Peerless Micro Entity Accounts Template Excel Free

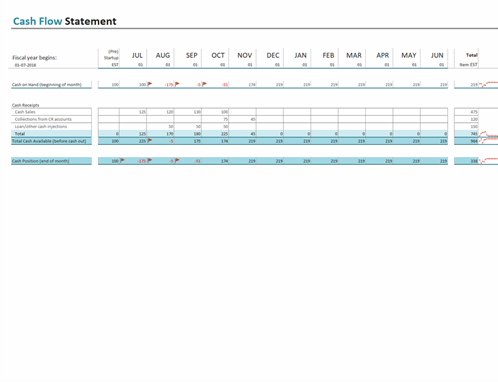

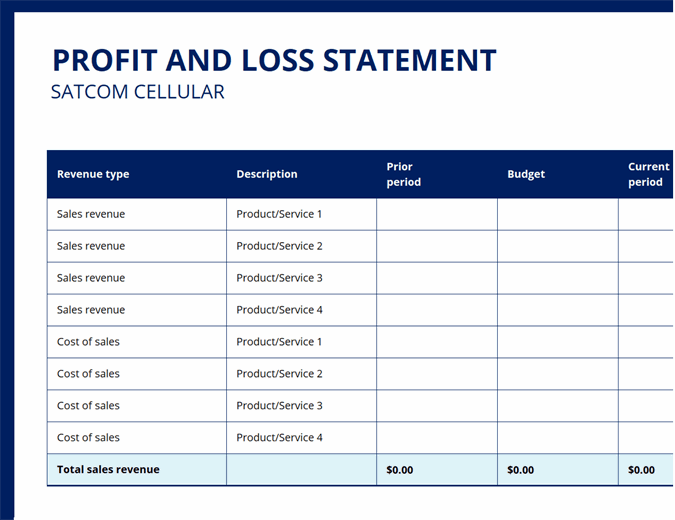

Small business expenses are the costs that are incurred in the regular course of business.

Micro entity accounts template excel free. So a companys turnover can be 5 Million but if its Assets are less than 312000 and has 10 or less employees it would. This template uses swim lanes to display the time from when the projectsub-project starts till when its. I really like this project management excel template developed by spreadsheet123 because it does a fantastic job of visualizing project duration and progress by percentage completion not just of projects but the sub-projects under each project.

Business expenses are deducted from the revenue in order to know the net taxable income of the company. Ad Flexible Monthly Subscription Self-paced Online Course. Sign Up for a 7-day Free Trial.

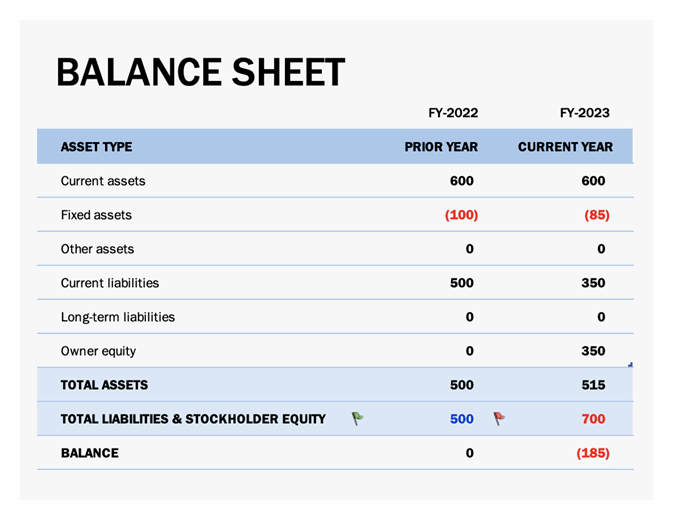

Accounting Directive there has been no change to the requirement to produce true and fair financial statements. This cost can be easily applied to small as well as large corporations. A statement that it is a public benefit entity as set out in paragraph PBE33A.

Business or small expenses are the main part of the income statement. Wondered if anyone would be willing to share an excel templateexample set of accounts or guidance re completing first set of company accounts for micro-entity under FRS 105. Ad Flexible Monthly Subscription Self-paced Online Course.

Preparing accounts under the new small and micro company regimes 3 Section 1 Section 2 Section 3 Section 4 FRS 102 1A case study FRS 105 example accounts FRS 102 1A related party disclosures. Theres a generic template on google which is easy to find and I attach link here. Explore a vast collection of premium Excel templates made available when you subscribe to Microsoft 365 or take a look at an expansive selection of free Excel templates.

Your company will be a micro-entity if it has any 2 of the following. According to the govuk Micro-entities are very small companies. I dont particularly want to pay someone to put together accounts for the LLP as the charge would wipe out any profit.