Neat Ratio Analysis Of Square Pharmaceuticals Ltd 2018

Enterprise Value to EBITDA 713.

Ratio analysis of square pharmaceuticals ltd 2018. Price to Sales Ratio 326. Converted into a Public Limited Company 2004. Industry Analysis The pharmaceutical sector providing about 98 of the total medicine requirement of the local.

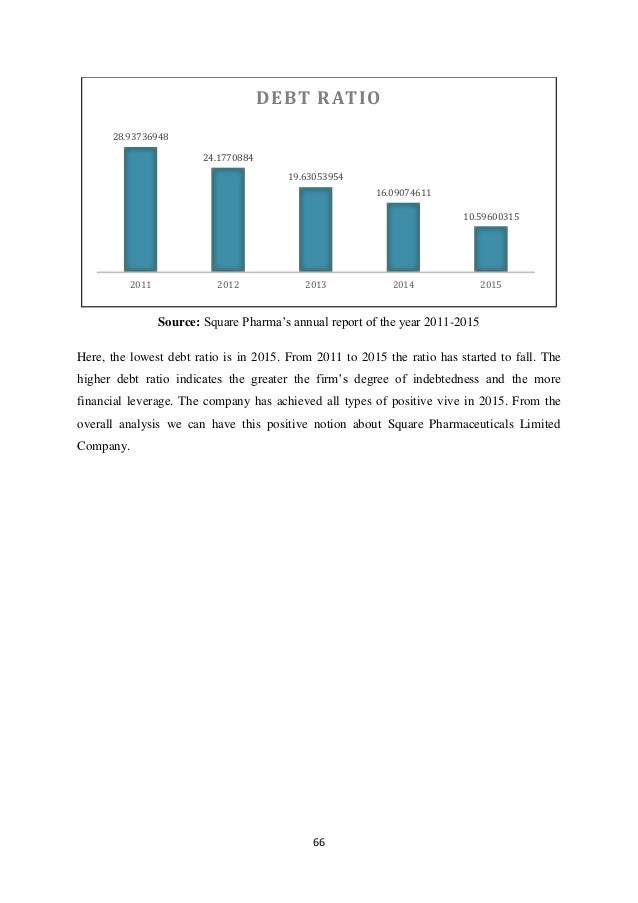

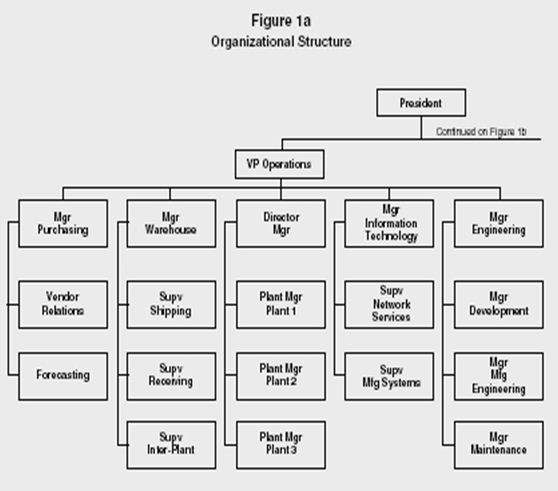

Square Pharmaceuticals Limited Financial Ratio Analysis The objective of this report is to project the financial volatility of a specific company as in this case Square Pharmaceuticals Limited Financial Ratio through different financial analysis which started off with identifying variables affecting the stock price and then through Stock Valuation. It indicates that Square Pharma has more liquid assets in the business. The main data collection from the annual financial reports on Beximco and square pharmaceutical companies in 2007 to 2008Different financial ratio are evaluated such liquidity ratios asset management ratios profitability ratios market value ratios debt management ratios and finally measure the best performance between two companies.

This paper is mainly an analytical outcome of financial ratio analysis of Square Pharmaceuticals Limited and pharmaceuticals industry. The main data collection from the annual financial reports on Beximco and square pharmaceutical companies in 2007 to 2008Different financial ratio are evaluated. Enterprise Value to Sales 253.

Shauvonik Datta Course Instructor of Investment Theory Portfolio Management School of Business and University of Liberal Arts Bangladesh ULAB for giving me chance to make this report which I found to be a rather interesting topic to work on. It is often expressed as a percentage. View SQURPHARMABD financial statements in full including balance sheets and ratios.

It is 18 in 2007 16 I 2008 and 19 in 2009. Ratio Analysis of beximco Pharmaceuticals Ltd Square Pharmaceuticals Ltd Acknowledgements At first my thanks go to Mr. Buy Square Stock Analyst Says.

Square Pharma has a higher quick ratio than Beximco pharma. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt. Yahoo 0318 1142 ET.