Outrageous Commission Paid In Advance Accounting Equation

1000 1000.

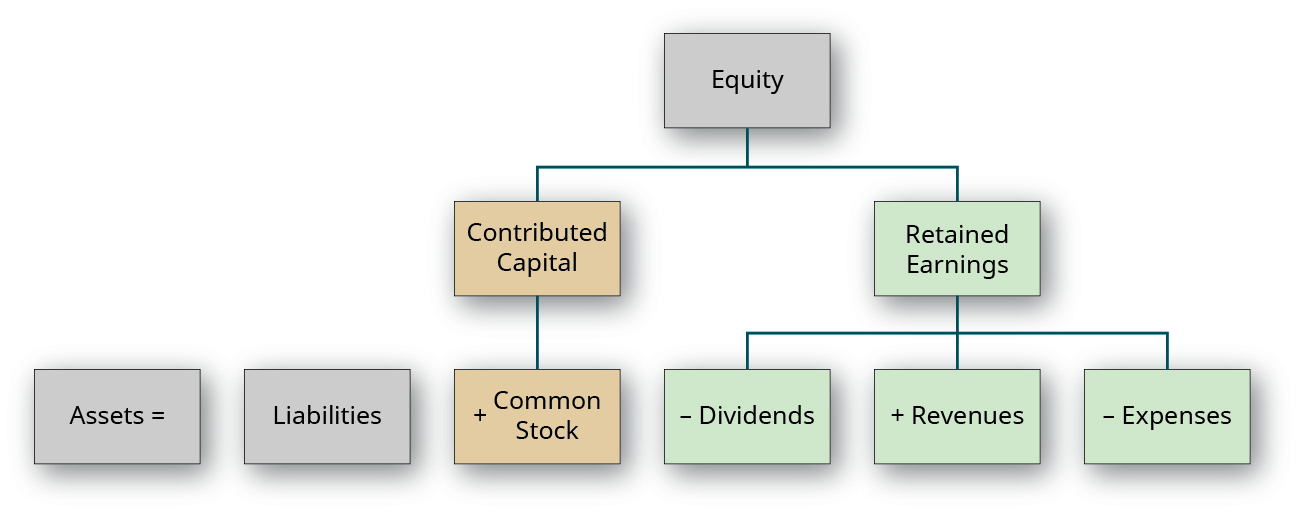

Commission paid in advance accounting equation. Also known as unearned income it is income which is received in advance however the related benefits are yet to be providedIt belongs to a future accounting period and is still to be earned. Since Commission Received in Advance in Cash results in Increase in Cash and Cash is an Asset receipt of Commission results in. Rent received Rs 2000.

On the 1 January it pays the next quarter rent of 15000 to cover the 3 months of January February and March. Ii Paid rent in advance 300. Under the accrual basis of accounting the commissions do not have to be received in order to be reported as revenues.

63000 500 1000 62500 v Amount withdrawn 5000 5000 5000. V Paid salary Rs450 and salary outstanding being Rs100. V Amount withdrawn 5000.

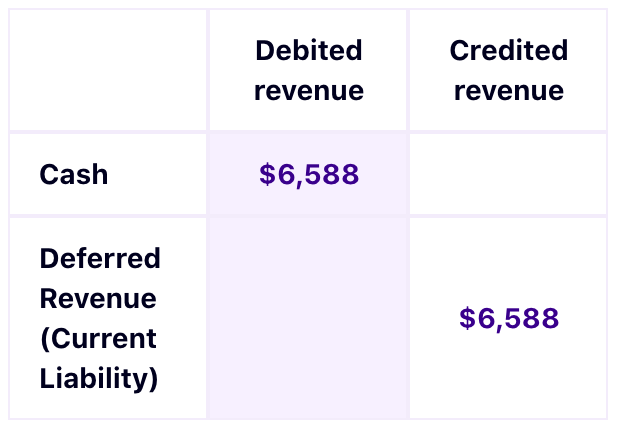

Liabilities Creditors 40000. When this happens the correct accounting is to recognize the advance as a liability until such time as the seller fulfills its obligations under the terms of the underlying sales agreement. 2000 2000 Income 62000 62000 iii Accrued Interest 500.

Iv Commission received in advance 1000. I Started business with cash 10000. Iv Sold goods for cash Rs8000 costing Rs4000.

Iii Accrued Interest 500. Journal Entry for Income Received in Advance. Show the effect of the following transactions on assets liabilities and capital using the Accounting Equation.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)