Divine Balance Sheet Accounts Are Not Affected By Adjustments

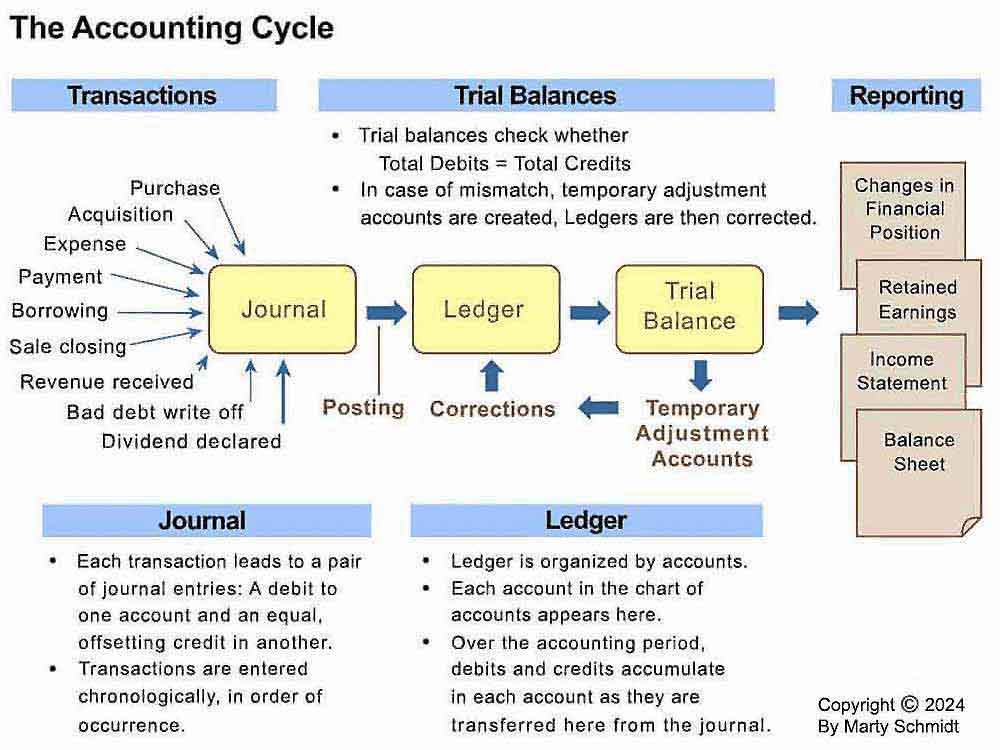

An accounting adjustment is a business transaction that has not yet been included in the accounting records of a business as of a specific date.

Balance sheet accounts are not affected by adjustments. The valuation loss gain account s are impacting your PL for the period in question. Are called real accounts. Represent amounts accumulated during a specific period of time b.

The adjustment in the change in balances in the accounts is made at the time of preparation of Final accounts. Represent amounts accumulated during a specific period of time. Shown in the balance sheet under the head of current liabilities.

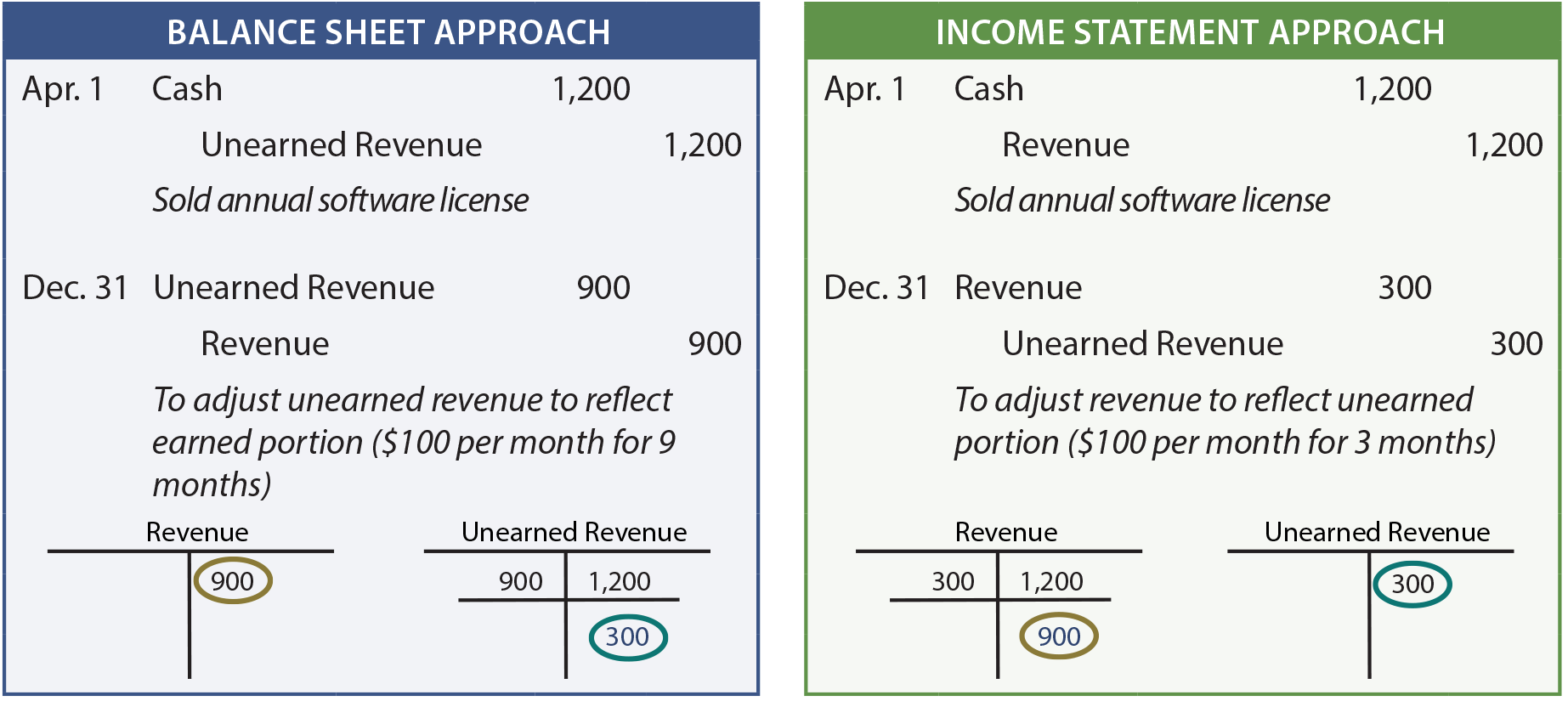

The accountant would make an adjusting journal entry in which the amount of cash received by the customer would be debited to the cash account on the balance sheet and the same amount of cash. In QuickBooks while the Adjust QuantityValue on Hand window is selected you can press Ctrl Y to display the Transaction Journal of the debits and credits entered. The account in the Balsheet adj1 field is the offsetting entry.

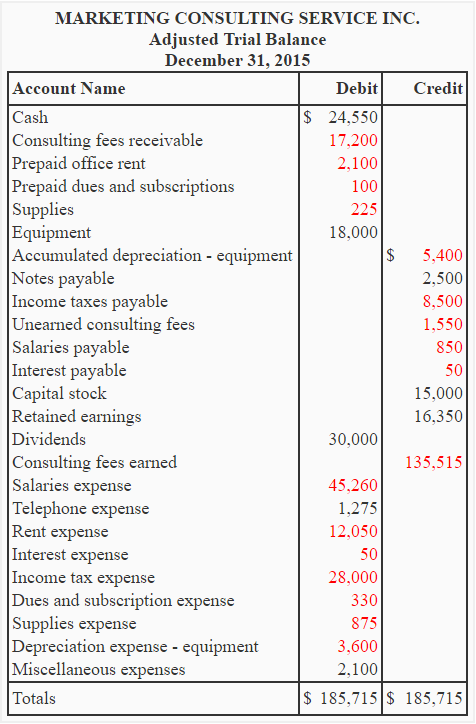

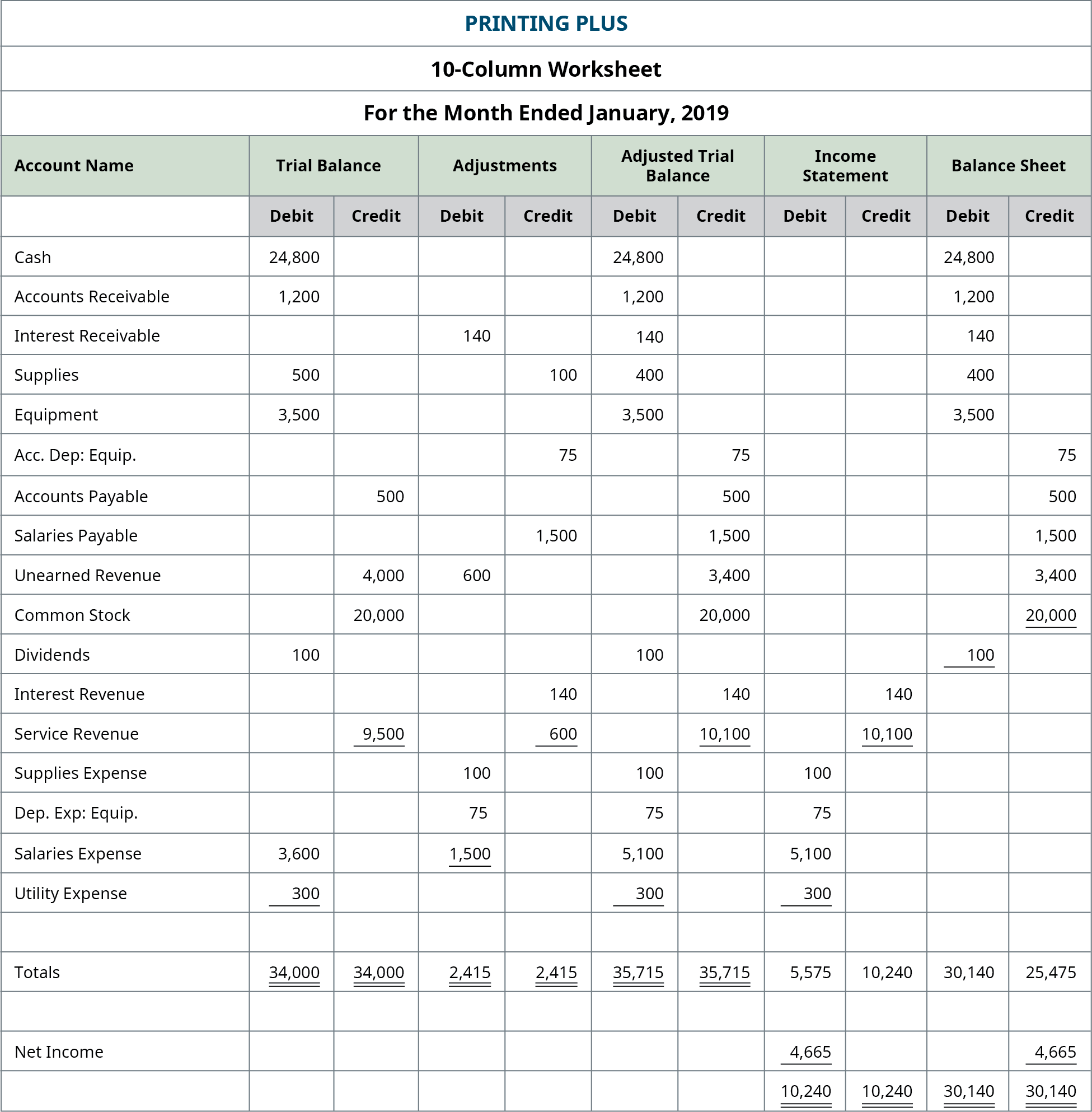

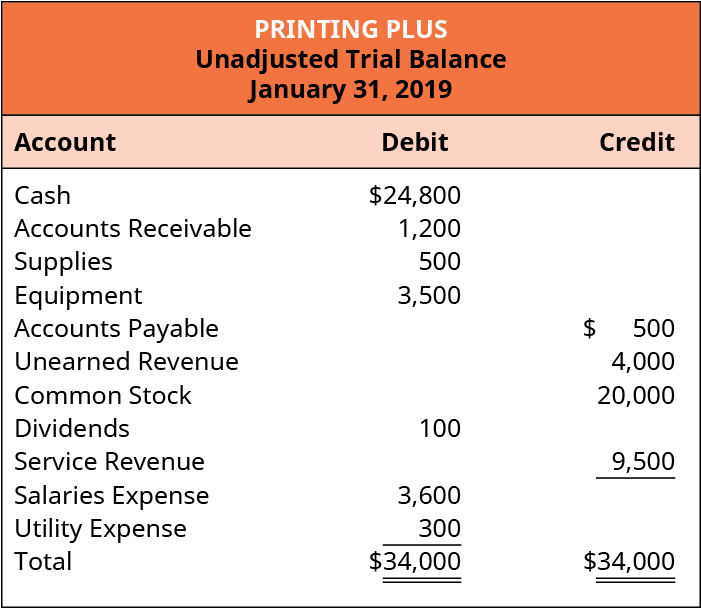

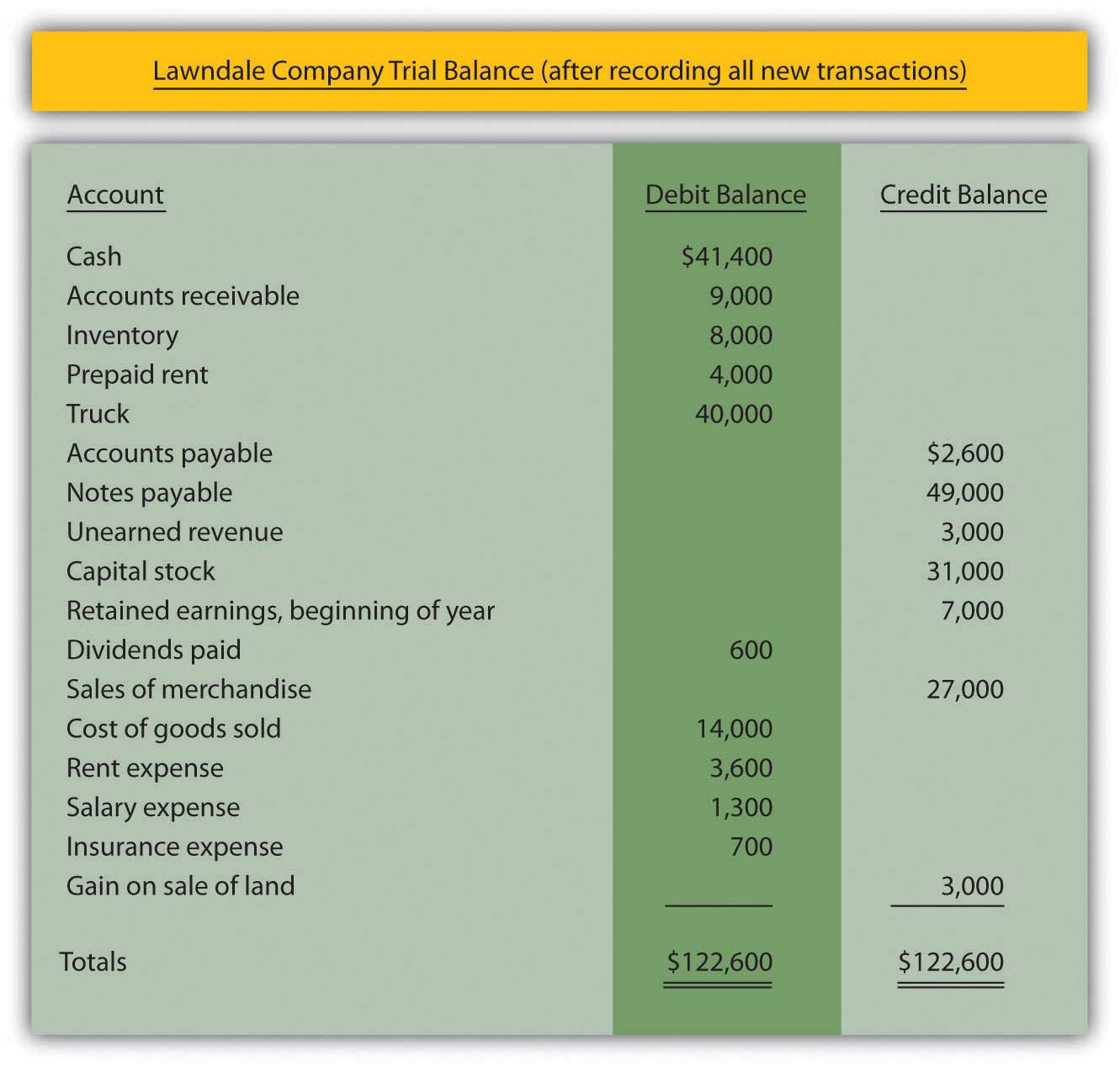

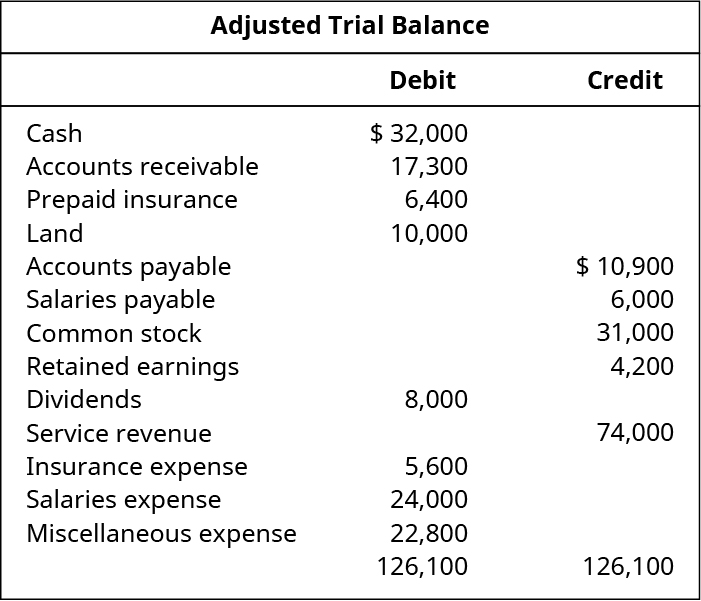

C 367 a 1000 b 3500 c 367 a 1000 b 3500 83500 5000 22000 7000 90000 4000 7000 500 35000 CREDIT ADJ. BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT Cash Accounts Receivable Supplies Prepaid Rent Equipment. The only time a transaction modifies this account is when cash is physically paid out or physically received.

Extend the balance of cash to the Balance Sheet Debit column. Make an adjustment so that the ending amount in the balance sheet account is correct. 4 pts Question 6 Balance sheet accounts represent amounts accumulated during a specific period of time are called real accounts have zero balances after the closing entries have been posted are not affected by adjustments Question 7 4 pts to close There are four closing entries.

Are not affected by adjustments d. The accounts that do not have adjustments are extended from the Trial Balance section to the Adjusted Trial Balance section. Are not affected by adjustments.