Outrageous Ias 12 Illustrative Examples

IAS 12 Income Taxes.

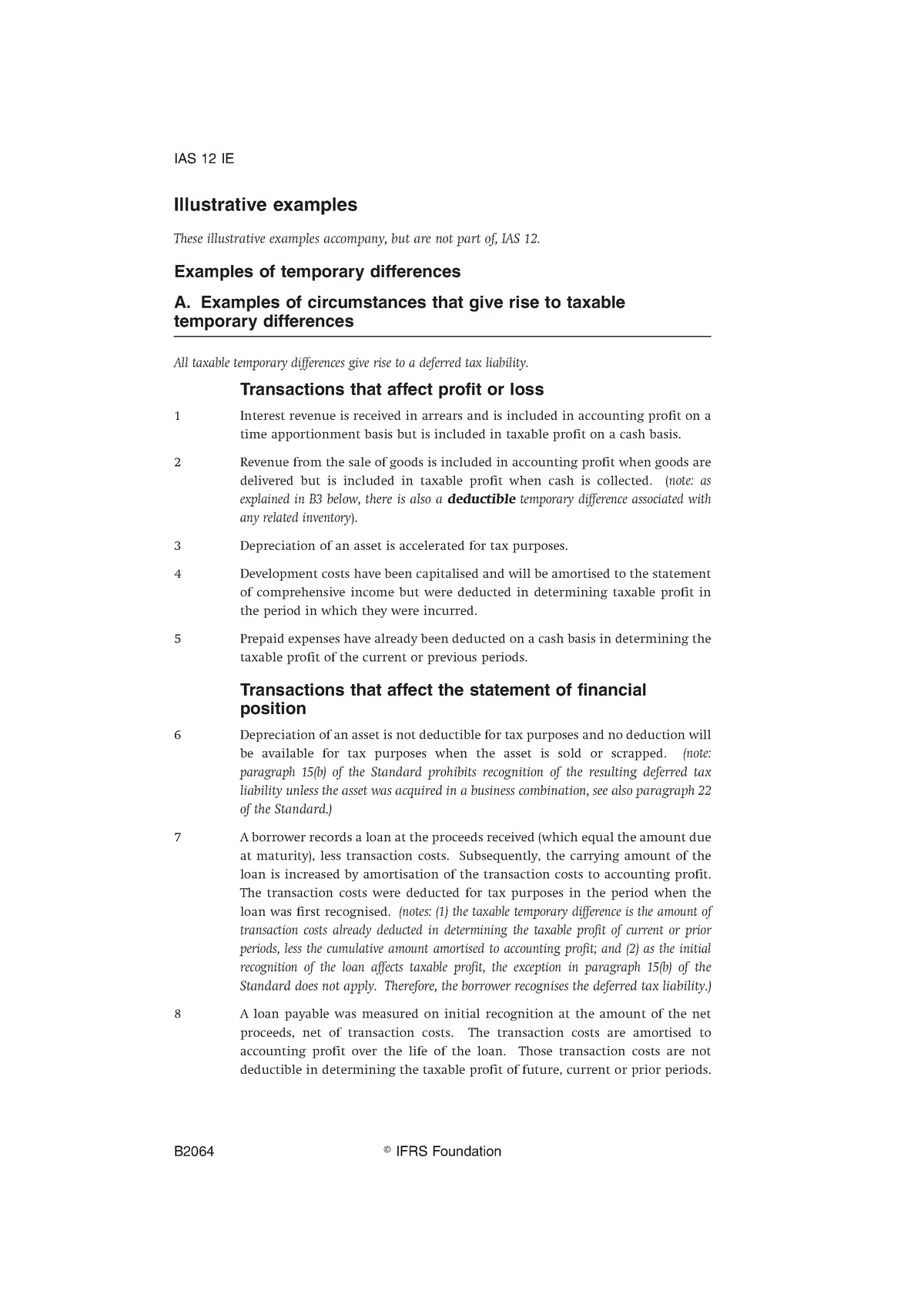

Ias 12 illustrative examples. Example 1 the tax base of an asset Company A purchased an item of property plant and equipment for CU10000. Simple calculation of defined benefit plan. IFRS Standards linked to Deloitte accounting guidance International Financial Reporting Standards linked to Deloitte accounting guidance International Accounting Standards.

IAS 19 excel examples. Illustrative Examples on IAS 12 Income Taxes DART Deloitte Accounting Research Tool. The tax base of a liability is its carrying amount less any amount that will be deductible for tax purposes in respect of that liability in future periods.

IAS 16 excel examples. 12-14 Recognition of deferred tax liabilities and deferred tax assets paras. Purpose of deferred tax.

Consolidated and Separate Statements of Financial Position. These illustrative examples accompany but are not part of IFRS 12. Trade and other receivables 60 18.

On commencement of the lease C records the following entries under IFRS 16 Leases. Diminishing balance depreciation without residual value. Exemption for initial recognition of leases under IFRS 16.

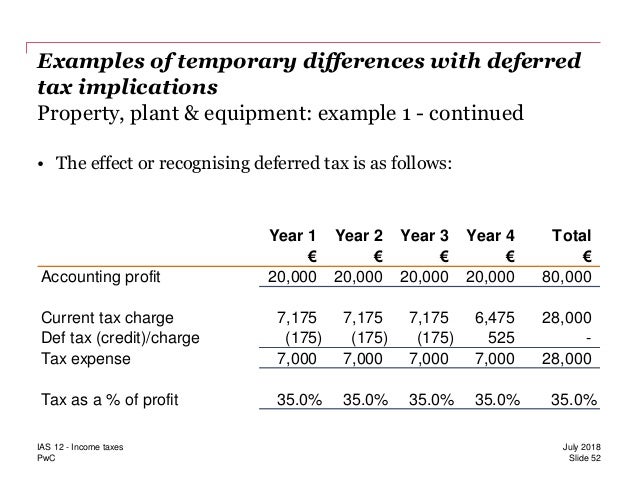

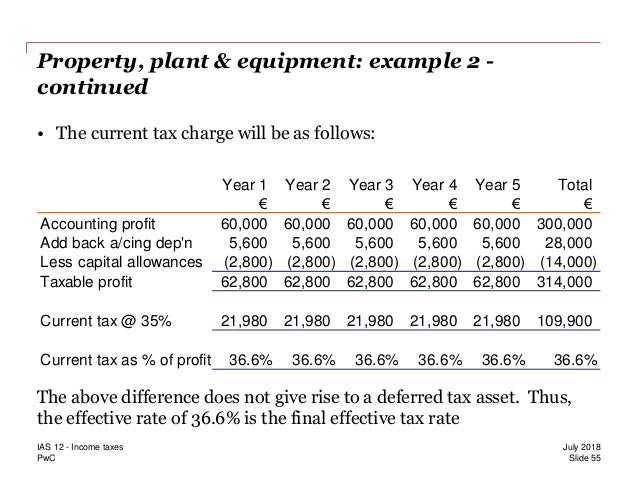

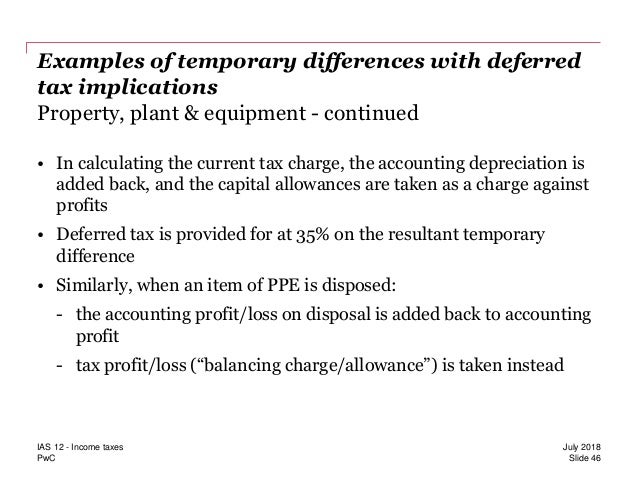

Examples of temporary differences. Major components of tax expense tax income IAS 1279 Examples include. Overview of IAS 12.