Beautiful Work Off Balance Sheet Items Examples

The risk of adverse effects on the banks profits and capital from similar off balance sheet sources.

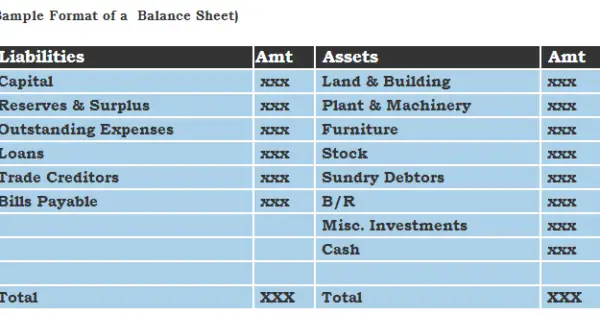

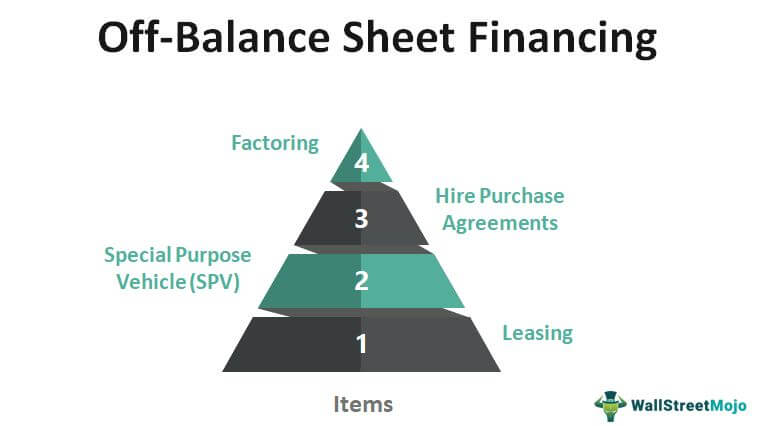

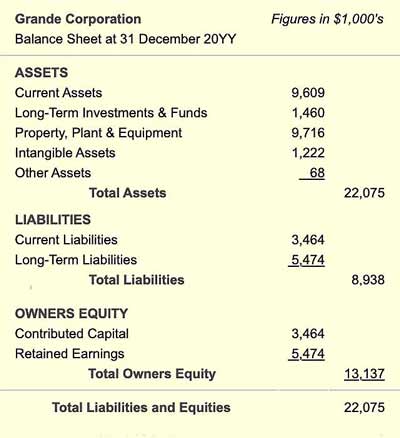

Off balance sheet items examples. Cash Cash Equivalents. Off-balance sheet items The pervasive use of off balance sheet transactions can be materially misleading for financial statement users. 1 Leasing It is the oldest form of off-balance-sheet financing.

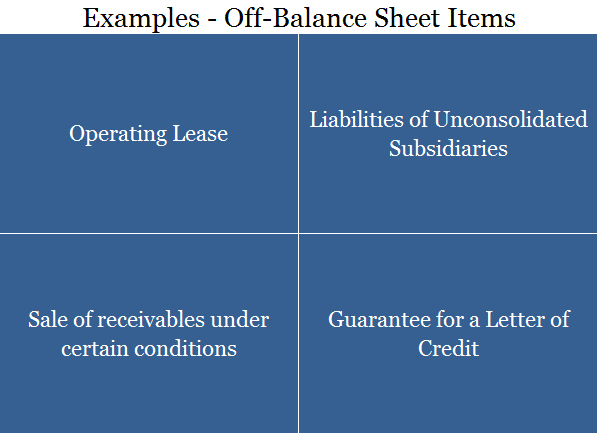

Instead of purchasing the machinery the company may decide to lease it from an external source so that it will not become an asset or liability and will not need to be recorded on the balance sheet. The following are some of the common instruments for off-balance-sheet Items. Examples of off-balance sheet items Lets say a company requires a new piece of machinery.

Schedule RC-L should be completed on a fully consolidated basis. Download Template Fill in the Blanks Job Done. These items are usually associated with the sharing of risk or they are financing transactions.

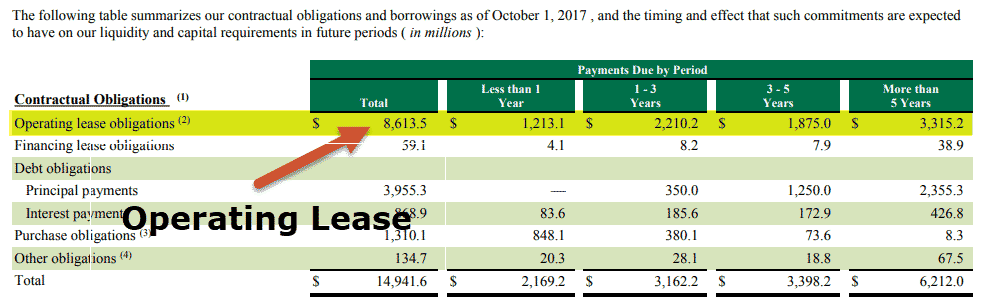

Most commonly known examples of off-balance-sheet items include research and development partnerships joint ventures and operating leases. Off-balance sheet items are typically those not owned by or are a direct obligation of the company. Another example of off-balance sheet items would be when investment management firms dont show the clients investments and assets on the balance sheet.

For example when loans are securitized and sold off as investments the secured debt is often. Which are contingent in nature are some of the examples off -balance sheet. Among the above examples operating leases are the most common examples of off-balance-sheet financing.

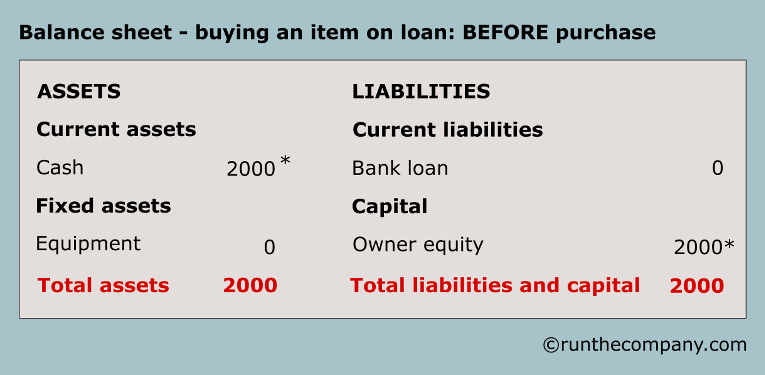

For example repo-to-maturity transactions. Items of Balance Sheet. Historical guidance on leasing agreements is found in the following standards.

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)