First Class Tax Basis Balance Sheet Tax Exempt Income

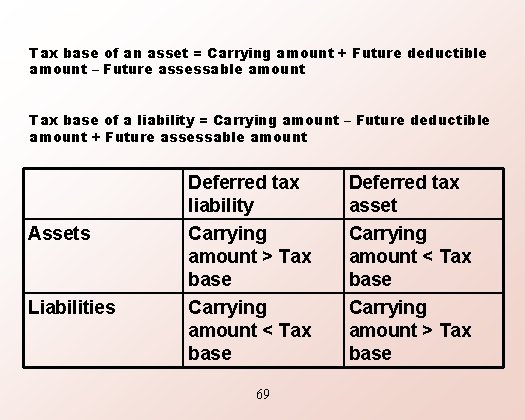

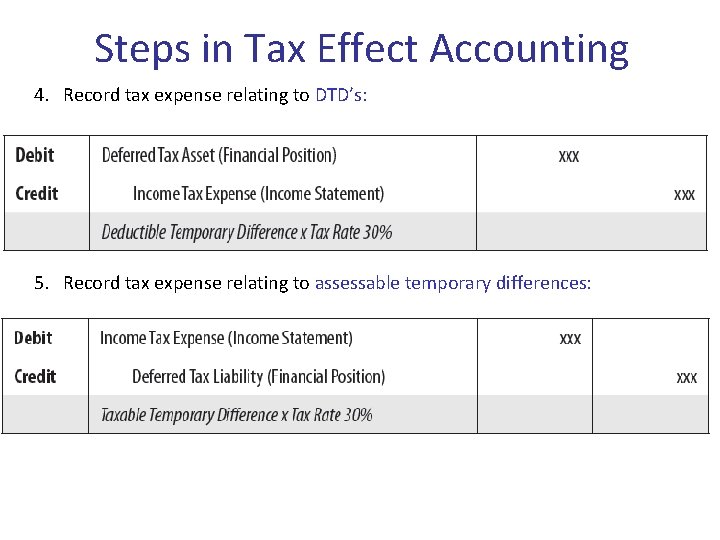

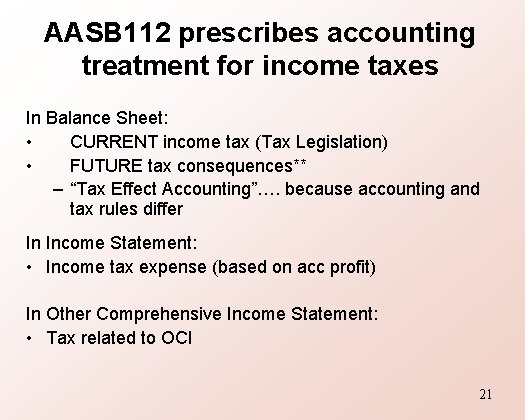

Temporary differences are determined by reviewing the current year balance sheet and identifying differences between GAAP accounting and income tax accounting.

Tax basis balance sheet tax exempt income. You enter it on page 4 of form 1120-S as Other Tax Exempt Income. 4 Adjusted basis of property contributed during the year reduced by the amount of liabilities to which the property is subject but not below zero. A tax-basis income statement is allowed for Schedule M-3 and a tax-basis balance sheet for Schedule L only if no non-tax-basis income statement and no non-tax-basis balance sheet were prepared for any purpose and the books and records of the corporation reflect only tax-basis.

Tax Basis Tax basis is the carrying cost of an asset on a companys tax balance sheet and is analogous to book value on a companys accounting balance sheet. A tax basis balance sheet also offers risk mitigation benefits when reporting for income taxes and a streamlined method to calculate income tax balances for auditors. This hands-on approach to tax liabilities also gives a business more control over their tax accounting processes and can help automate tax calculations.

A Ordinary Income a 76934 b Interest Income b 190 c c d d. Tax basis starts with the sum of the cash and basis of property generally at cost that the partner contributes to the partnership. For example under the income tax basis of accounting.

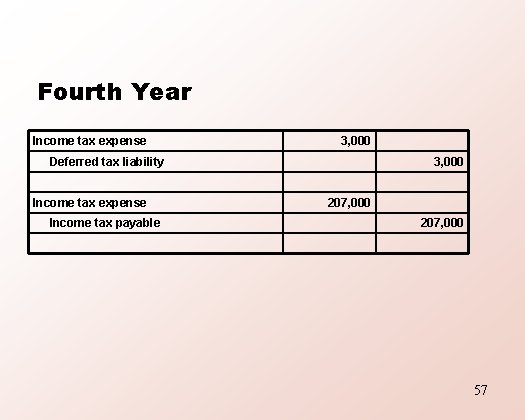

If the loan is not forgiven until 2021 then it is still on the balance sheet as PPP Loan Payable as of 12312020. Thus the income or expense item will eventually be allowed for both GAAP and income tax purposes with the only difference being the timing of the item of income or expense. After beginning tax basis capital is calculated activity is recorded in the capital accounts on the tax basis going forward.

M-1 line 9 Tax exempt interest and income Section 743b negative adjustments - Non-deductible expenses permanent - Guaranteed payments - Section 743b positive adjustments Net income loss per books tax basis In addition to the Schedule M-2 line 3 calculation be aware of the following. If your receipts for the year were less than 250000 and your assets at the end of the year are less than 250000 you do not have to submit a balance sheet. On the line for current year net income loss enter the partners distributive share of partnership income and gain including tax-exempt income as figured for tax purposes for the year minus the partners distributive share of partnership loss and deductions including nondeductible noncapital expenditures as figured for tax purposes for the year.

Since it is tax exempt that is a book entry. Compared to GAAP the income tax basis approach typically involves treatments that could make the reporting less complex. Debit PPP Loan Payable Credit Tax exempt income.