Marvelous Schedule Vi Companies Act 1956

The Schedules referred to above accounting policies and explanatory notes that may be attached shall form an integral part of the balance sheet.

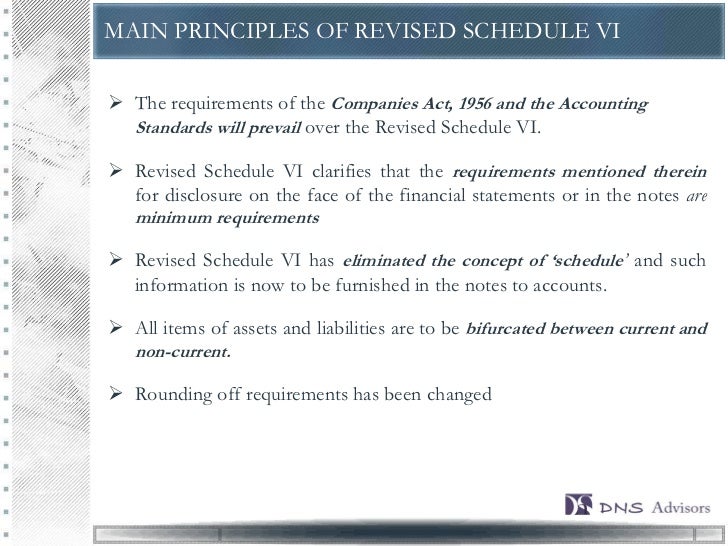

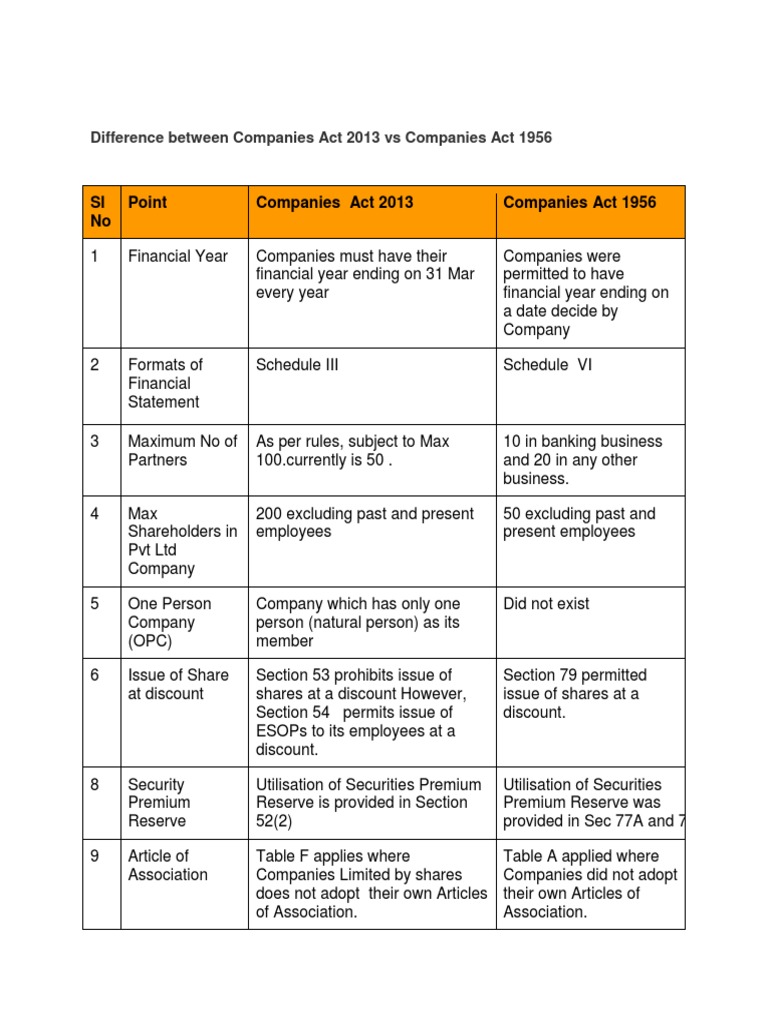

Schedule vi companies act 1956. MAIN PRINCIPLES OF REVISED SCHEDULE VI The requirements of the Companies Act 1956 and the Accounting Standards will prevail over the Revised Schedule VI. B every material feature including credits or receipts and debits or expenses in respect of non-recurring transactions or transactions of exceptional nature. The disclosure requirements specified in Part I and Part II of this Schedule are in addition to and not in substitution of the disclosure requirements specified in the Accounting Standards prescribed under the Companies Act 1956.

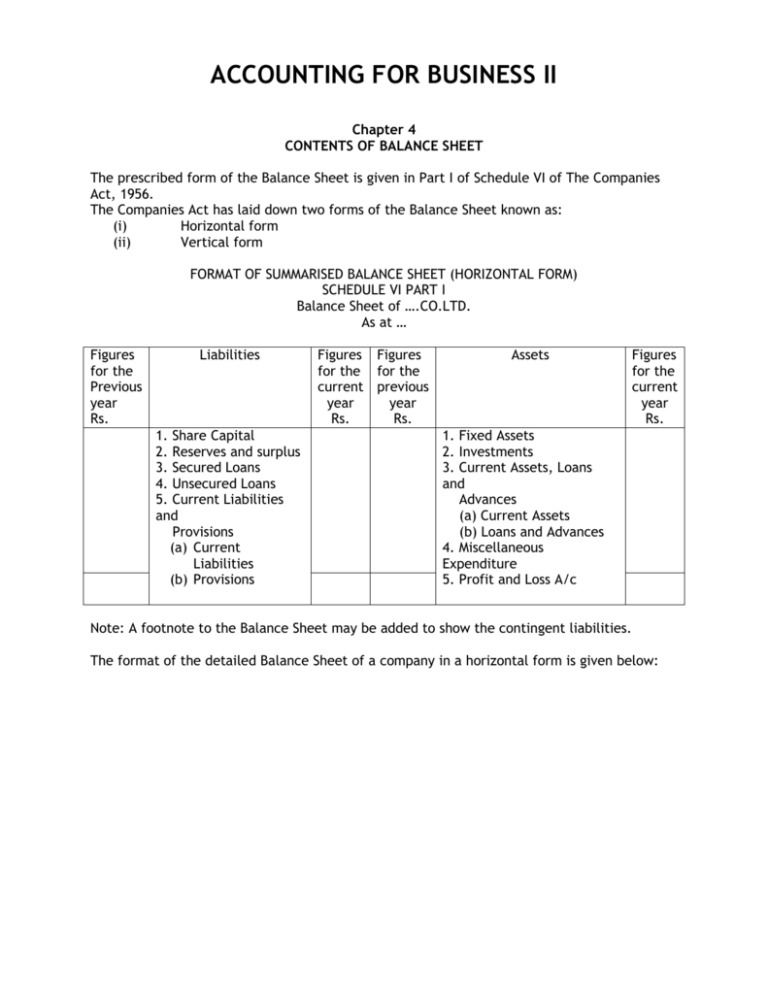

500 Crs - Roff to the nearest Hundreds thousands lakhs or millions or decimal thereof. It is a major step and members of the profession have a greater role and responsibility in its preparation. The Schedules shall incorporate all the information required to be given under A-Horizontal Form read with notes containing general instructions for preparation of balance sheet.

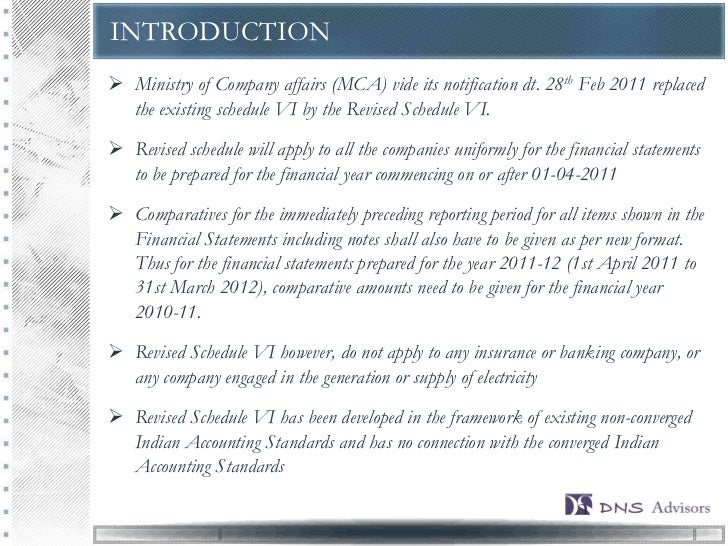

DISCLOSURE REQUIREMENTS AS PER SCHEDULE VI PART II OF THE COMPANIES ACT 1956. Schedule VI shall stand modified accordingly. The Revised Schedule VI to the Companies Act 1956 became applicable to all companies for the preparation of Financial Statements beginning on or from 142011.

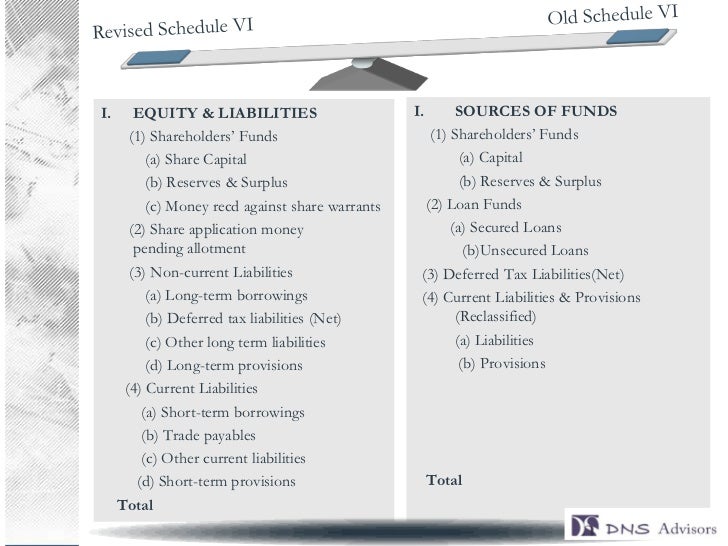

Revised Schedule VI of Companies Act 1956 1. The significant points of differences between the old and New Schedule VI to the Companies Act 1956 with respect to the Profit and Loss Accounts is summarized in the table given below PART-C- Format of Balance Sheet in New Schedule VI to the Companies Act 1956 Items given in. To facilitate the preparation.

Revised Schedule VIto The Companies Act 1956 Features Concepts Disclosures A revised schedule is to business what a new season is to an athlete or a new canvas to an artist. Meaning of holding company and subsidiary 4A. Other loans and advances Note ii Disclosure pursuant to Note no.

Norman Ralph Augustine CA. 100 Crs or more but less than Rs. Section 2111 of the Companies Act 1956 requires the companies to draw up their financial statements as per the form set out in Revised Schedule VI.