Spectacular Income Statement Dutch Gaap

Companies are well advised to comply with DASs and are furthermore recommended to use the DASs for reference when interpretation of Title 9 of the Netherlands Civil Code is required.

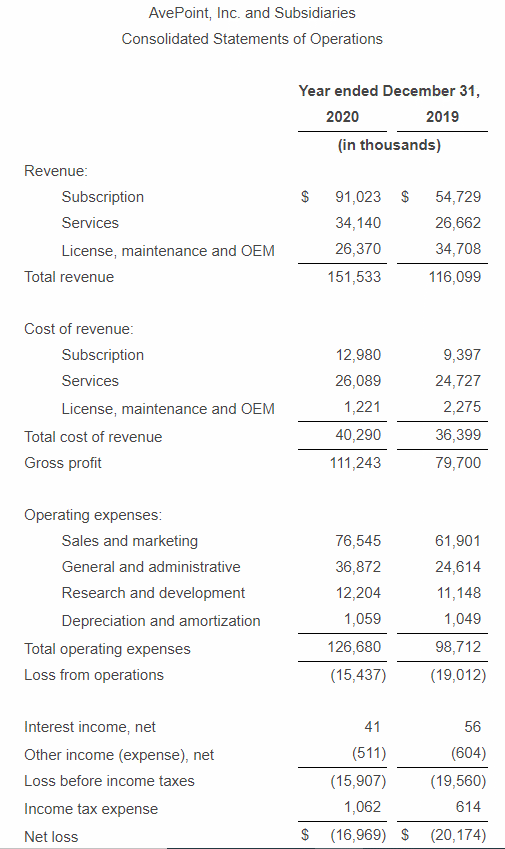

Income statement dutch gaap. If the investee incurs a loss the investor company debits a loss account and credits the investment account for the investors share of the loss. Under the GAAP the financial statements of a Dutch company must be made of. An income statement or profit and loss account.

These must be filed in accordance with specific regulations which apply differently based on the type of company. The Dutch Generally Accepted Accounting Principles Dutch GAAP are mainly based on EU directives. The financial statements must contain at least a balance sheet a profit and loss account and notes to the accounts.

The changes in accounting may result in temporary differences it should be considered how these temporary differences are calculated and if the initial. The Dutch Generally Accepted Accounting Principles Dutch GAAP are mainly based on EU directives. In the past the Dutch GAAP revised many of their principles to align them with IFRS.

Van Eert Accountants Advisers can prepare the financial statements for your company according to GAAP or IFRS consisting of. The following financial documents must be prepared under the Dutch GAAP. Company-only Statutory Dutch GAAP Income Statement for the year ended December 21831 2007 Notes to the Company-only Statutory Dutch GAAP 219Financial Statements Other Information 228 Auditors Report on the Statutory Financial Statements 229 Supplementary Information 231 Company-only IFRS Financial Statements 232 Auditors Report on the Company-only IFRS Financial Statements.

Dutch GAAP accounting standards in the Netherlands The Dutch accounting rules are regulated by law. - the balance sheet and an income statement - detailed notes on the accounting policies employed by the company alongside explanatory notes - the cash flow statement is also required in the case of medium and large companies. Legal entities under Dutch GAAP can now opt to account impairment of financial assets based on expected credit loss model under IFRS 9 Financial instruments and apply IFRS 15 Revenue from contracts with customers from.

Us IFRS US GAAP guide 14132. Dutch GAAP requires disclosures of changes in the tax laws and tax rates enacted or announced after the reporting date if they have a significant effect on current or deferred tax as a post balance sheet event. The Netherlands Civil Code BW 2 Titel 9 the Framework and the Guidelines on Annual Reporting called Richtlijnen voor de Jaarverslaggeving RJ or DAS from the Dutch Accounting Standards Board DASB.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg)