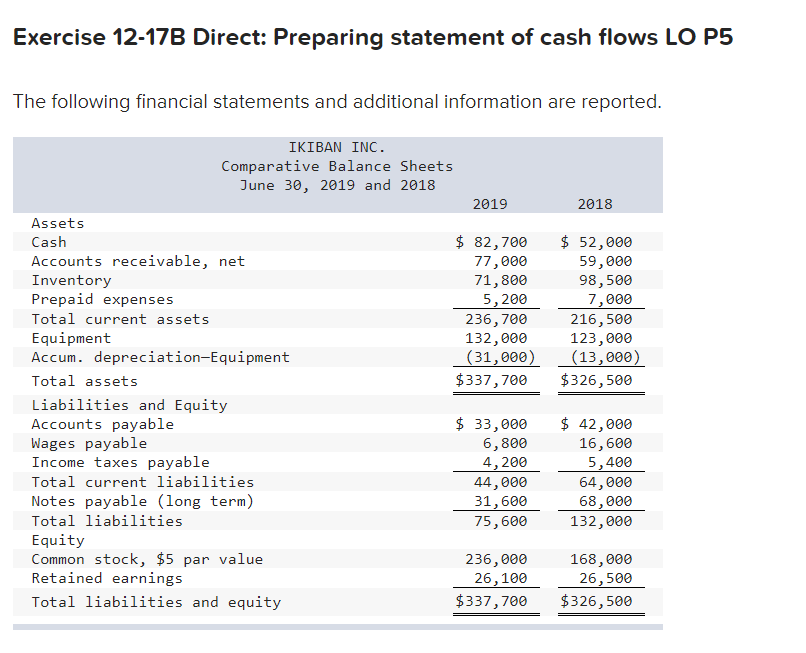

Statement of Cash Flows Indirect Method For Year Ended June 30 2015. IKIBAN INC Statement of Cash flows Direct Method For the Year Ended June 30 2019 Cash flow from Operating Activities. Income statement items notaffecting cash.

Income Statement For Year Ended June 30 2019 Sales 718000 Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses 419000 299000 66600 75000 Total operating expenses 141600 157400 Other gains losses Gain on sale of equipment Income before taxes 2800 160 200 44690 Income taxes expense Net income 115510 Additional Information a. Income statement items not affecting cash. Statement of Cash Flows Direct Method For Year Ended June 30 2015 Cash flows from operating activities Cash received from customers 664000 Cash paid for inventory 393300 Cash paid for operating expenses 75000 Cash paid for income taxes 44290 Net cash provided by operating activities 151410 Cash flows.

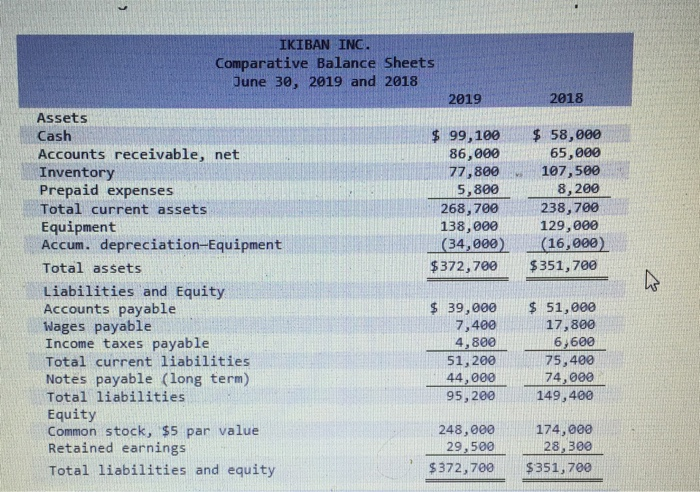

A 30000 note payable is retired at its 30000 carrying book value in exchange for cash. Comparative Balance Sheets June 30 2016 and 2015 Additional Information a. Statement of Cash Flows Direct Method For Year Ended June 30 2019 Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net increase decrease in cash Cash balance at prior year-end Cash balance at current year-end.

Also this favorably compares to its return on assets figure of 326 high quality earnings. Net Income 9951000. DepreciationEquipment 28500 10500 Total assets.