Top Notch Accretion Expense Example

For example if the company has an EPS of 1 and after acquiring the EPS rose to 130 then the acquisition would be referred to like 30 accretive.

Accretion expense example. For example assume that the par value of a bond is 1000 but it is offered at a discounted price of 950. In accounting an accretion expense is created when updating the present value of an instrument. Ad Get the Expense Tools your competitors are already using - Start Now.

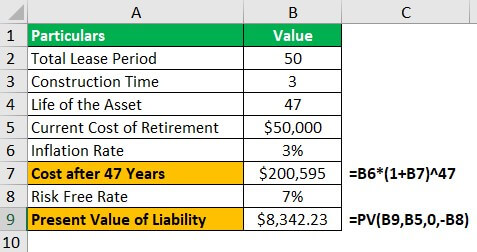

Assuming a risk-free rate of 7 this obligations present value comes out to. If an accountant originally recognizes the present value PV of a liability at 1300 which has a future value FV of 2000 the accountant periodically increases the PV of. Over the next 10 years Jane will see 100 of accretion on her bond 1000 - 900.

Assuming an inflation rate of 3 the cost of retirement at the end of 47 years will be 200595. Leases a building for 5 years to host their annual awards shows and. Accretion expense is the cost associated with an increase in a liabilitys carrying value over time.

In corporate finance accretion is the creation of value through organic growth or through a transaction. For example when new assets are acquired at a discount or for a cost that is below their. See also Accretion finance.

Bond accretion is the growth in the value of the bond as time lapses. To take that into consideration the retirement cost will increase at the rate of inflation. For example after year 2 the accrual can be calculated as.

Even though Jane doesnt actually receive the 100 until the bond matures she must pay taxes on the accretion as it occurs over the 10 years. Dont Wait - Let GetApp Help You Find The Perfect Software For Your Business Needs. Accretion expense example.