Favorite Interest Due But Not Received Accounting Equation

3500 1500 500 5000 500 iv Salary due but not paid.

Interest due but not received accounting equation. If the interest is deposited in the bank account of the business the accounting journal to post this interest earned to the accounting records would be as follows. When the actual interest payment is received the entry is a debit to the cash account and. Just as the business allows interest on capital it charges interest on drawings.

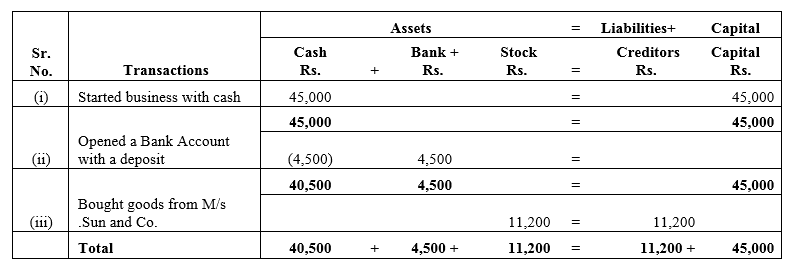

5000 500 5000 500 iii Insurance Premium paid in Advance 1500 1500. B Purchased goods for cash 20000 and credit 30000 c Sold goods for cash 40000. The solution for this question is as follows.

For the year ending December 2018. Debit - Income Receivable Credit - Income. Is interest charged by a creditor an asset income expense liability.

Interest due but not received Rs. To answer this question you first have to work out what interest is. Accrued interest is interest thats accumulated but not yet been paid.

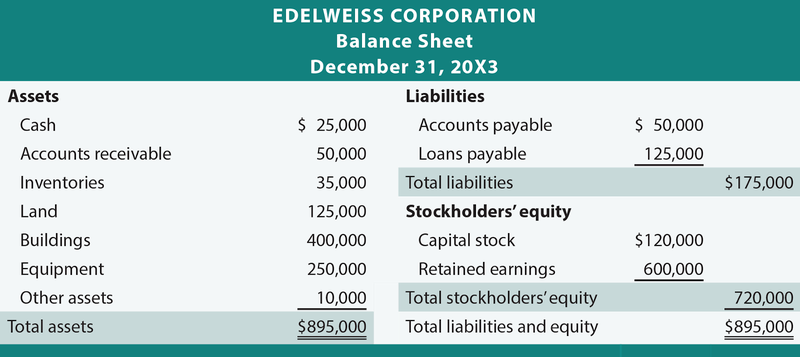

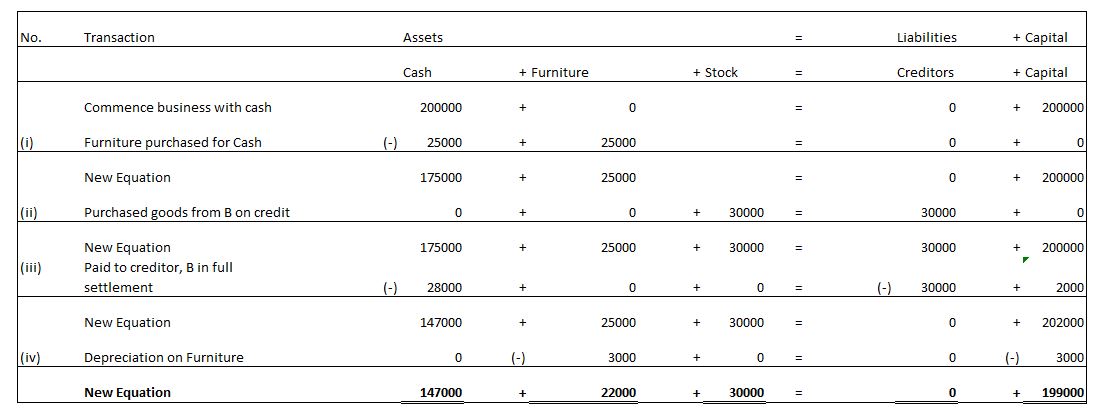

So it is debited to the Profit and Loss ac and added to the capital in the Balance Sheet. A Interest due but not received 500 b Rent received in advance 1000 c Insurance premium paid in advance 1500 d Salaries due but not paid 2000 6. Drawings are money withdrawn by the proprietor from his capital.

Show the effect of the following transactions on the Accounting Equation. Interest due but not paid 100 100 expenses 48000 300 47700 v Rent paid in advance 150 150 47850 150 300 47700. Interest charged by a creditor on an overdue account would be debit or credit.

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)