Breathtaking Royalty Expense In P&l

All Other Golf Expenses Salaries Wages Service Charges Contract Labor and Bonuses Payroll-Related Expenses Cost of Retail Merchandise and Clothing Other Expenses or Labor Costs All Other Spa Expenses Parking-Salaries Wages Parking-Payroll-Related Expenses Parking-Other Expenses Other-Salaries Wages Other-Payroll-Related Expenses All Other Expenses or.

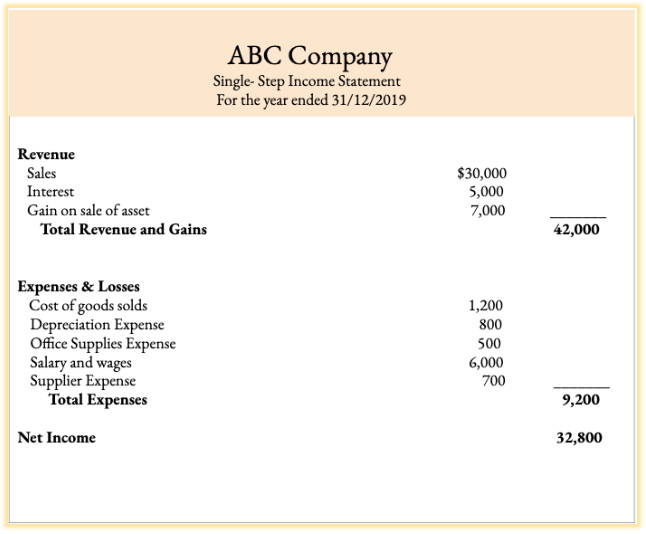

Royalty expense in p&l. Expenses are not a contingent liability ie. Level such as credit card fees legal and accounting fees licenses permits music satellite television franchise royalties and office expenses. It is the cost that the buyer bears to use the goodsservices provided by the owner.

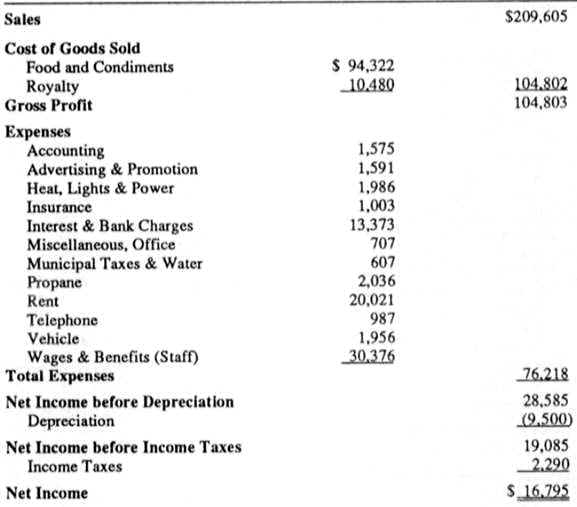

Necessary expenses including any form of compensation decrease a companys net income. Royalty payment rates are outlined in a contract between the company and the individual being paid and are therefore determined based on sales figures for the applicable product. This helps in getting the tax benefit over the asset.

Expenses are revenue and not capital in nature. After the prepayment is exhausted the licensees cash balance is credited Period 2. Let us assume the subsequent royalty payment is 6 of net income of 10000 paid quarterly.

It is a one time expense and can be put under the asset category. Royalties can arise in things such as. This guide looks at some of the practical questions on how to apply the contingent consideration principles in IFRS 3 Business combinations.

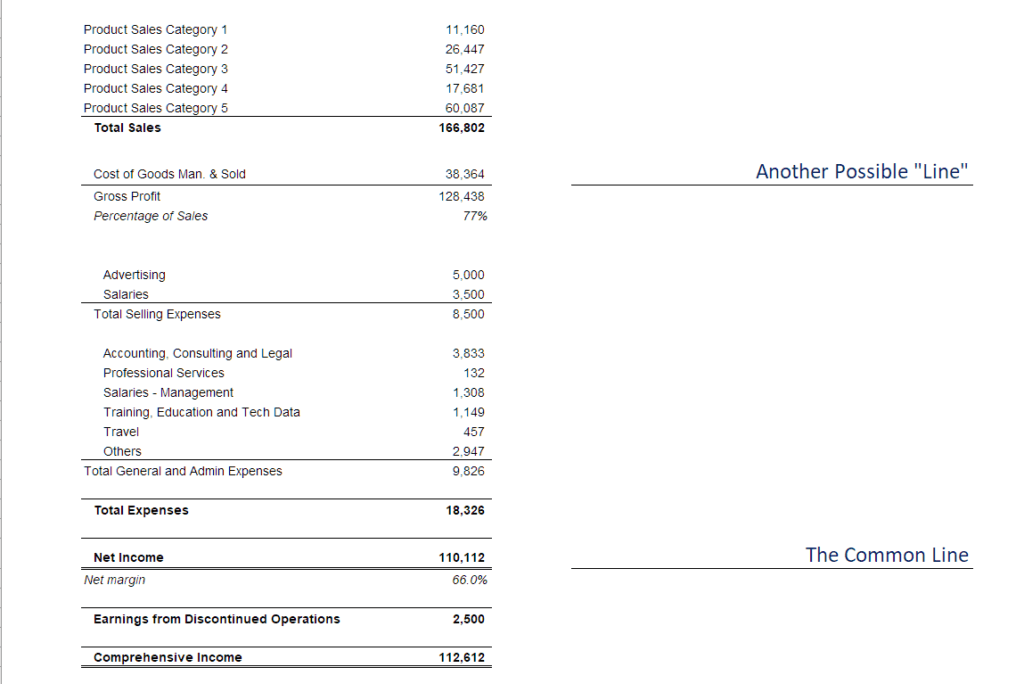

To record the payment debit Royalty Expense for 3000 and credit. Operating expenses and overhead which are listed as selling general and administrative SGA are listed below COGS and go into calculating operating income which came in. Arts including literature and music.

Occupancy expenses include insurance rent CAM charges utilities. The royalty expense incurred by the Company is classified as a general and administrative expense on the Companys consolidated statements of operations in accordance with the accounting guidance of ASC 605-45-45 Principal Agent Considerations and ASC. At the end of the quarter royalties due are calculated by multiplying net income of 10000 by 6 which is 600 Period 1.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

.jpg)