Supreme T776 Rental Expenses

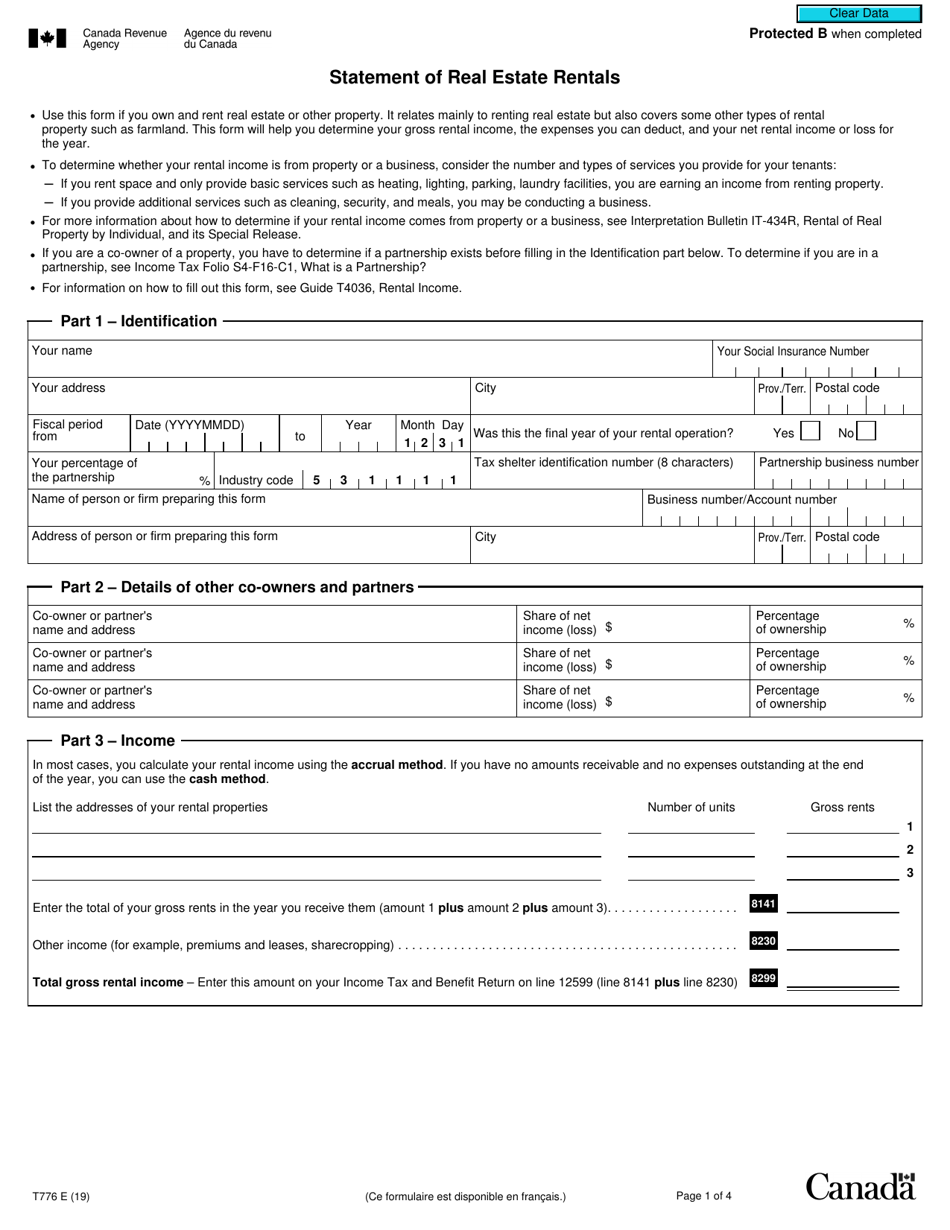

In most cases rental income is considered to be personal other income when filing your taxes in Canada.

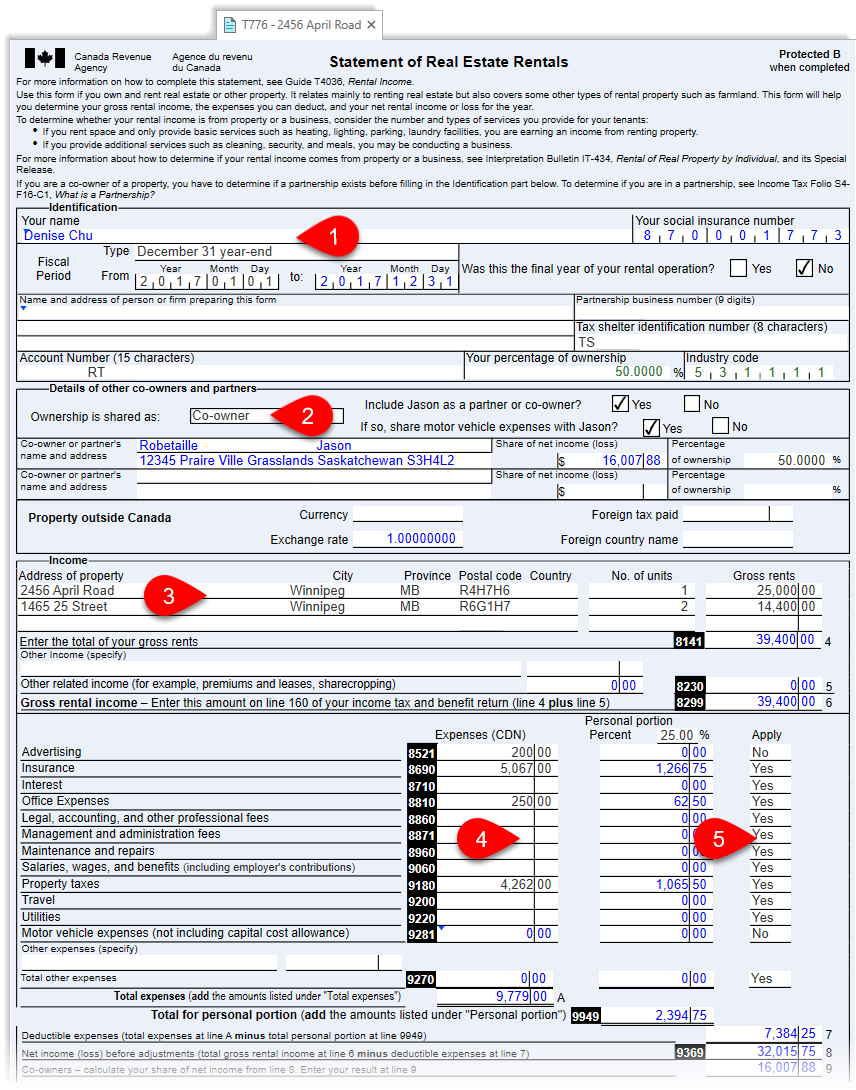

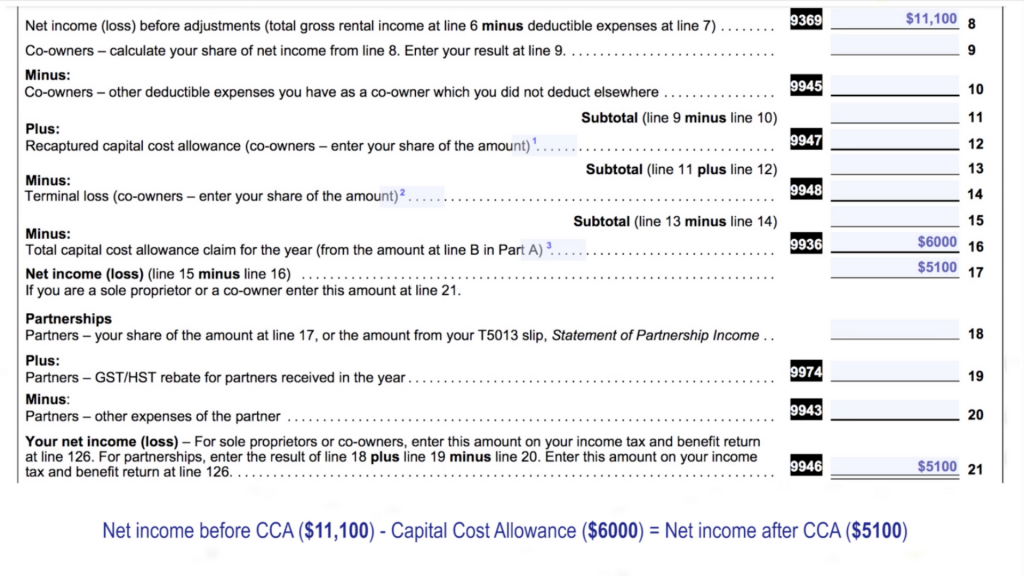

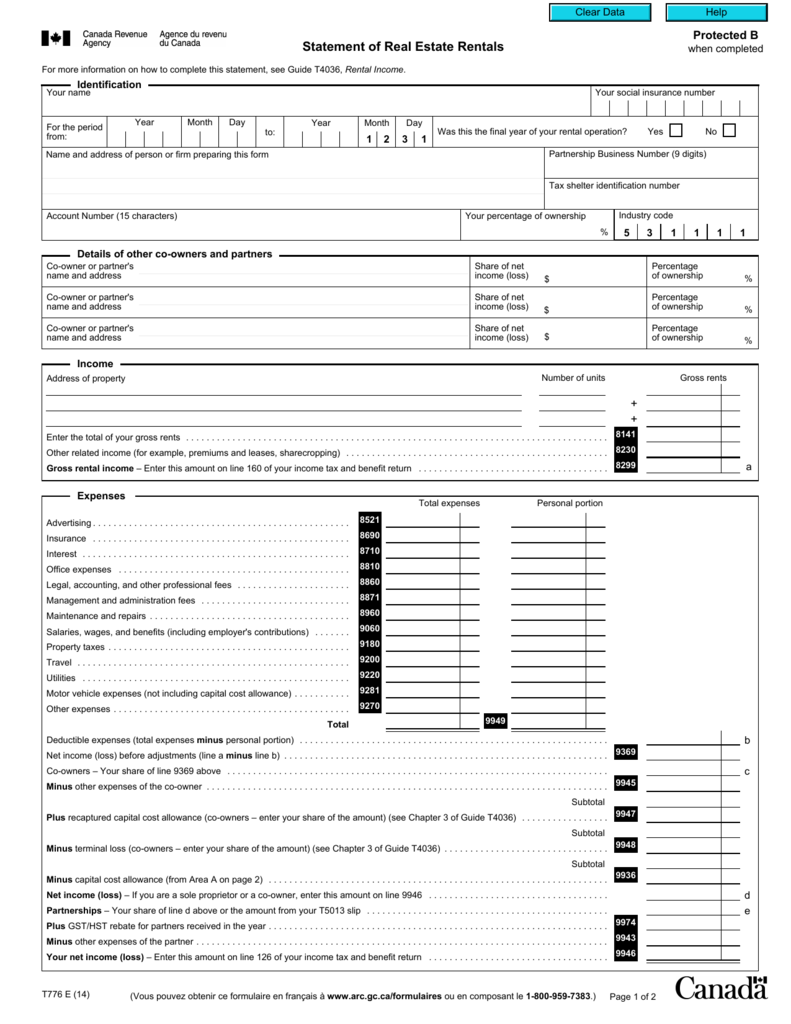

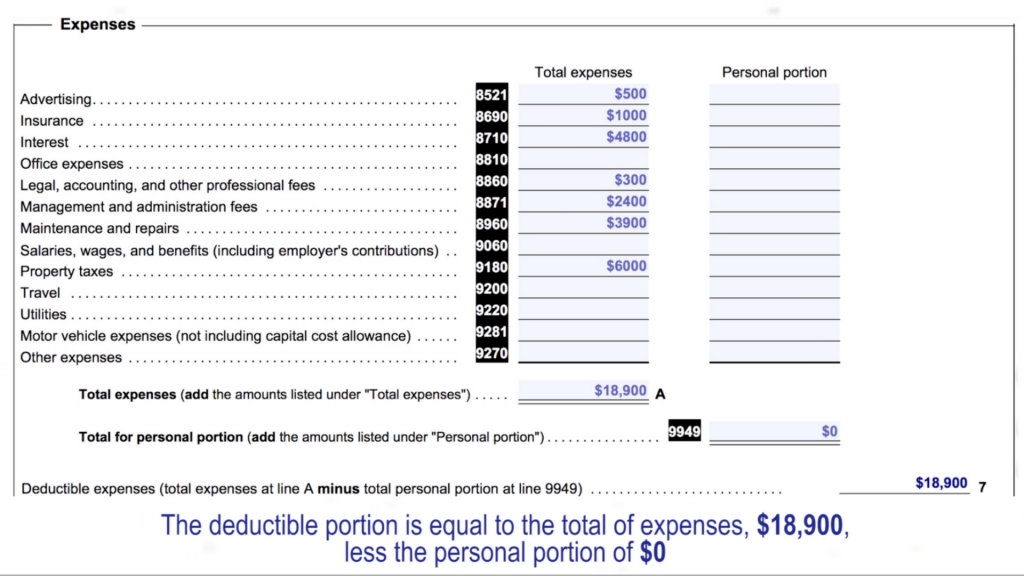

T776 rental expenses. And borrow money from my HELOC to pay off the rentals monthly expenses. As you will realize shortly some expenses are only acceptable as a deduction in the year you incur them while others are deductible in future years. Rental Property 5600 Home 450 Life 300 Mortgage 9000.

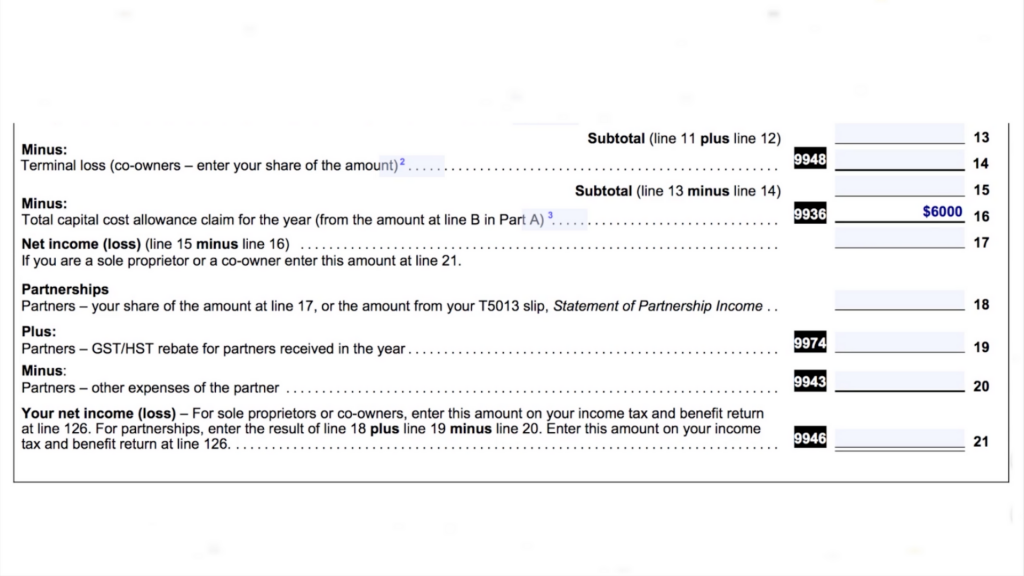

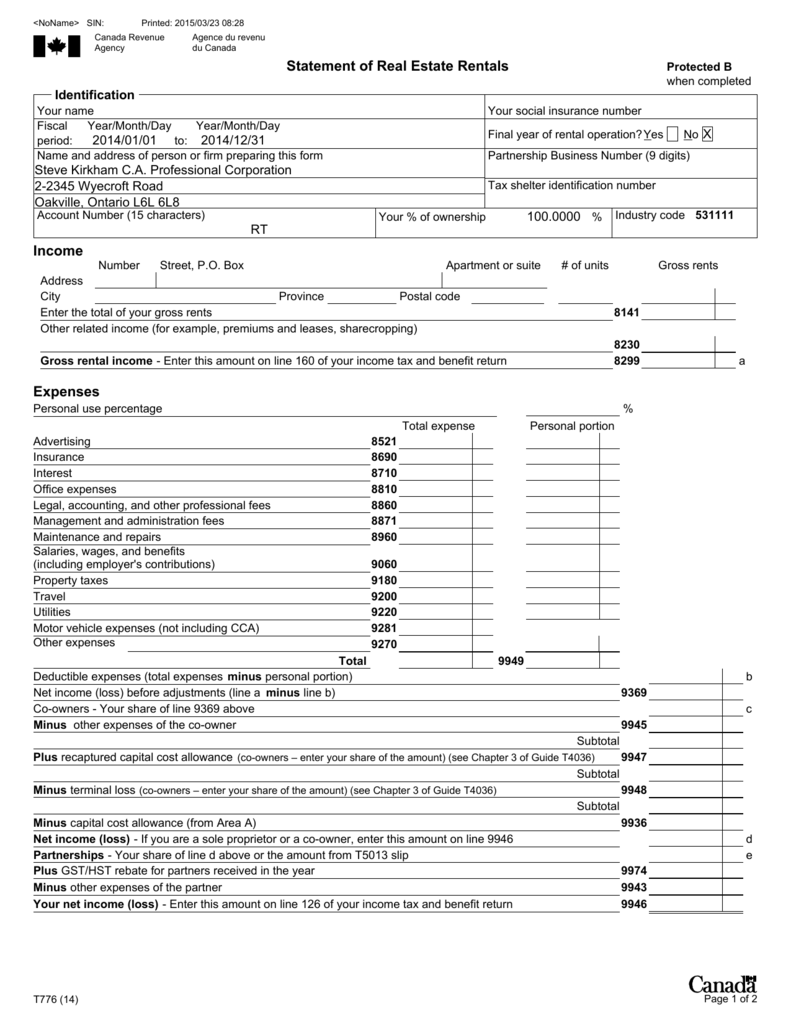

4 in the Calculation Of Capital Cost Allowance section of the T776 Statement of Real Estate Rentals. The CRA specifies not only the expenses that can be deducted from your rental income but also when specifically the tax year in which they can be deducted. Is Rental Income Considered Other Income.

If on the other hand you operate more as a bed and breakfast and provide additional services to your guests such as cleaning security. The two basic types of expenses are current expenses and capital expenses. Christina has a rental property.

You have a rental loss if your rental expenses are more than your gross rental income. T776 Real Estate Rentals plus related CCAasset manager worksheets T2042 Farming Activities plus related CCAasset manager CEC farming inventory adjustment and T1139. 13 Rental Income 5 months at 1400 per month 6 months at 1500 per month 1 month vacant Expenses Advertising 600 Insurance.

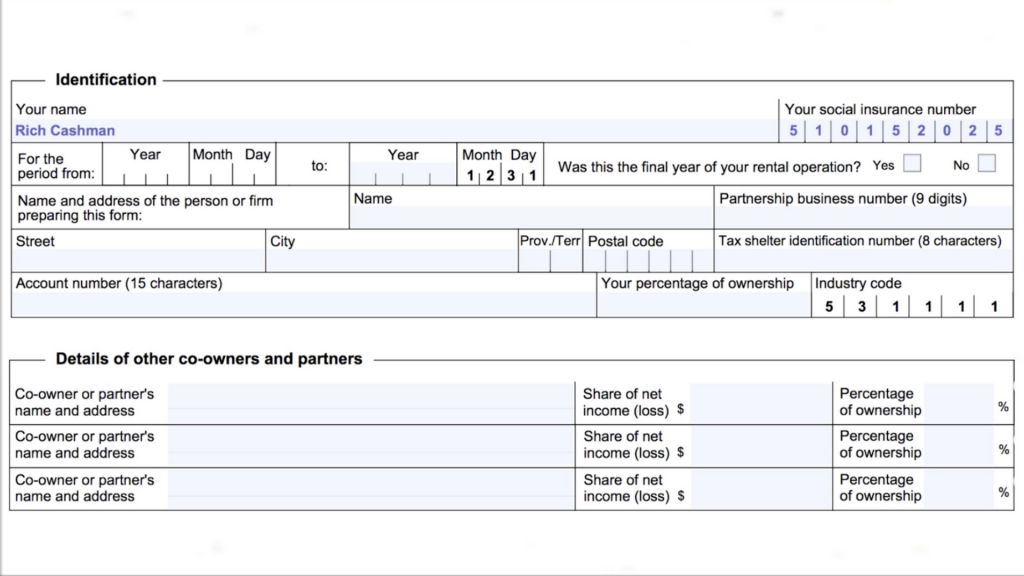

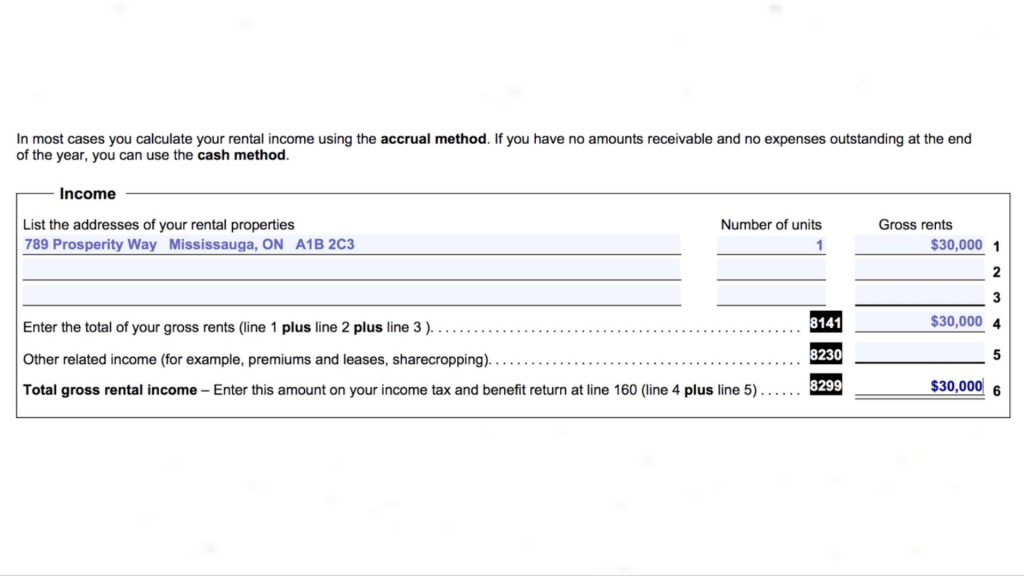

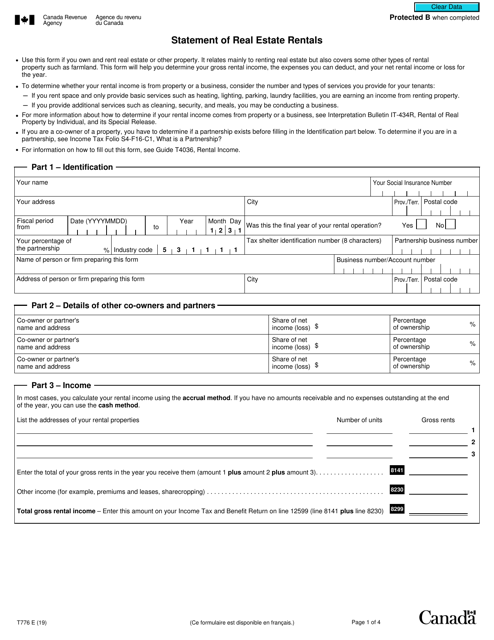

You claim rental income and expenses on Form T776. Can we deduct car gas and other expenses from total income of 5000 if we put this on line 104 and if we use t2125 client does not have business gsthst no as this is not mandatory for uber eats and skip the dishes income. Common rental property expenses include home insurance heat hydro water and mortgage insurance.

Claim tax deductions for any expenses related to your rental property. The national tax rate for rental income is a federal rate of 38 and each province has its own tax rate as well. T5013 Statement of Partnership IncomeTax Shelters and Renounced Resource Expenses Tuition T2202TL11 Tuition and Education Amounts INCOME STATEMENTS.