Brilliant P And L Appropriation Account Format

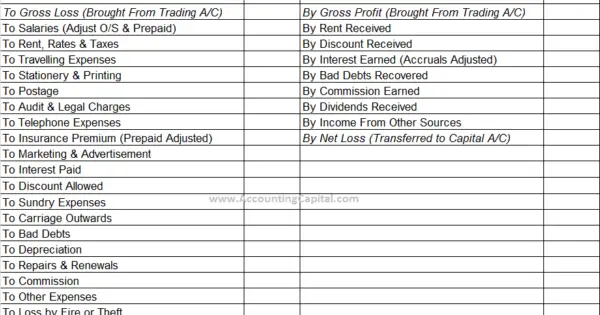

For items of Incomes.

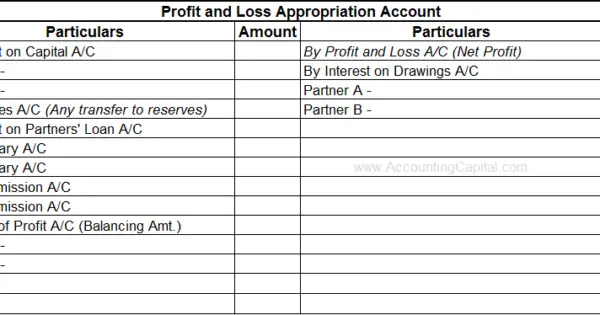

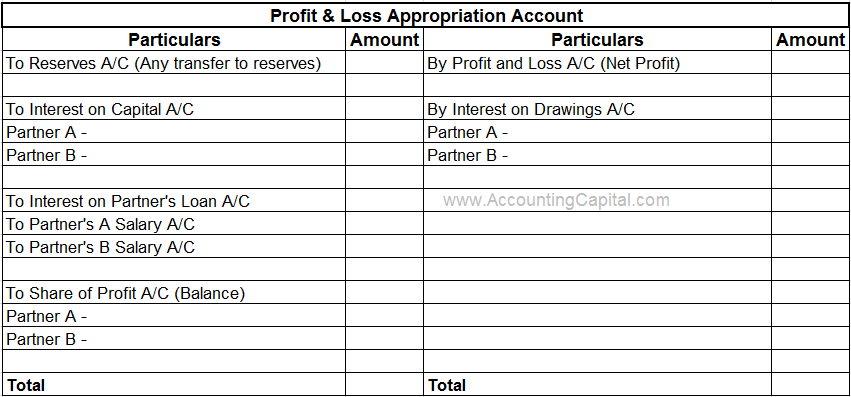

P and l appropriation account format. Drawing by the partners and the interest thereupon. Format of Profit and loss appropriation account The following is the format of profit and loss appropriation account. In case of loss.

In other words Net Profit or Net Loss from Profit and Loss Account will be transferred to opposite side Below the line method. The PL statement is also referred to as a statement of profit and. Template and Method of Preparation.

January 23rd 2010 Comments off. The PL statement aligns with the income statement which records information about a companys ability or its inability to generate profit by increasing the sales revenue by reducing costs or both. PL Appropriation AC for the Year Ended 3112XXXX.

The balance being the profit or loss is transferred to the partners capital or current account in the profit sharing ratio. Profit and loss account ac. PL appropriation account is prepared mainly by partnership firms.

Profit and loss account Definition The account that shows annual net profit or net loss of a business is called Profit and Loss Account. To segregate charges and appropriations of profits being made to the profit and loss account the PL ac is divided into two by creating a new account by name Profit and Loss Appropriation ac. Net Profit Transferred to the account from the Profit and Loss Account 2.

PL account is a component of final accounts. Which means all the expense items of the firm are debited and income items are credited. To Interest on Partners Capitals To Reserve Ac.

/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg)