Top Notch Tax-basis Balance Sheet

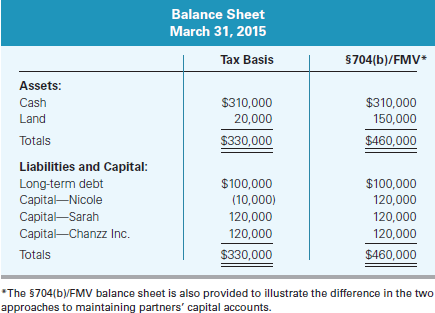

Basis Fair Market Value Kevan.

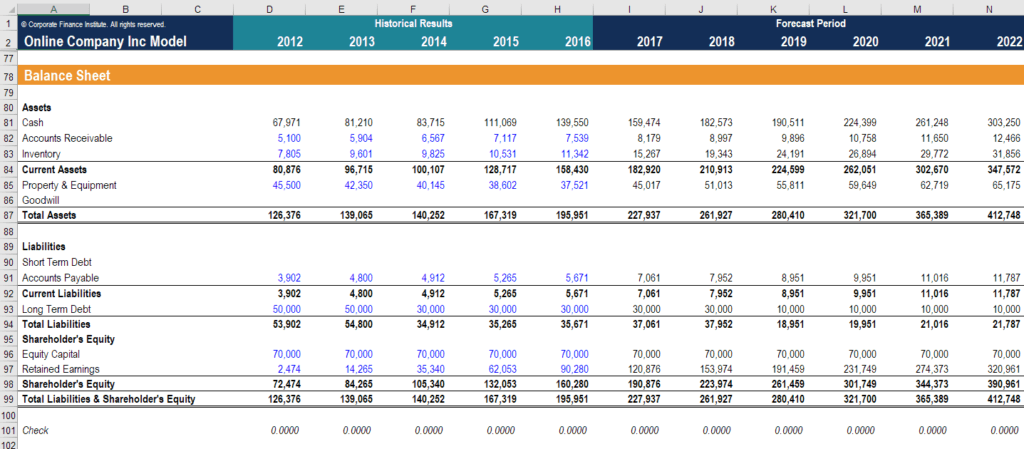

Tax-basis balance sheet. Tax basis balance sheets follow the same format as regular balance sheets but are designed as if they were prepared for tax purposes. It is unclear how to adjust the balance sheet where the practitioner relies on the tax basis information provided by the partners. This is the best place to begin when preparing a tax-basis balance sheet.

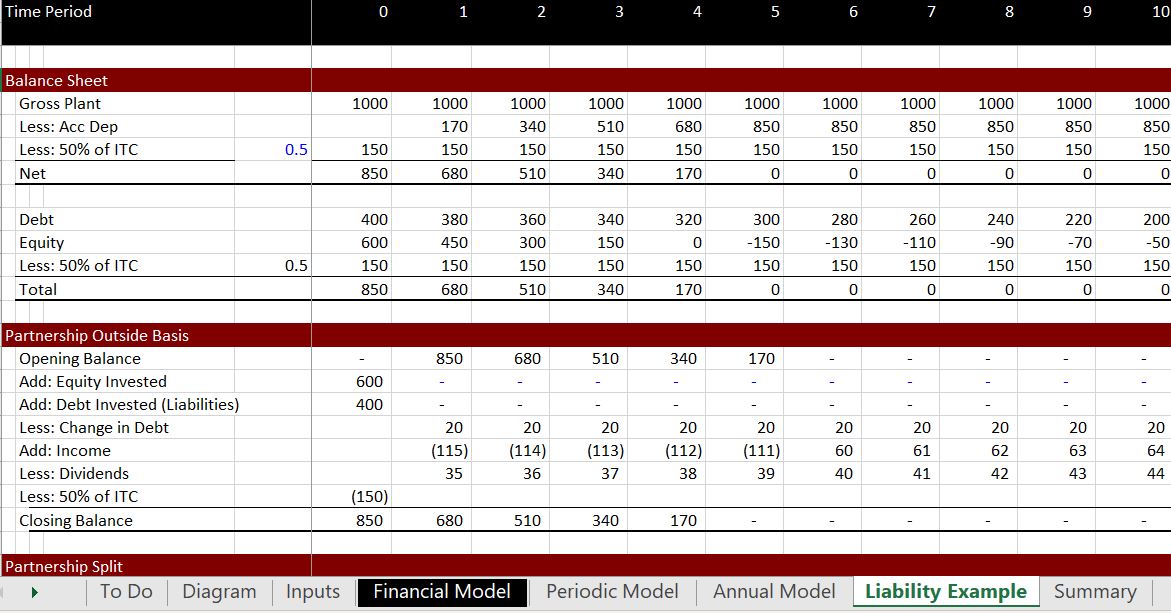

The Form 1065 balance sheet and the partners capital accounts have been maintained on GAAP. Historically income tax accounts on the balance sheet were not a significant emphasis of review by financial statement auditors as the income statement method was used to calculate the tax provision. Cash Land Totals Liabilities and capital.

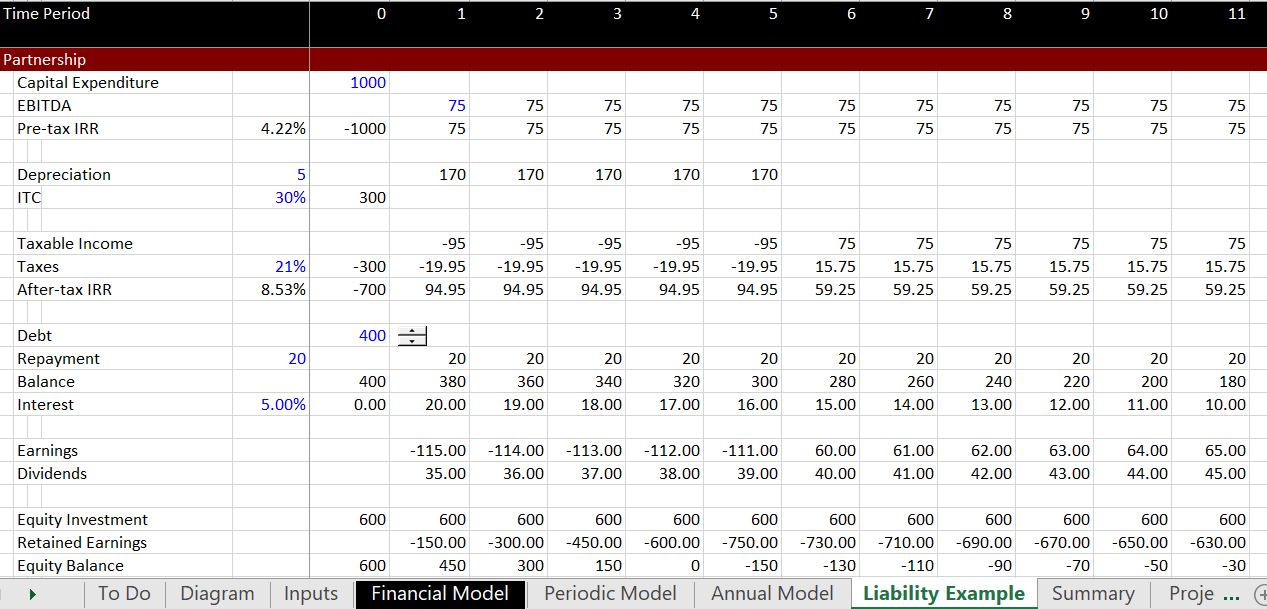

The first is dividends paid pre-tax dividends from the cash flow distribution that can bring the balance to below zero. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities. In a tax basis balance sheet the liabilities of a company are reported at their true current value assuming the business paid for the liability immediately.

This form contains the following RollForward members in the columns across. Tax Basis Balance Sheet Variance. Tax basis balance sheets have become increasingly important as there has been a shift of financial statement audit focus related to the accuracy of the tax account balances.

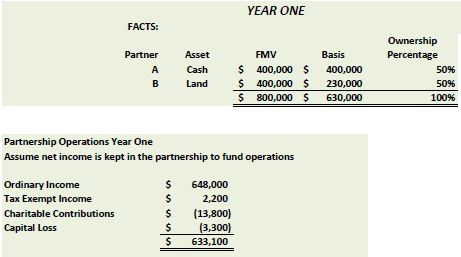

Mortgage debt Capital-Kevan Capital-Jerry Capital-Dave Totals Kevan Jerry and Dave formed Albee LLC. The balance sheet should balance. In most cases assets are initially recorded at acquisition cost for both book and tax purposes.

Cash or taxbasis financial statements may be appropriate whenever the entity is not contractually or otherwise required to issue GAAP financial statements. The starting point for the tax basis balance sheet is the book balance sheet. A balance sheet is a way for business owners accountants and tax preparers to understand the assets liabilities and equity in an organization.