Neat Comparing Financial Ratios Across Years

Acid test ratio The quick ratio also behalf like the current ratio.

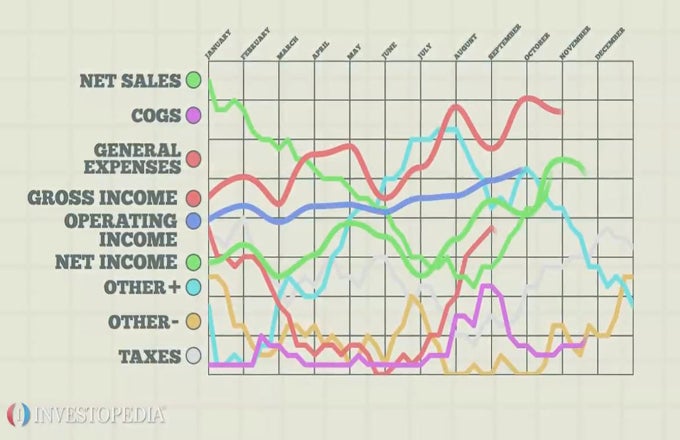

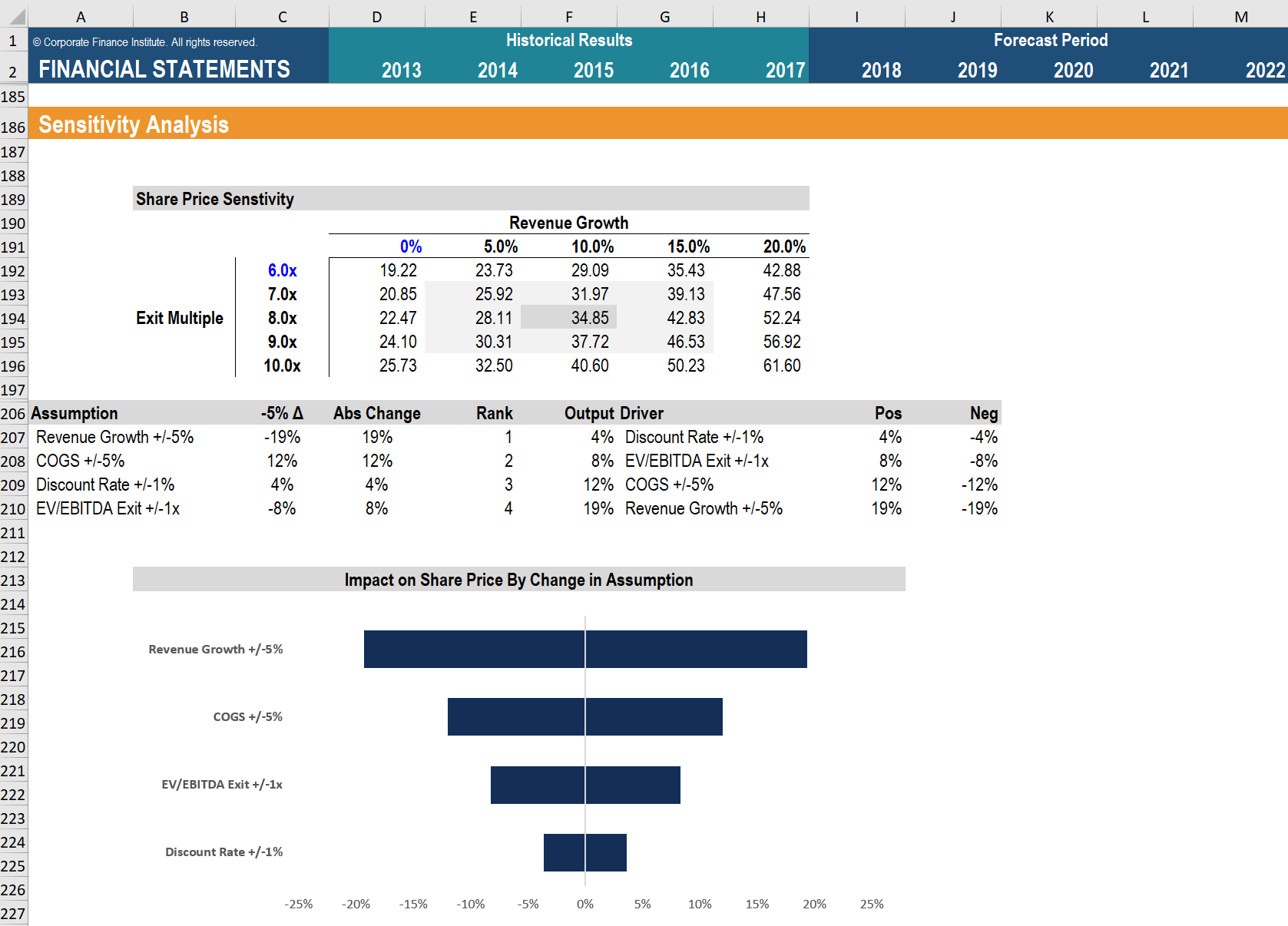

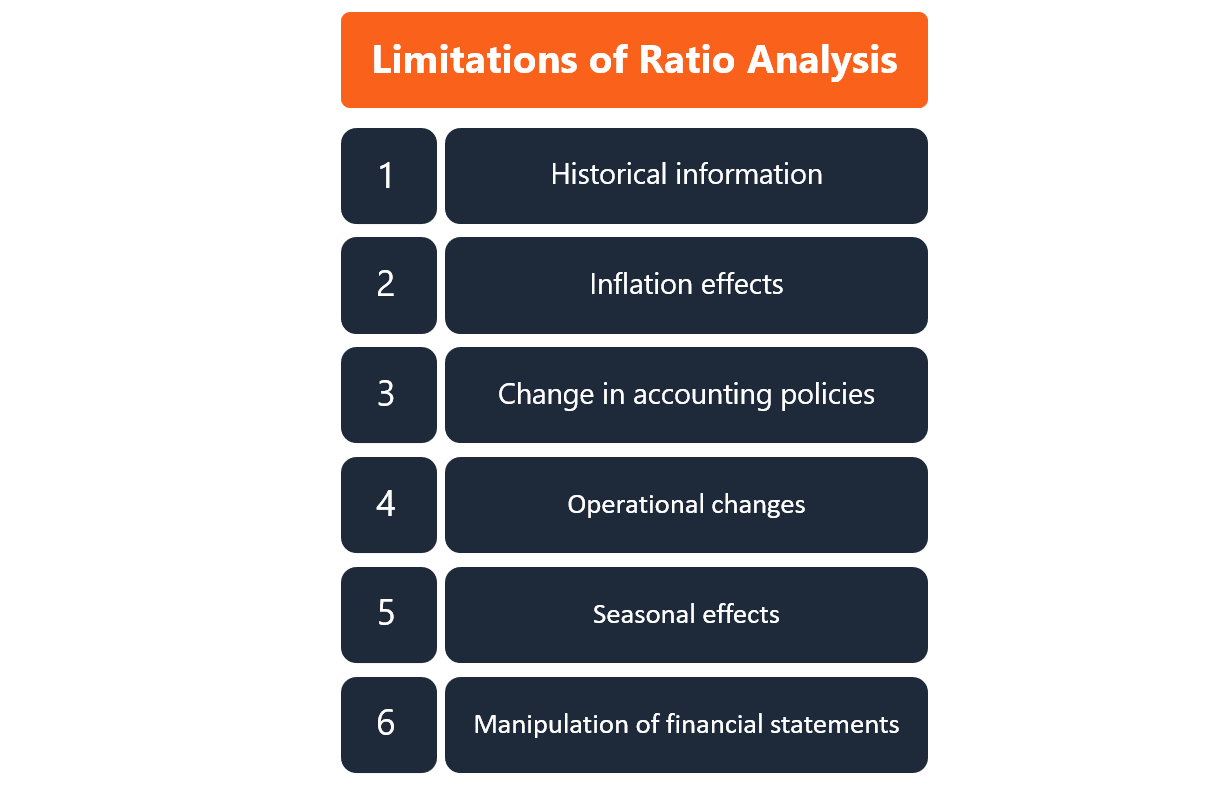

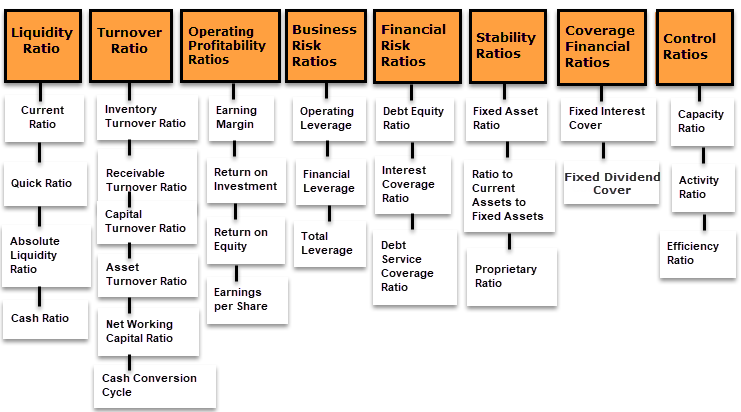

Comparing financial ratios across years. Meaningful financial ratios are meant to give information about a companys financial state by comparing two values in a ratio for evaluation over time or as compared to other values. Financial ratios are very useful tools for comparing the financial performance of a company across time as well as against the performance of its peer companies or industry. Seeing them in isolation for only one year can cause a recency bias without putting the numbers in context.

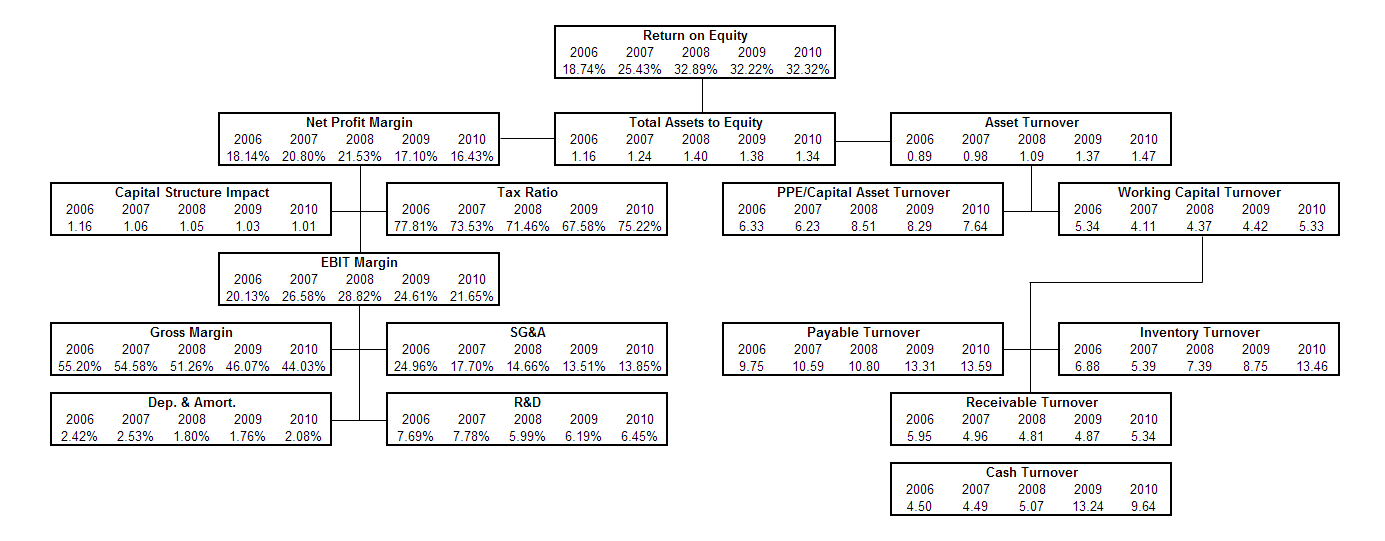

Hence this technique is also termed as Horizontal Analysis. For the last three years of my Bachelor Degree I have been studying a lot of business investments and financial issues but hardly got any information about. The financial ratios Ratios used to understand financial statement amounts relative to each other.

Local roots in more than 100 countries across the globe with annual sales of 498 billion. Ratio analysis A way of comparing amounts by creating ratios or fractions that compare the amount in the numerator to the amount in the denominator. Financial ratios averaged by industry serve as a benchmark for comparison against individual companies and help users make informed investing and credit decisions.

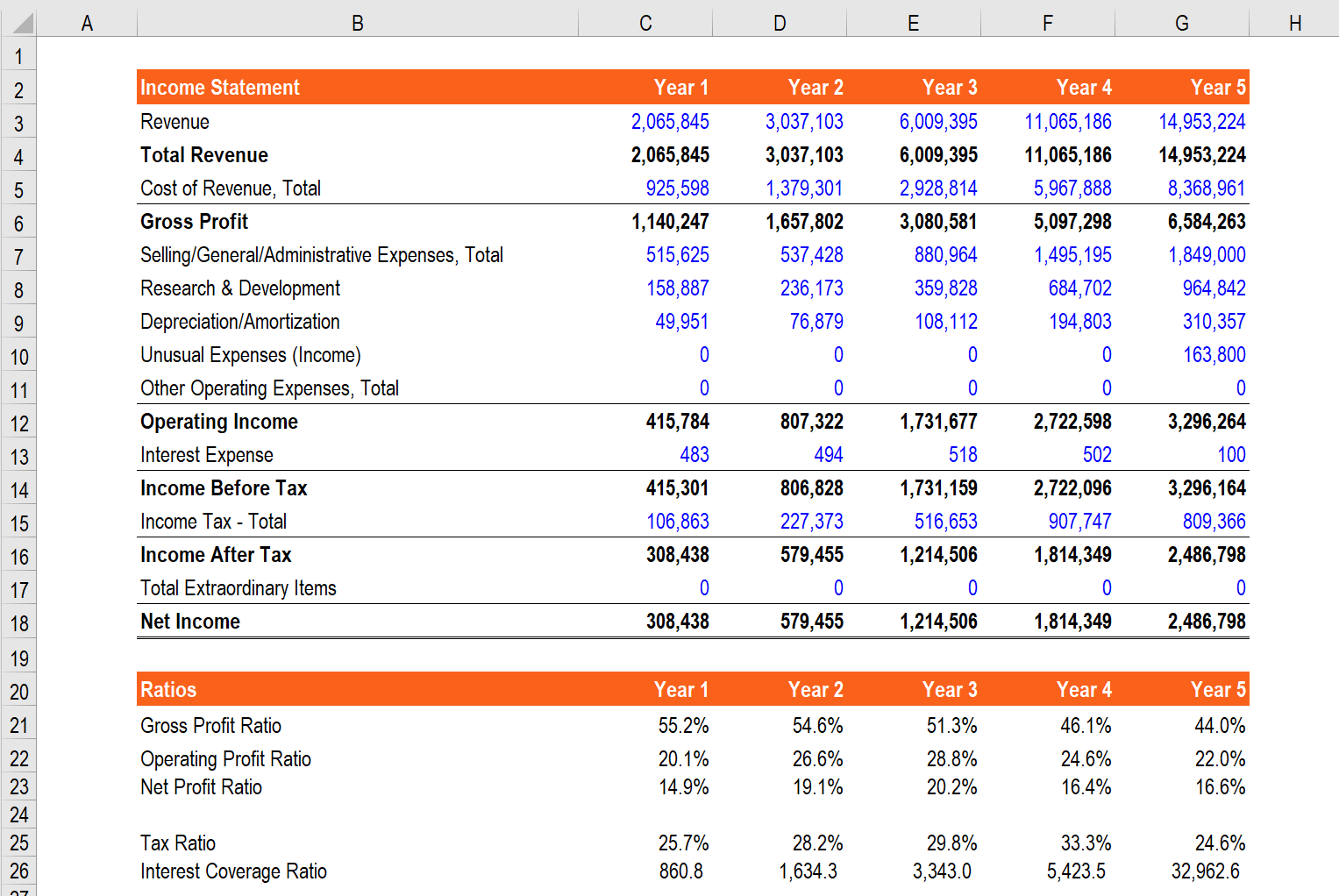

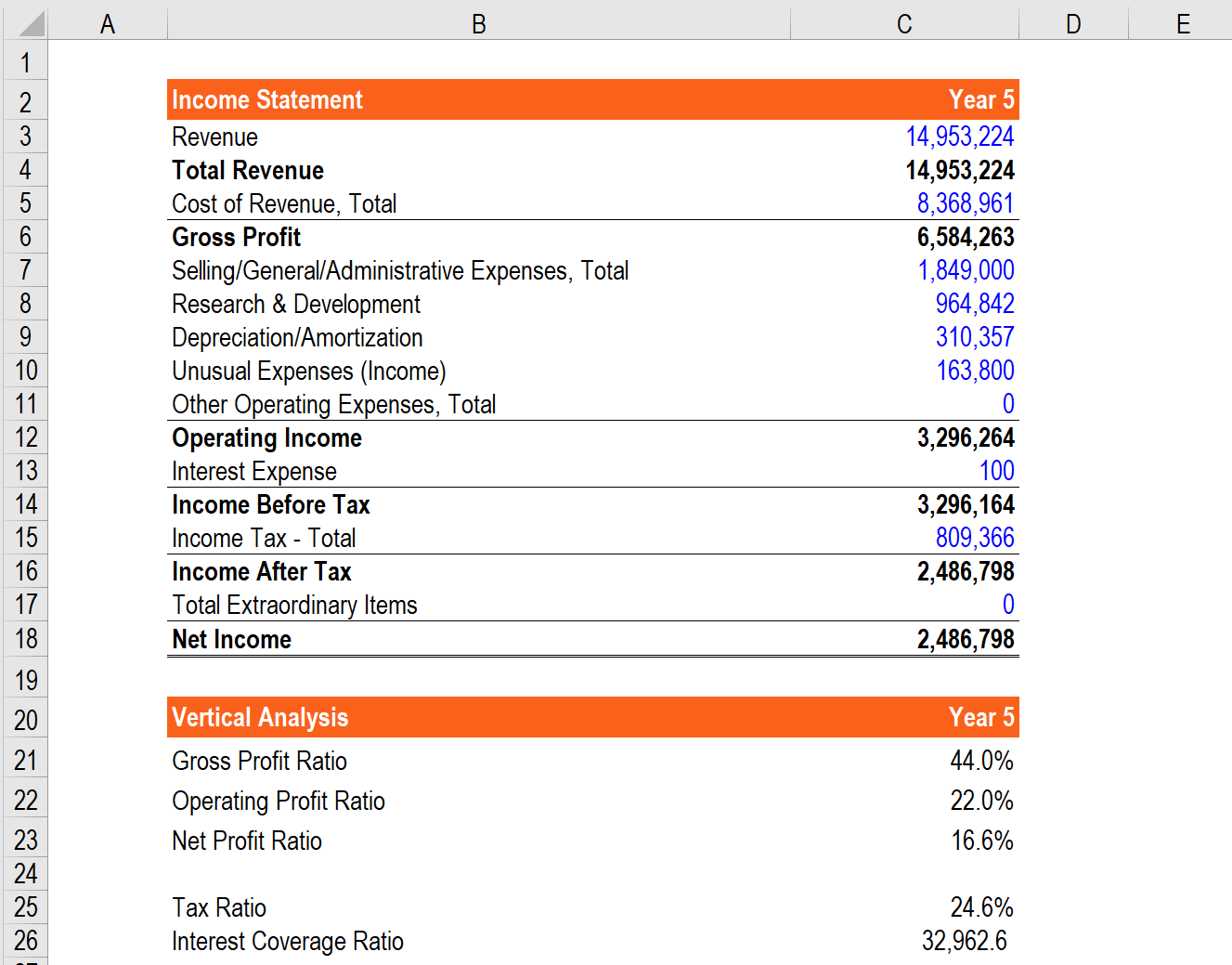

424 Comparative Financial Ratio Analysis. And used to compute the financial ratios for the three-year period. Can give you the answer.

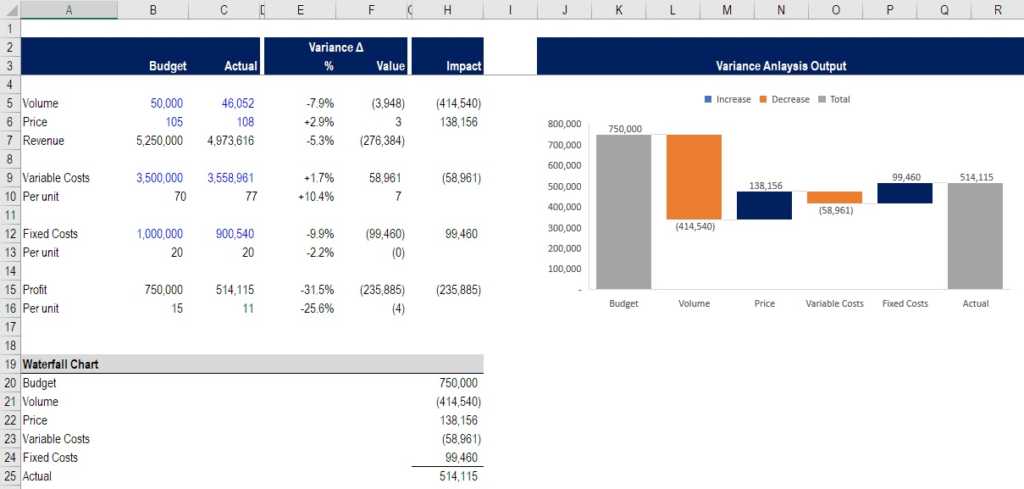

From these financial statements were summarized and used to compute financial ratios for the five-year period. Companies are unable to compare basic numbers because the raw data provides no context for understanding if the data is high or low or good or bad. Financial ratios are comparative values.

Taking a ratio can help equalize values for comparison allowing financial managers and analysts to make judgments on a companys financial health and what decisions need to be made. In relation to inventory management there are specific ratios which can assist in determining how effective a company is in managing its inventories relative to other companies. Trend analysis Comparing a companys performance from one period to another current year vs last year etc.

/GettyImages-1085069872_journeycrop_financial_ratios-2beca482cffe497a97be706cc07a2124.jpg)

/balance_sheet-5bfc2f1246e0fb00514577bc.jpg)

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)