Fantastic Tax Basis Balance Sheet Define

The tax basis balance sheet can be used to enter adjustments and the actual tax basis of assets liabilities based on the return as filed.

Tax basis balance sheet define. The tax basis balance sheet is based on the tax return filing. It can also be referred to as a statement of net worth or a statement of financial position. Tax Basis Tax basis is the carrying cost of an asset on a companys tax balance sheet and is analogous to book value on a companys accounting balance sheet.

Tax basis may be reduced by allowances for depreciation. Tax Basis Balance Sheet Variance. If the partnership has nonrecourse debt then the partners share of this debt is added to his tax basis.

This is the difference between the tax basis balance sheet. When comparing GAAP and tax-basis statements one difference relates to terminology used on the income statement. Such reduced basis is referred to as the adjusted tax basis.

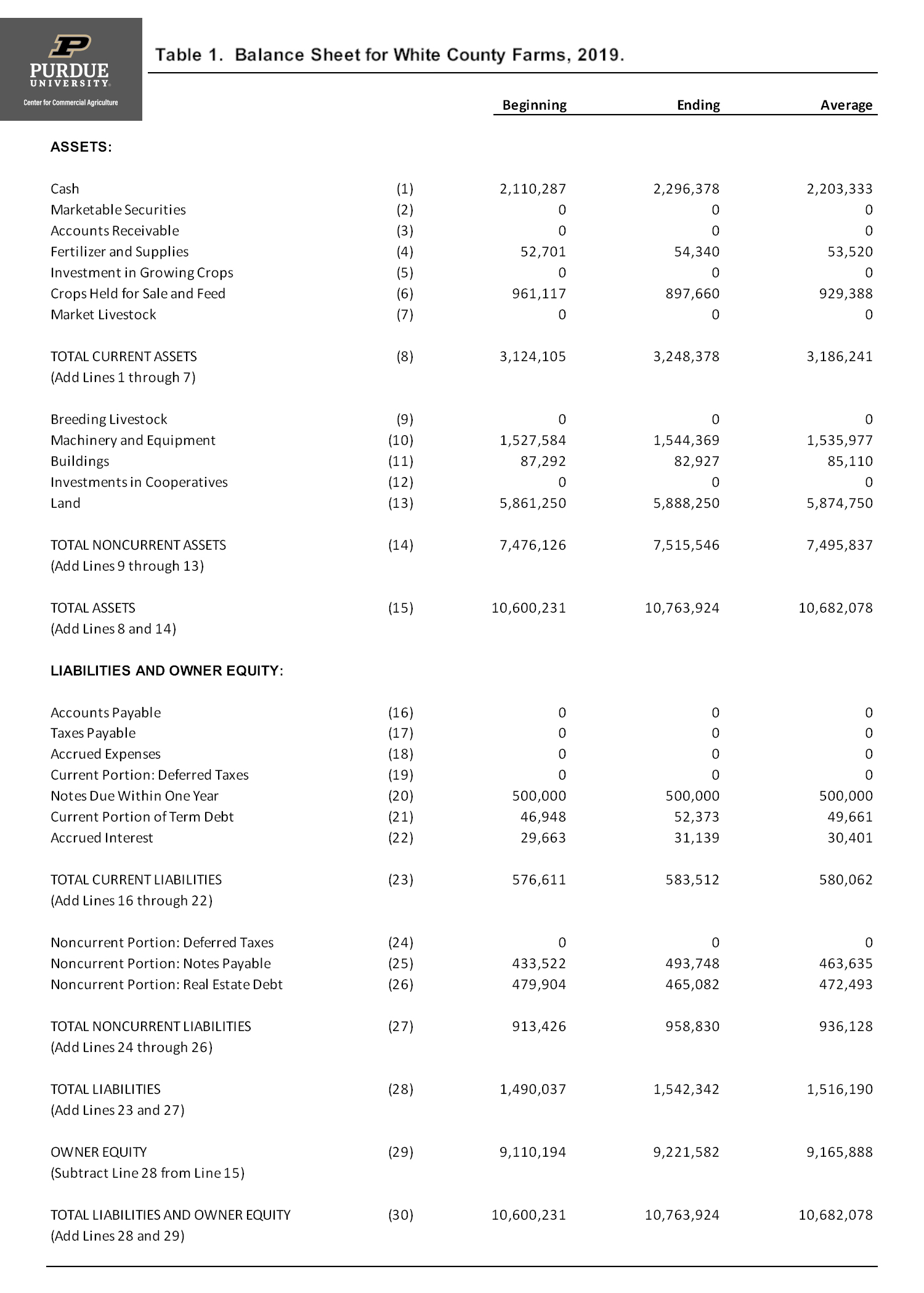

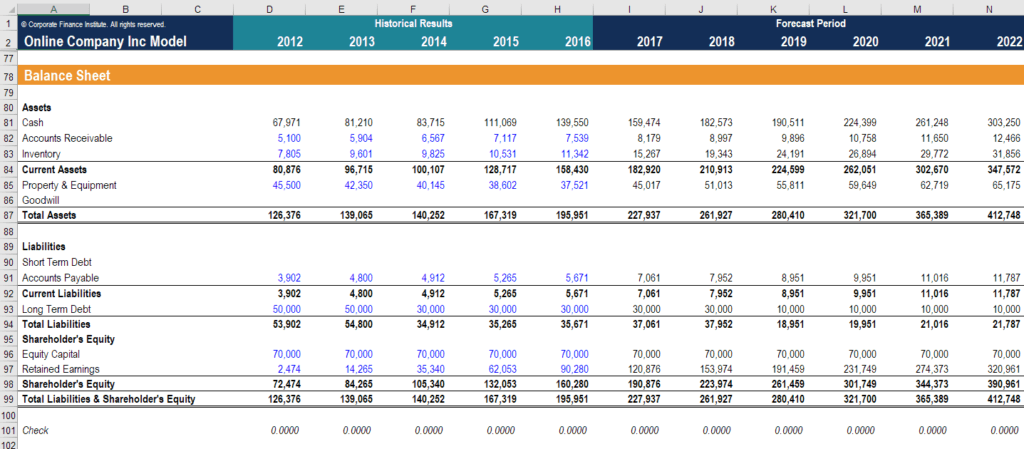

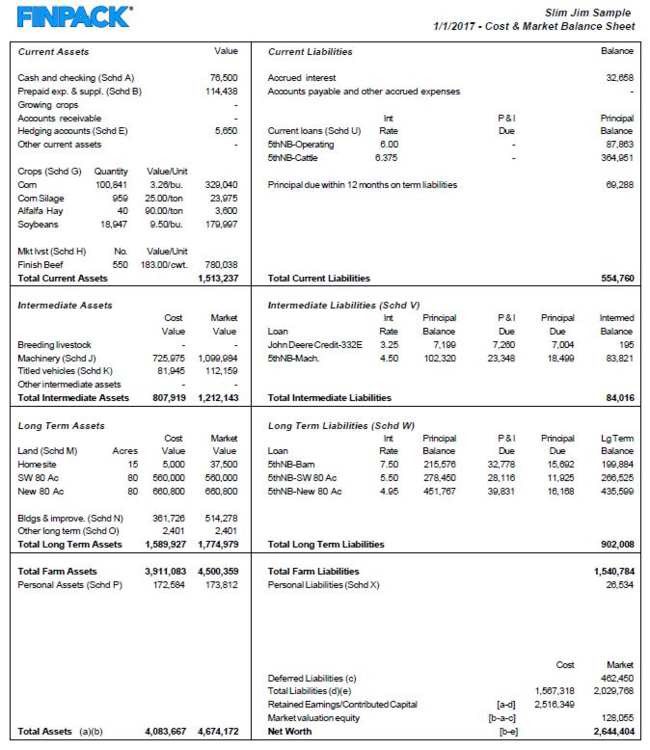

The balance sheet is based on the fundamental equation. This value is used to determine. Federal tax law the tax basis of an asset is generally its cost basis.

704b capital account starts at the sum of the cash and property at FMV that the partner contributes to the partnership. Here is a cash basis accounting balance sheet example. In most cases assets are initially recorded at acquisition cost for both book and tax purposes.

The balance sheet displays the companys total assets and how these assets are financed through either debt or equity. The balance sheet should balance. Many times this analysis uncovers areas where a book tax difference should be in place and is not.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)