Casual How To Calculate Profit Using Assets And Liabilities

Its possible to tweak the Chart of Accounts to reflect where they should appear in reports like the Balance Sheet and Profit Loss.

How to calculate profit using assets and liabilities. 1000 2000 05 or 50 percent. Similarly we have to calculate Closing Owners Equity using the same accounting equation. If ROA is known to be 10 percent this means that net income divided by 50 equals 10 percent.

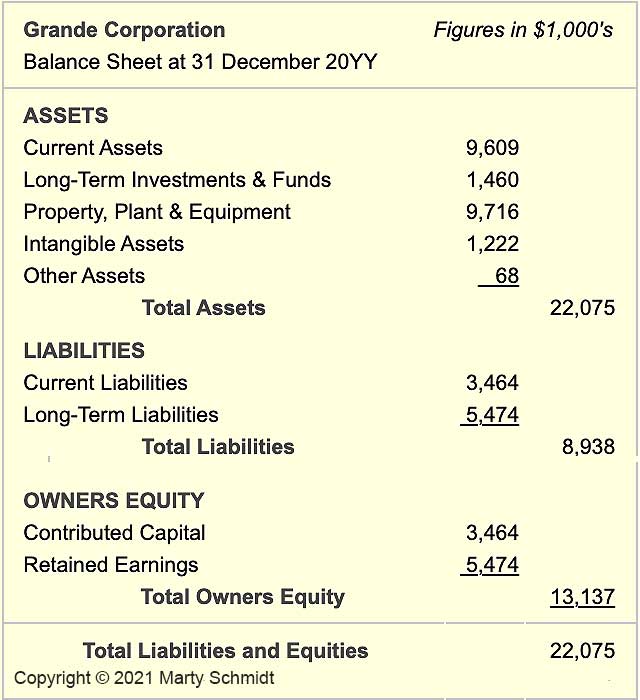

Anyone familiar with balance sheets from accounting and company financial statements will recognize the format here. So How to Find Profit or Loss under the Statement of Affairs Method. Include cash savings retirement accounts mutual funds your.

The remaining figure represents a companys equity. For example a small business has total liabilities of 1000 and total assets of 2000. The number of net assets can be tallied out with the shareholders equity.

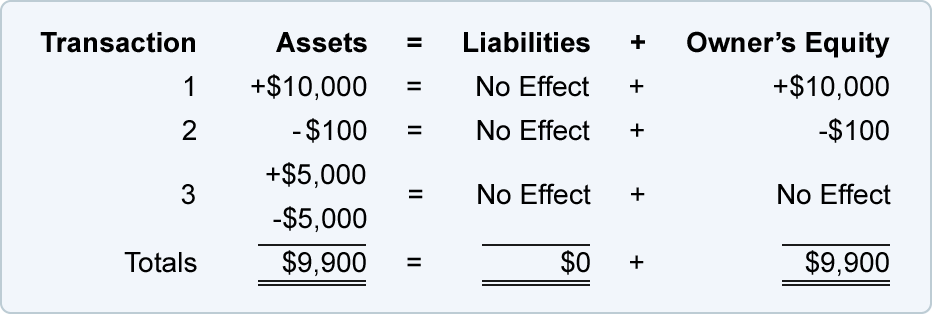

For calculation of profit through Assets Liabilities we need Opening Assets Liabilities and Closing Assets Liabilities. To calculate this ratio use this formula. How much of a company someone owns in the form of shares.

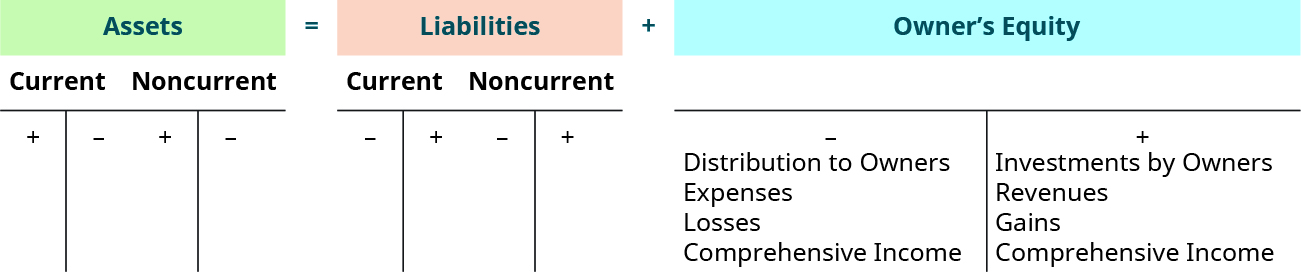

Profit or Loss is calculated using the following formula. For example if total sales are 100 and total assets are 50 then total sales turnover equals 10050 or 20. A quick way to think of equity is assets minus liabilities.

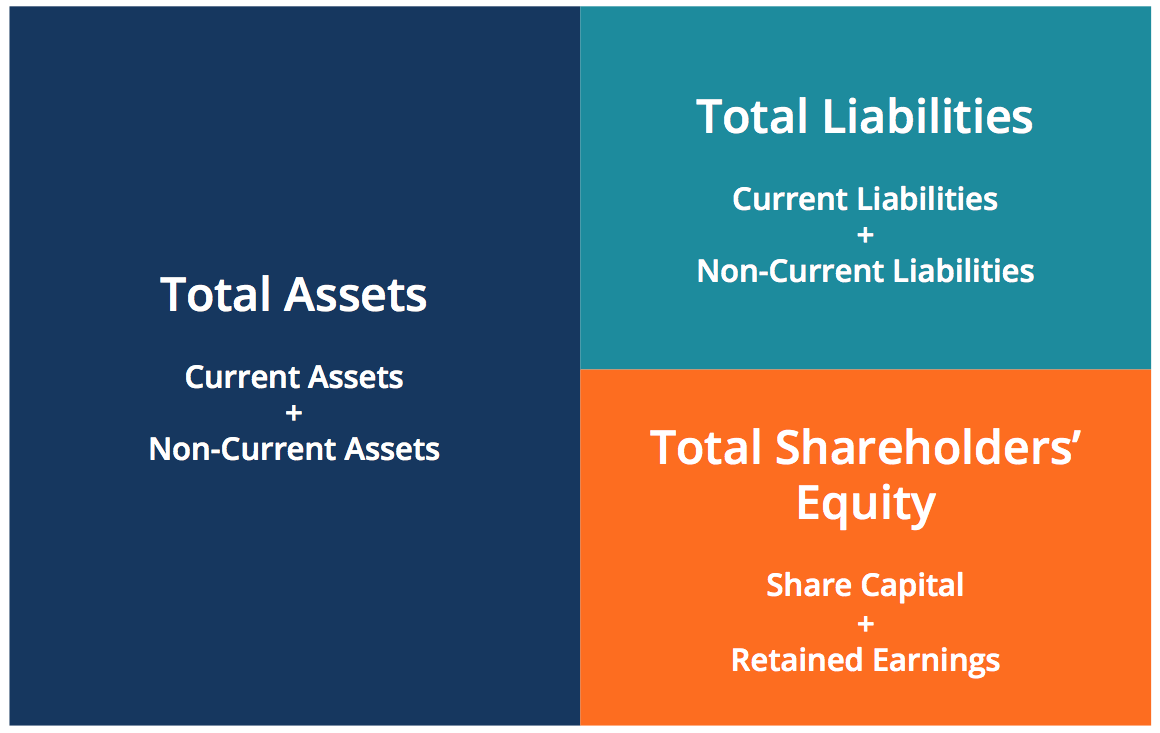

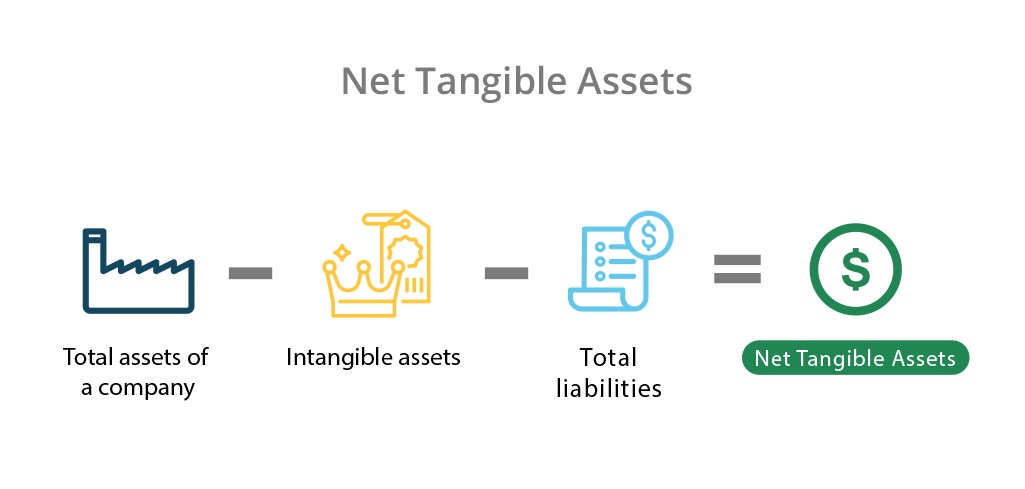

Owners Equity Total Assets- Total Liabilities. To begin calculating your assets and liabilities write down all of the assets you believe you have. Once weve jotted down our Personal Assets Liabilities we move on to the final step and compute our net worth.

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)