Sensational How To Find The Net Income Based On Assets, Liability And Owner Equity Sheet

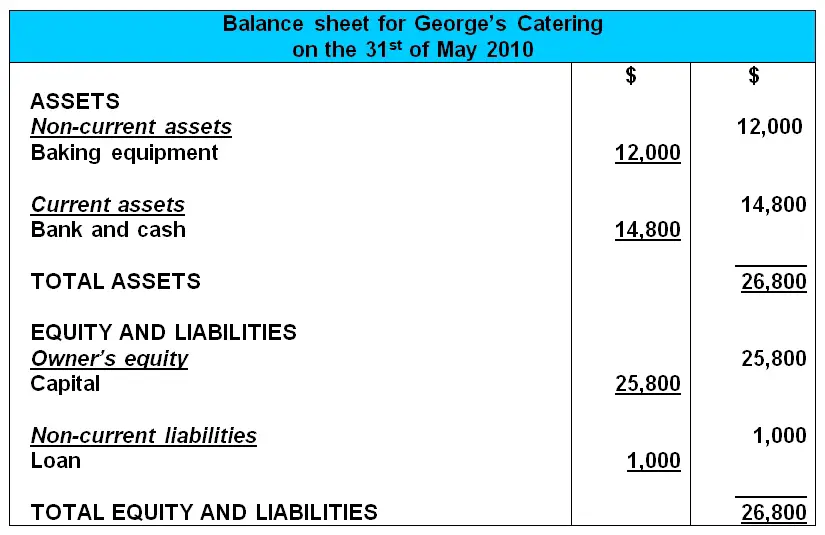

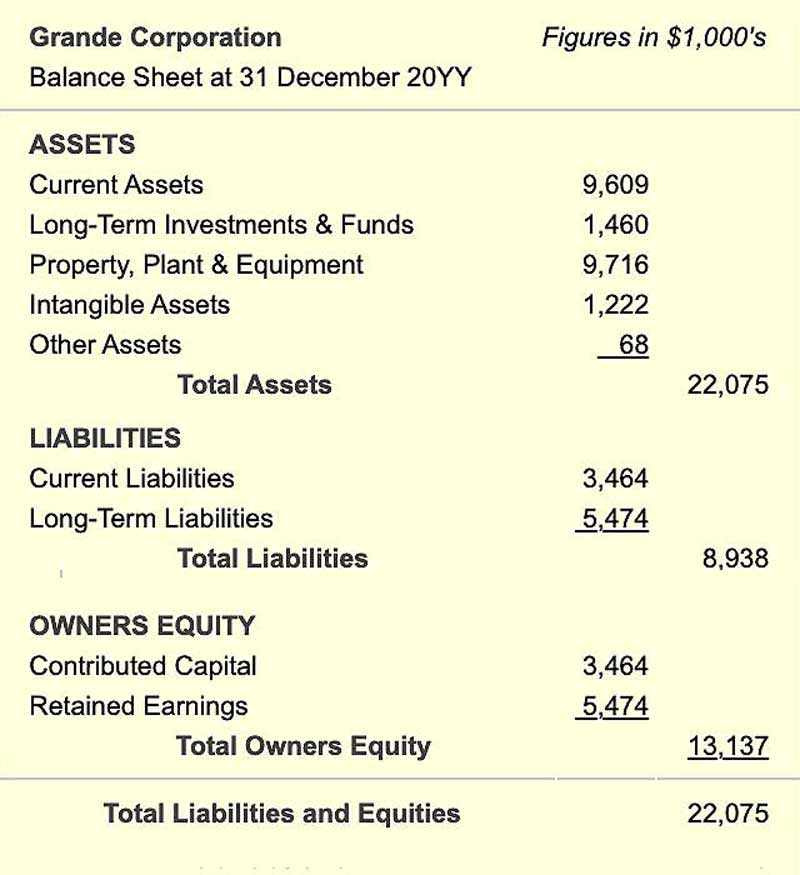

Current assets such as cash and savings and long-term assets such as buildings and machines are located.

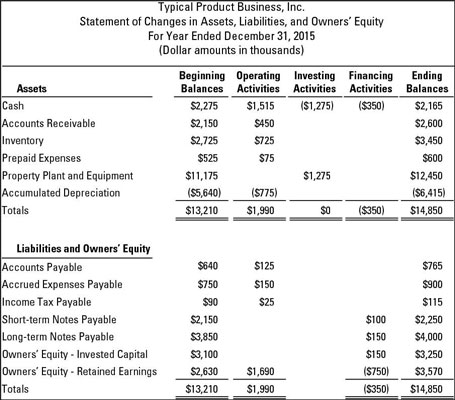

How to find the net income based on assets, liability and owner equity sheet. As such the balance sheet is divided into two sides or sections. Insert the previously missing amount in this case it is the 64000 of net income into the statement of changes in owners equity and recheck the math. If you look at your companys balance sheet it follows a basic accounting equation.

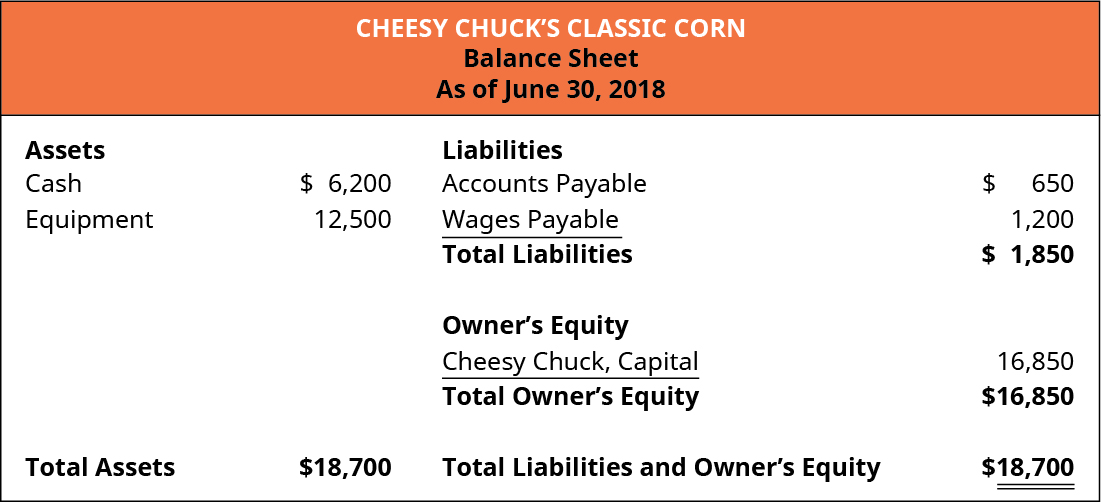

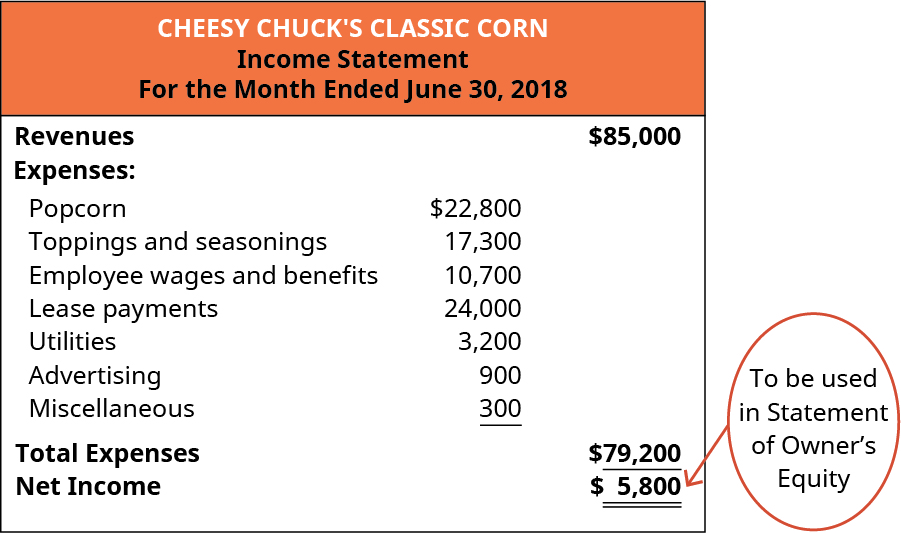

For a sole proprietorship or partnership equity is usually called owners equity on the balance sheet. A net income line item shows a positive dollar amount while a net loss line item shows a negative dollar amount enclosed in parentheses. Identify the dollar amount listed on the same line as the net income or net loss description.

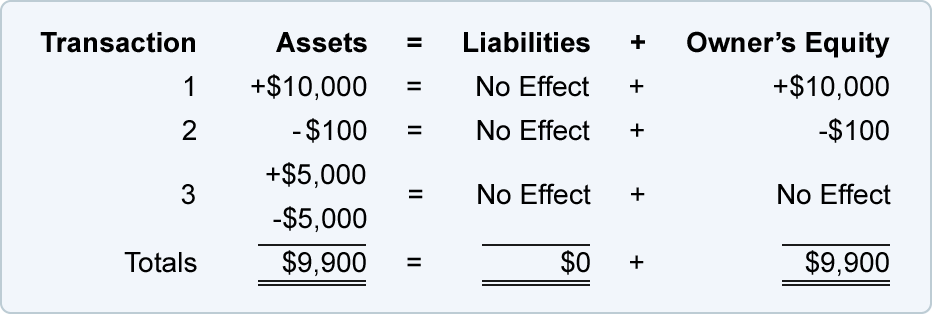

Net incomeloss Ending equity - Starting equity owner withdrawals - owner investments. The company had a net loss of 100 for the year. In this case the equity would be 10.

Its entirely possible to calculate. Assets Liabilities Owner Equity Beginning 395000 190000 X investments X X X. Assets have a measurable value and they can be broken down on the balance sheet by category.

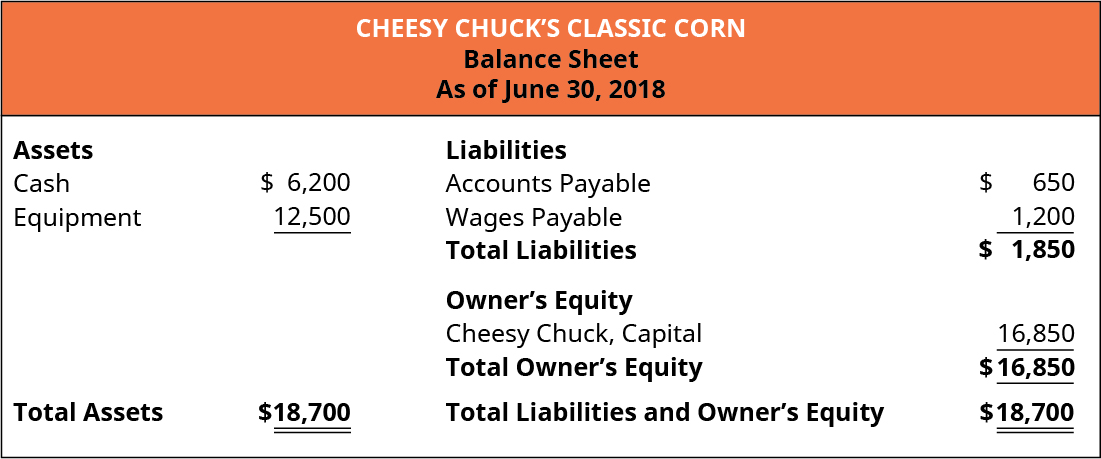

Net income can also be measured as the change in equity. The higher the percentage the less of a business or farm is leveraged or owned by the bank through debt. The assets are shown on the left side while the liabilities and owners equity are shown on the right side of the balance sheet.

Owners equity is essentially the owners rights to the assets of the business. Assets Liabilities Equity. The balance sheet equation also known as the accounting equation is Assets Liabilities Equity.

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)