Favorite New Schedule Vi Of Companies Act 1956

Short title commencement and extent 2.

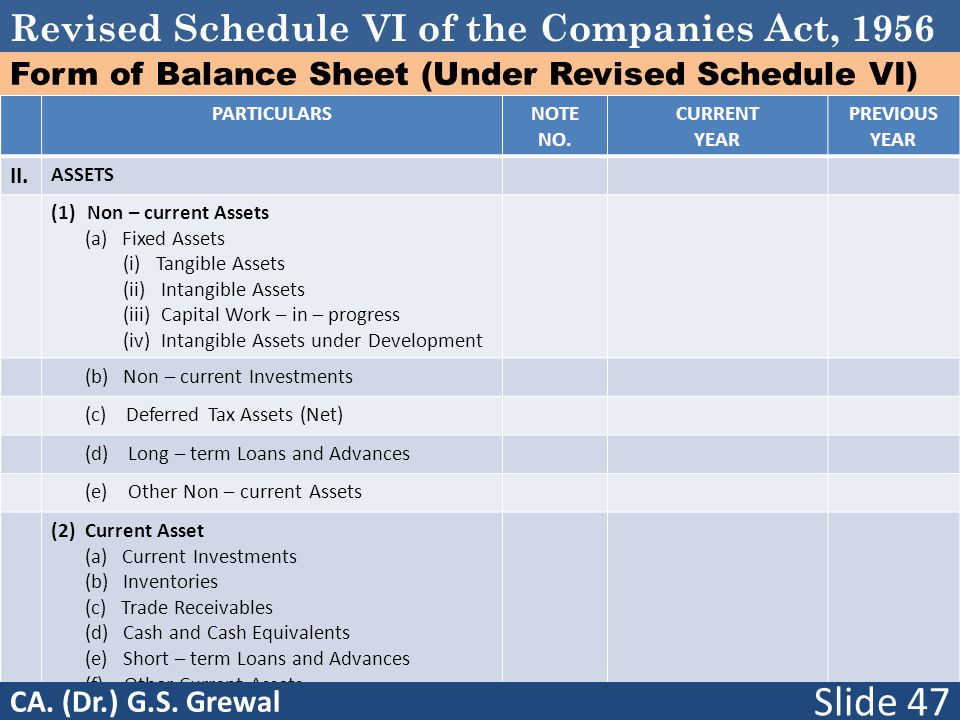

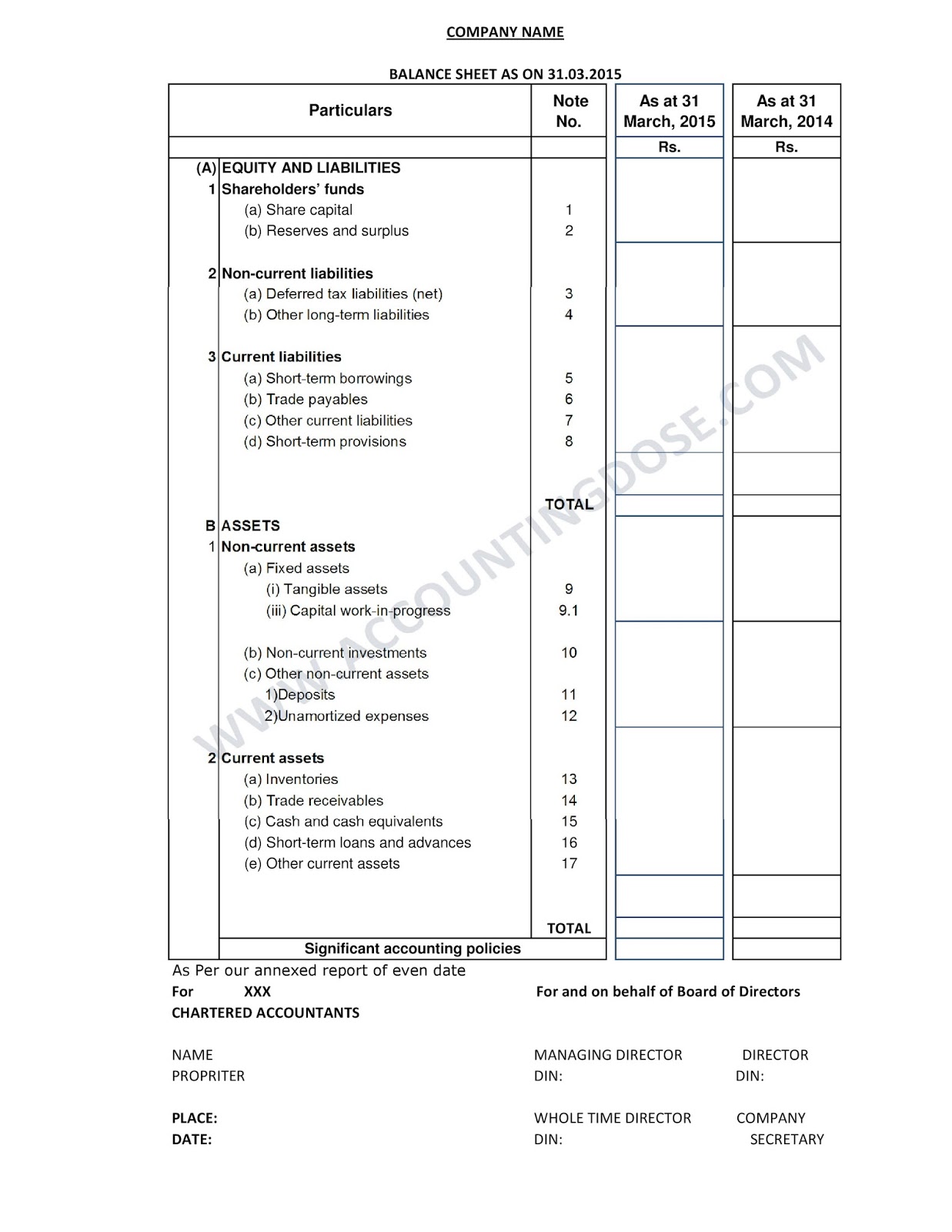

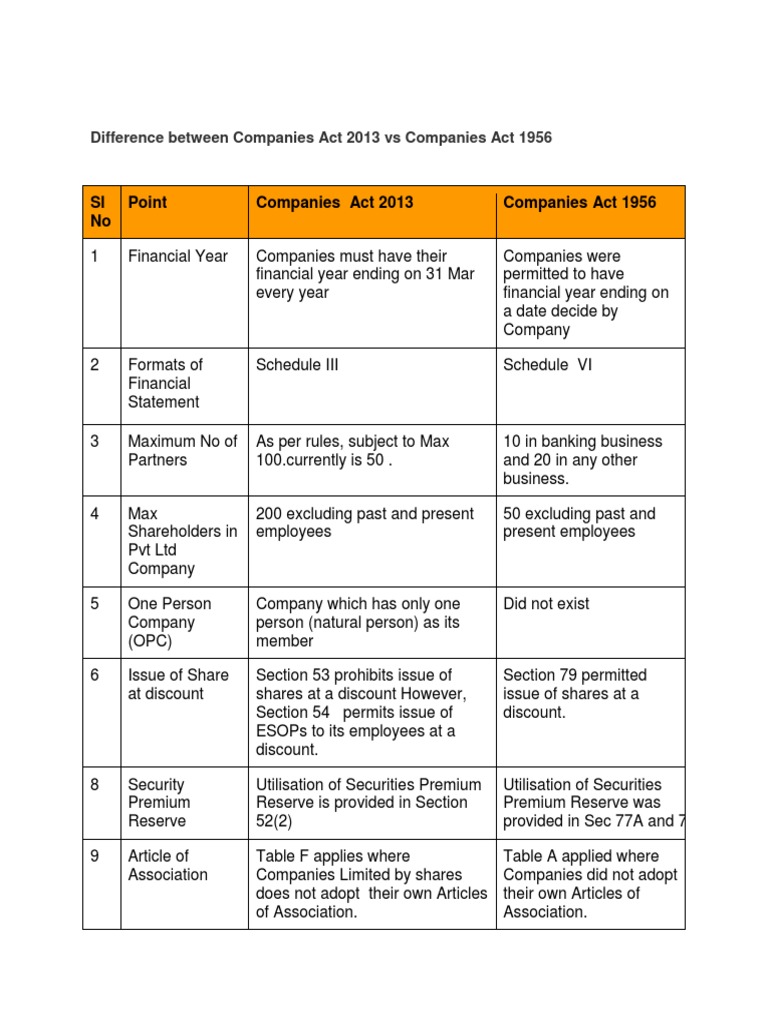

New schedule vi of companies act 1956. SCHEDULE VI OF THE COMPANIES ACT 1956REVISED The revised Schedule VI has been framed as per the Existing non-converged Indian Accounting Standards notified under the Companies Accounting Standards Rules 2006. This will apply to all the companies uniformly for the financial statements to be prepared for the financial year 2010 11 and onwards. Meaning of holding company and subsidiary 4A.

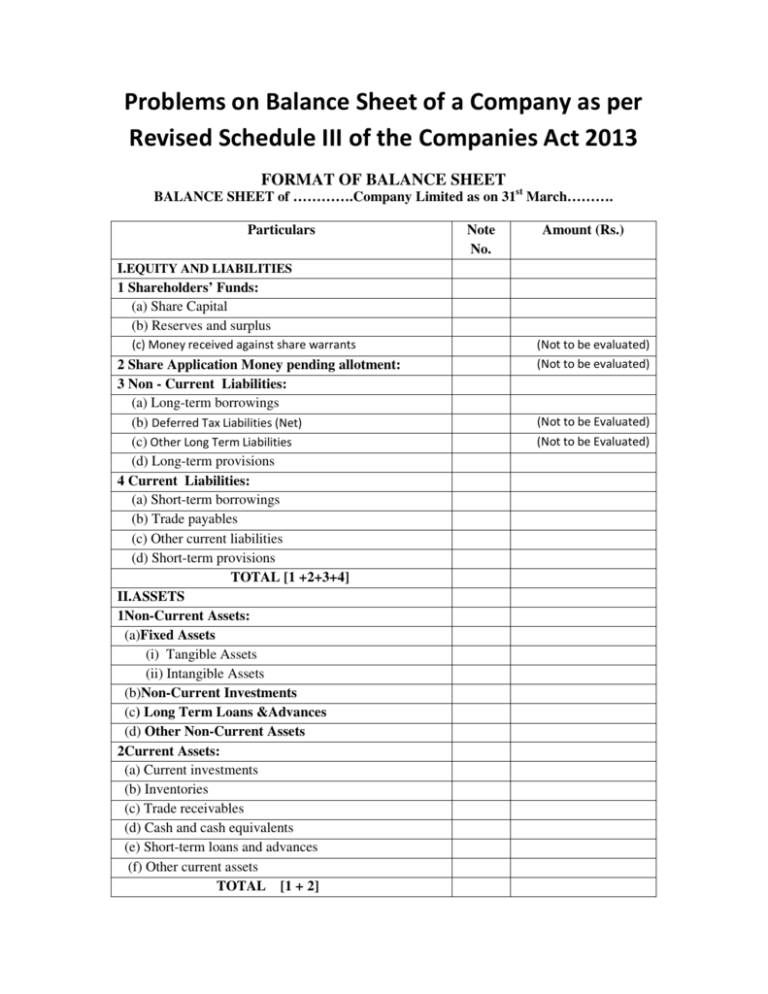

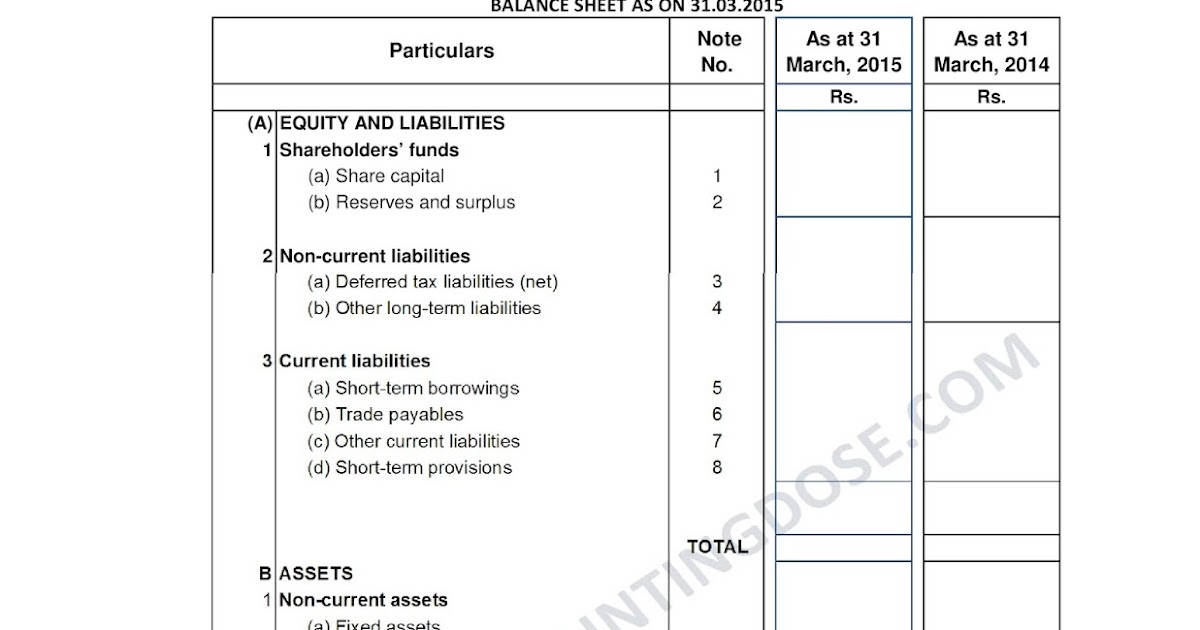

The amount paid for application allotment and call money as may be the case is fully confiscated and the same is transferred to Forfeited shares account. INTRODUCTION TO REVISED SCHEDULE VI Every company registered under the Act shall prepare its Balance Sheet Statement of Profit and Loss and notes thereto in accordance with the manner prescribed in Schedule VI to the Companies Act 1956. COMPANIES ACT 1956 Act No.

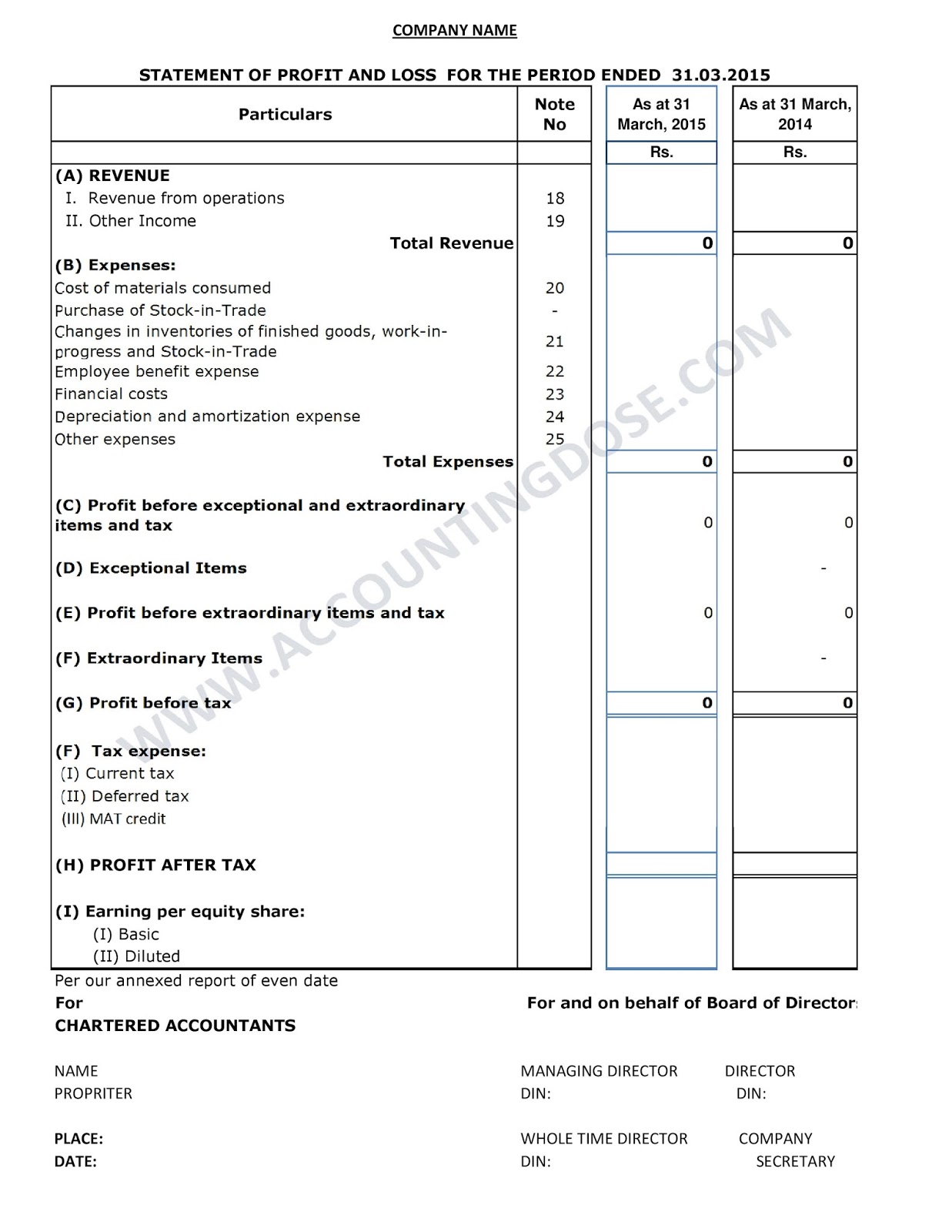

Section 216 Profit and loss account to be annexed and auditors report to be attached to balance sheet. These stipulations ensure comprehensive presentation of the financial performance andposition of a company. Section 218 Penalty for improper issue circulation or publication of balance sheet or.

Revised Schedule VI clarifies that the requirements mentioned therein for disclosure on the face of the financial statements or in the notes are minimum requirements Revised Schedule VI has eliminated the concept of. R iv of Part I of Schedule VI to the Companies Act 1956 As at 31 March As at 31 March Long Term Loans Advances to Related Parties Directors Other officers of the Company Firm in which director is a partner Private Company in which director is a member Either severally or jointly Note 19 Disclosure regarding Other Current Assets Note i Disclosure pursuant to Note no. New schedule vi see section 211 general instructions for preparation of balance sheet and statement of profit and loss of a company in addition to the notes incorporated above the heading of balance sheet under parts a and b.

Form of Proxy. Section 215 Authentication of balance sheet and profit and loss account. Reduction of issued share Capital of the company.

These stipulations ensure comprehensive presentation of the financial performance and position of a company. 1 OF 1956 PART I. Revised Schedule VIto The Companies Act 1956 Features Concepts Disclosures A revised schedule is to business what a new season is to an athlete or a new canvas to an artist.