Neat Schedule 3 Companies Act 2013 Format Cash Flows

Under the heading Assets under sub-heading Non-current assets for the words Tangible assets.

Schedule 3 companies act 2013 format cash flows. In respect of listed companies the listing agreement requires the indirect method for preparing cash flow statements. The Schedule III to the Companies Act 2013 provides general instructions for presentation of financial statements of a company under both Accounting Standards AS and Indian Accounting Standard Ind AS. The Companies Removal of Difficulties Order 2015 dated 13022015 making changes in definition of small company ie.

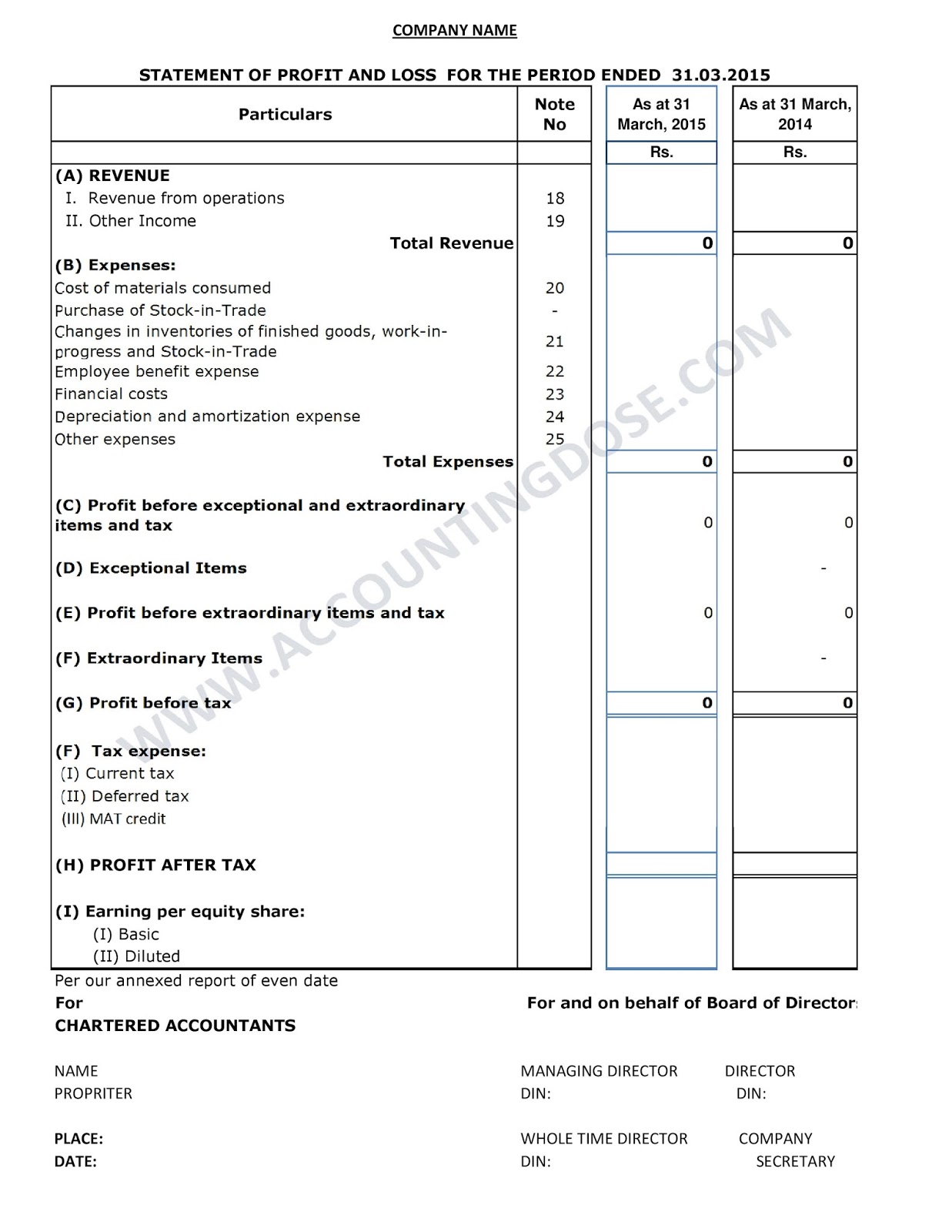

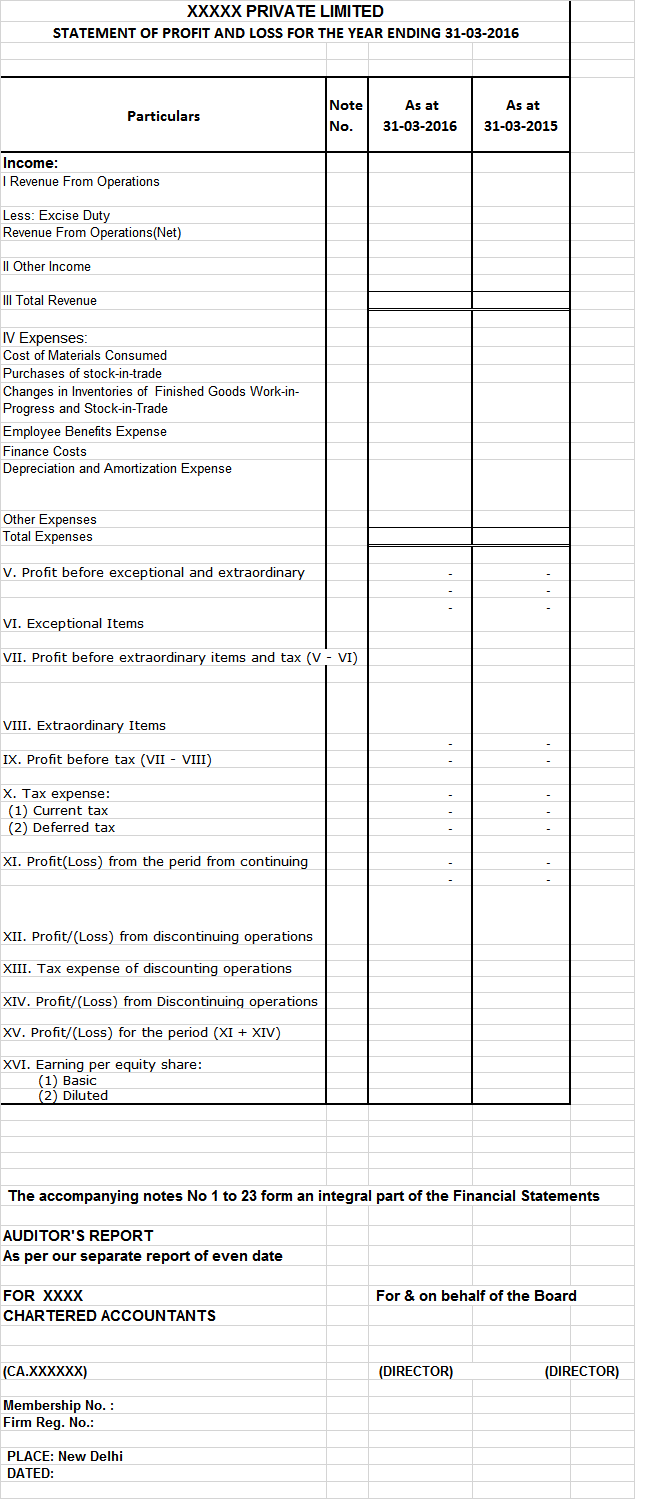

Since the Companies Act 2013 does not lay down any format for preparation of cash flow statement companies will need to follow AS 3 in this regard. The Schedule III to the Companies Act 2013 became applicable to all companies for the preparation of. Identifiable difference from previous format only one format has been prescribed in earlier there were two alternatives formats.

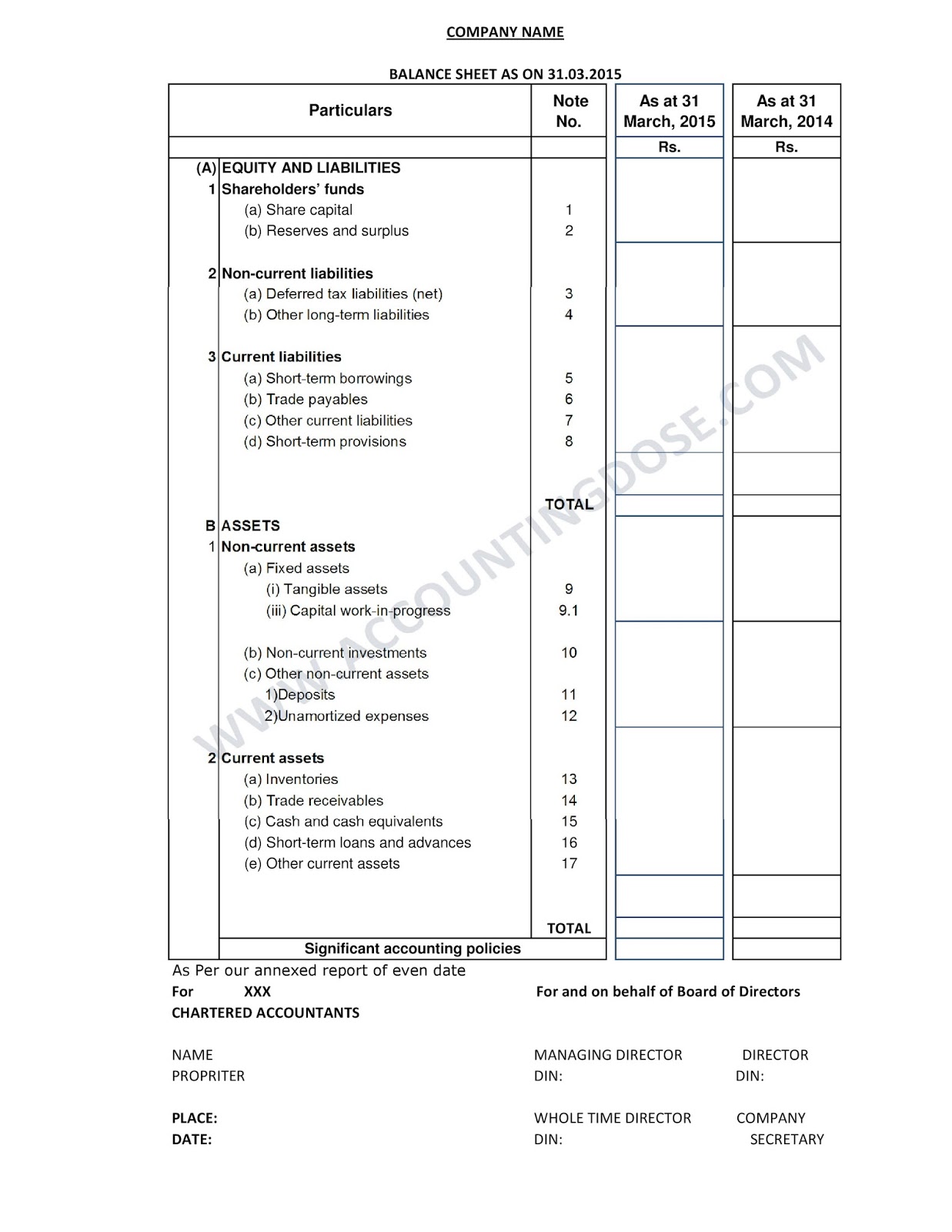

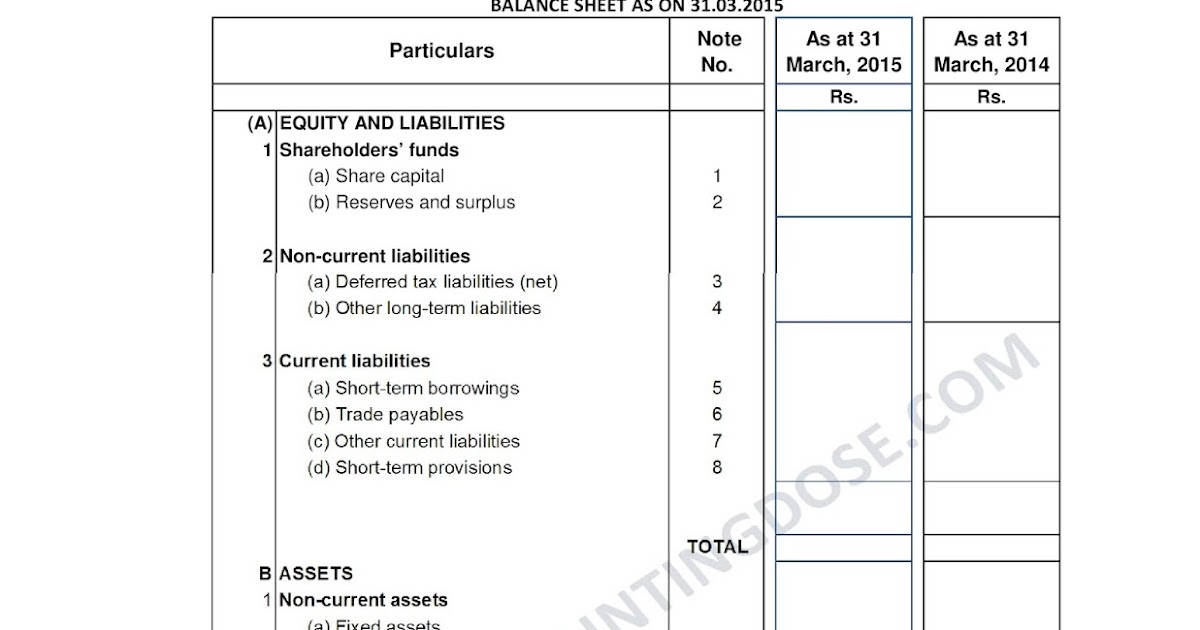

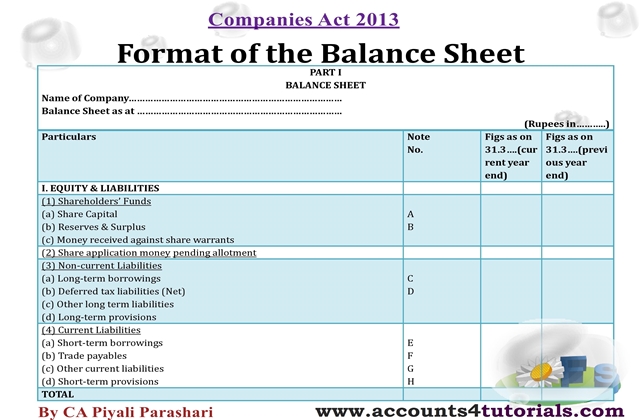

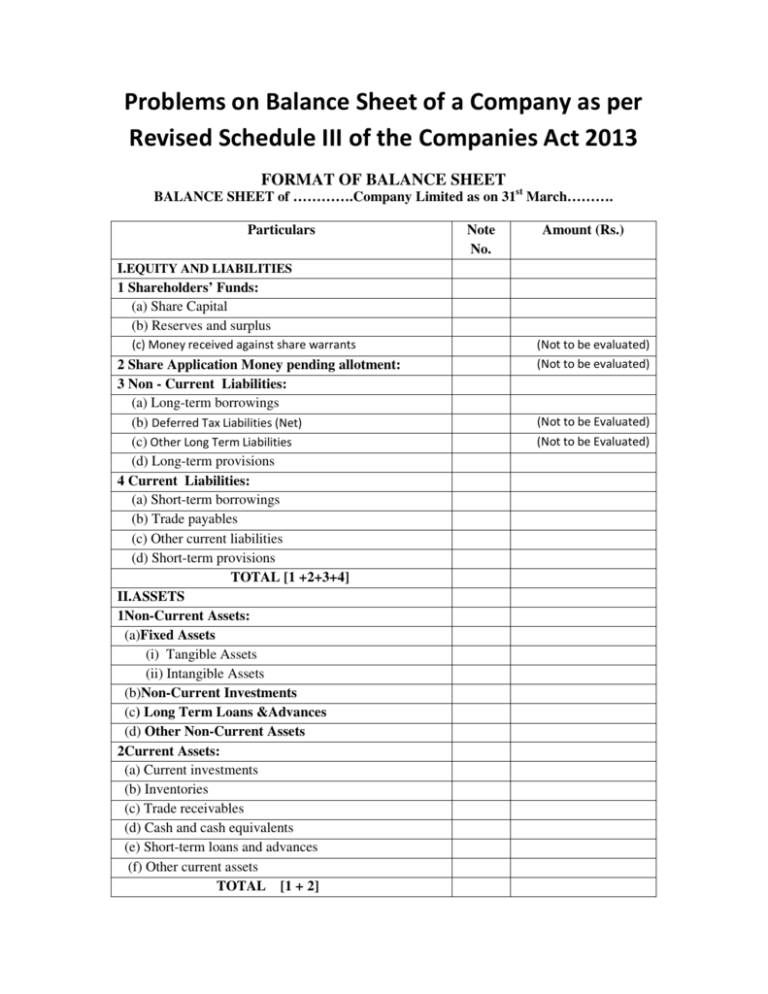

Effective from 01st April 2021. Schedule III of the 2013 Act deals with instructions for prepation of Balance Sheet and Profit and Loss of account of a company under section 129 of the 2013 act. Section 129 read with Schedule III of Companies Act 2013 provides that the Cash Flow statement wherever applicable shall be prepared in accordance with the relevant accounting standard as recommended by the Institute of Chartered Accountants of India in consultation with and after examination of the recommendations made by the National Financial Reporting Authority.

Cash Flow statement Format Indirect Menthod as per AS 3 in Excel format. Amendments to Schedule III to the Companies Act 2013 and the format of Schedule III was termed as Division I to be complied with by Non Ind AS companies and inserted Division II- Ind AS Schedule III which is a format of Financial Statements for companies that are required to comply with the Companies Indian Accounting Standards Rules 2015. SCHEDULE III TO THE COMPANIES ACT 2013 Division I Financial Statements for a company whose Financial Statements are required to comply with the Companies Accounting Standards Rules 2006 GENERAL INSTURCTION FOR PREPARATION OF BALANCE SHEET AND STATEMENT OF PROFIT AND LOSS OF A COMPANY 1.

Note on the balance sheet format within Schedule 3 to The Large and Medium-sized Companies and Groups. Section 3 to 22. PART 1 GENERAL RULES AND FORMATS SECTION A GENERAL RULES.

Cash Flow statement Format Indirect Menthod as per AS 3 in Excel format. Financial Statements are defined in Companies Act 2013 Section 2 40 and includes Cash Flow Statement prepared in accordance with Accounting Standard- 3 AS-3- Cash Flow Statement. Chapter II Incorporation of Company and Matters Incidental thereto.