Peerless Ola Profit Or Loss

Read more about Ola cuts down losses on way to profitability revenue up 61 at Rs 2223 cr on Business Standard.

Ola profit or loss. The company has reported a 6098 per cent increase in the consolidated revenue in FY18. Within 3 years its revenue has soared up to 375. Balance Sheet Profit and Loss and shareholder return for last three years upto 31 March 2019 along with latest MoA and AoA.

Keeping the supply in check. OlaUber business plan explained in Tamil in detail about the investment running costs expenses and finally whether it is profit or lossApproximate pr. Uber and Ola have fundamentally not.

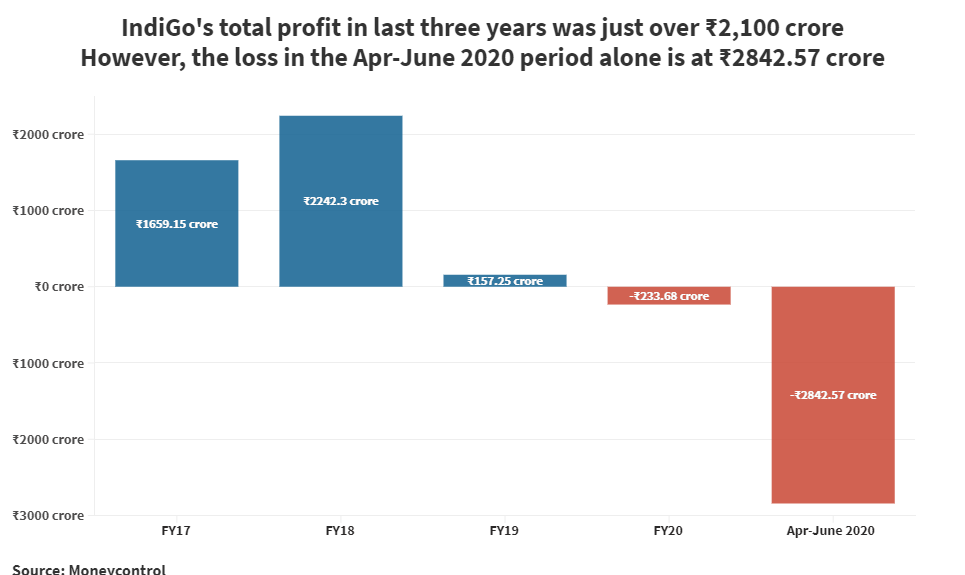

The home-grown Indian ride-hailing major Ola had claimed that it was on a path to profitability. Ride-hailing company Ola which is expanding operations globally and reportedly eyeing an IPO in a few years saw 92 per cent increase in losses for its cab-leasing business Ola. App-based taxi services company Ola had to spend at least three rupees for every rupee it earned in 2016.

Get detailed financial reports of Ola Cabs Ani Technologies Private Limited including EBITDA Assets. This number stood at Rs 184753 crore in the previous fiscal. The Bengaluru-based firm recorded a significant spike of 377 in operating revenue during FY19 by earning Rs 254363 crore according to its regulatory filings with the MCA.

Ola Loss Trend FY18-FY19 - Infogram. Ola was also able to trim its losses by 9 as the total expenses were limited to a growth of 63. Ola vs Uber comparison from users perspective Ola Cabs was incorporated in 2010.

8 working hours Mon-Fri. While Ola reported operating revenues of Rs 38344 crore for the year Uber India Systems closed with Rs 37479 crore with a profit of Rs 2884 crore. In its latest revelations of Annual Reports via RoC filings with Ministry of Corporate Affair it turns out that the claim isnt untrue.