Fine Beautiful Contribution Format Income Statement Mcgraw Hill

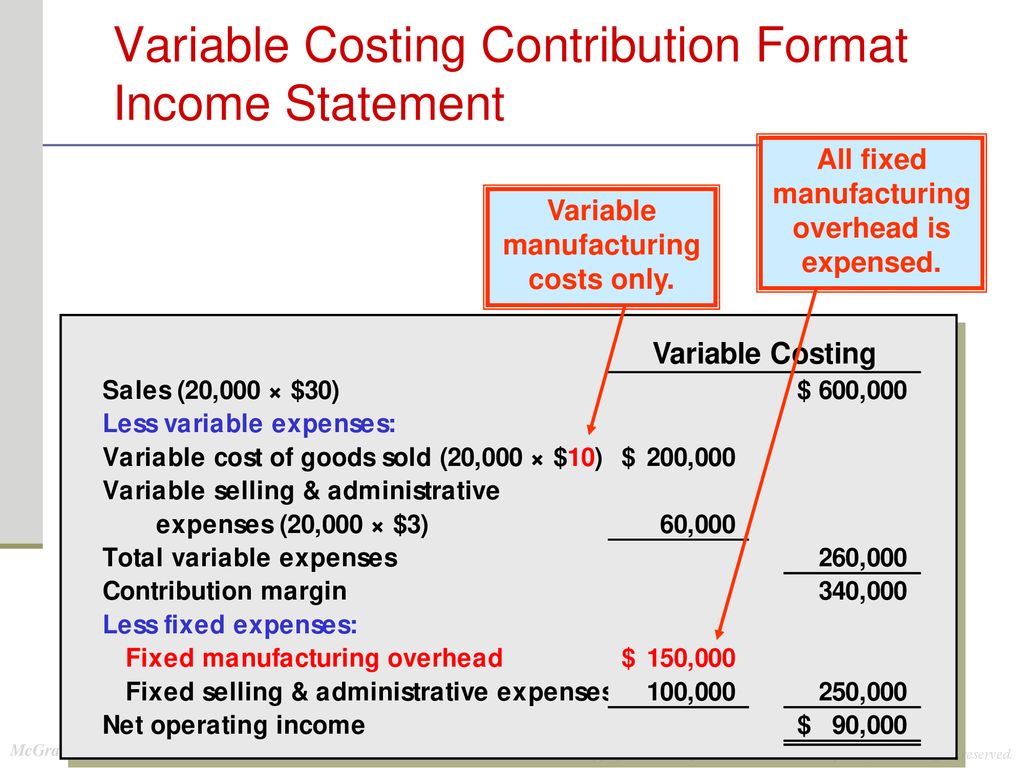

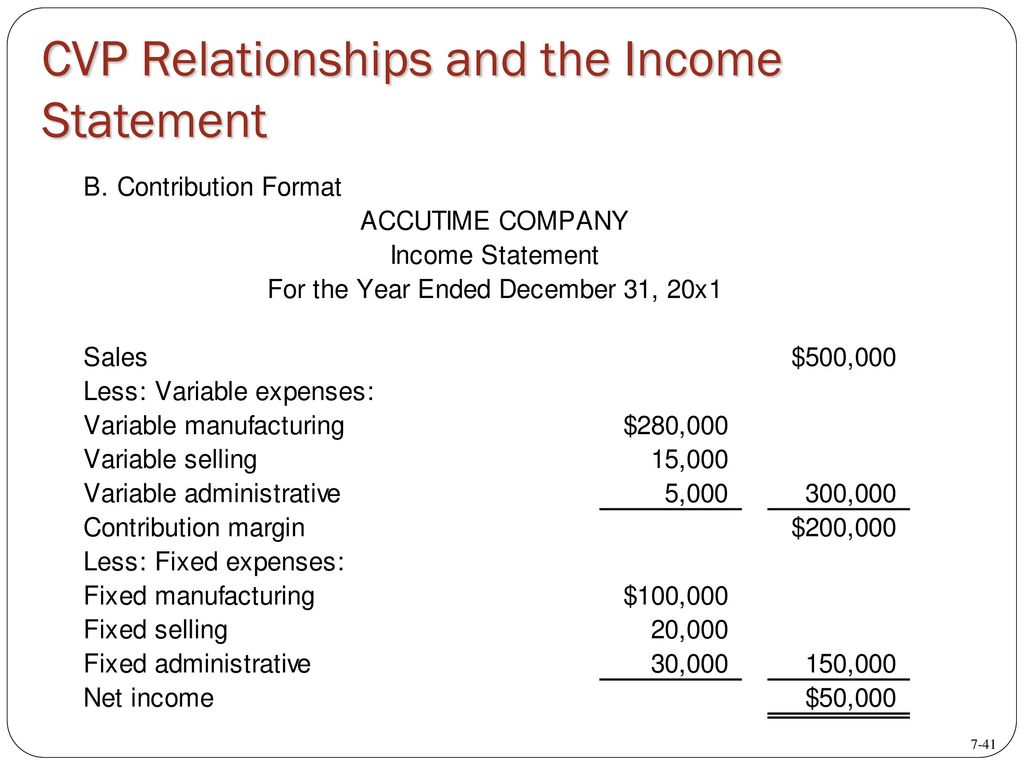

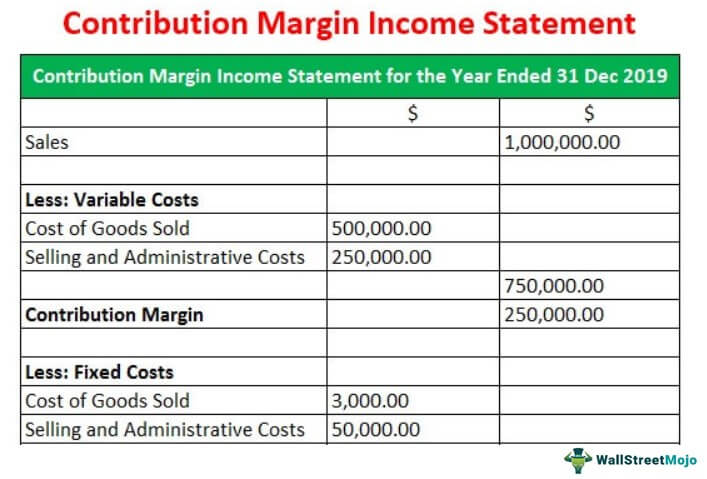

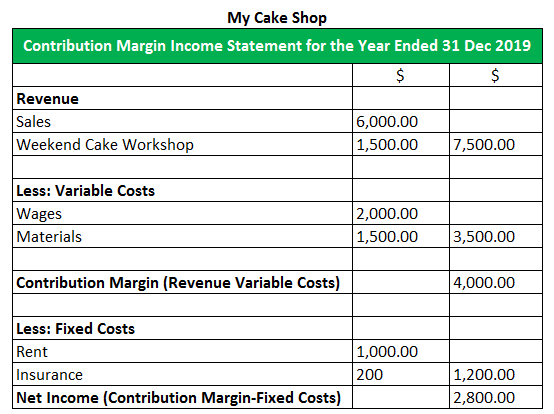

The total income line before taxes in the profit and loss account in contribution format is the difference between the contribution margin and the fixed costs.

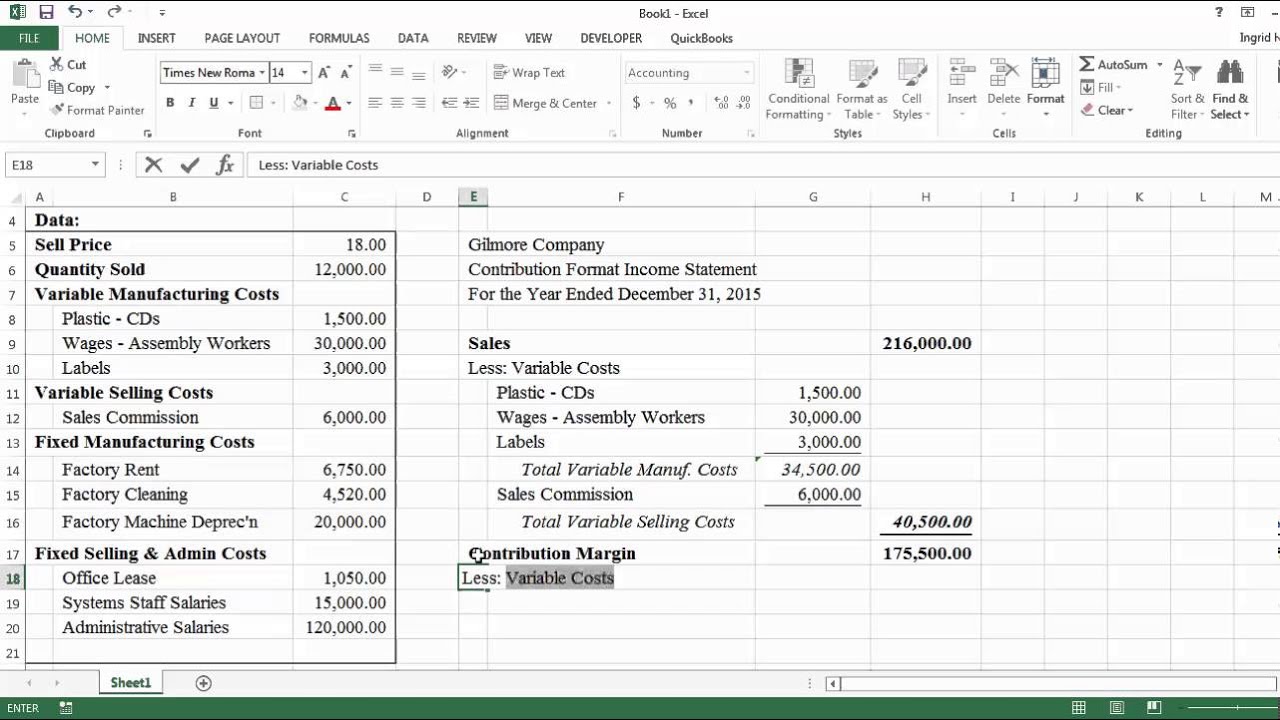

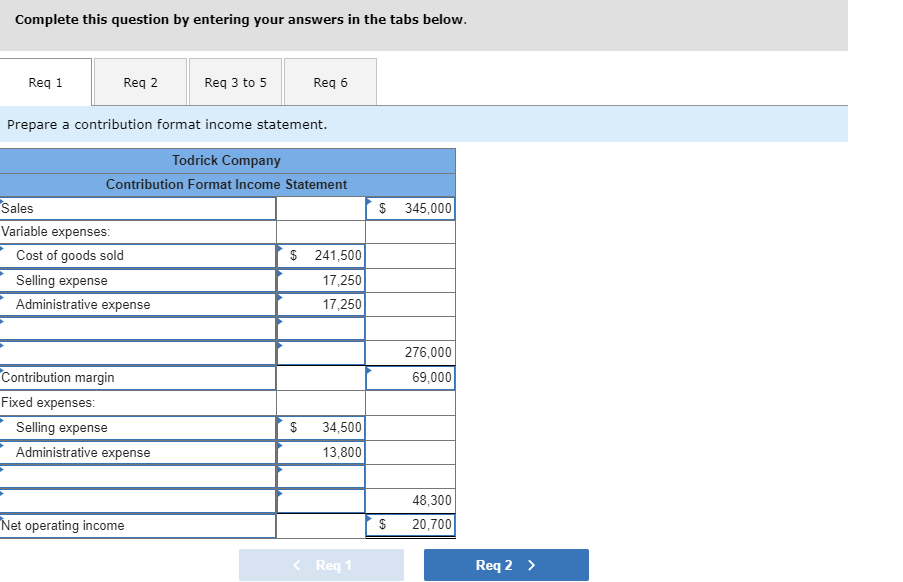

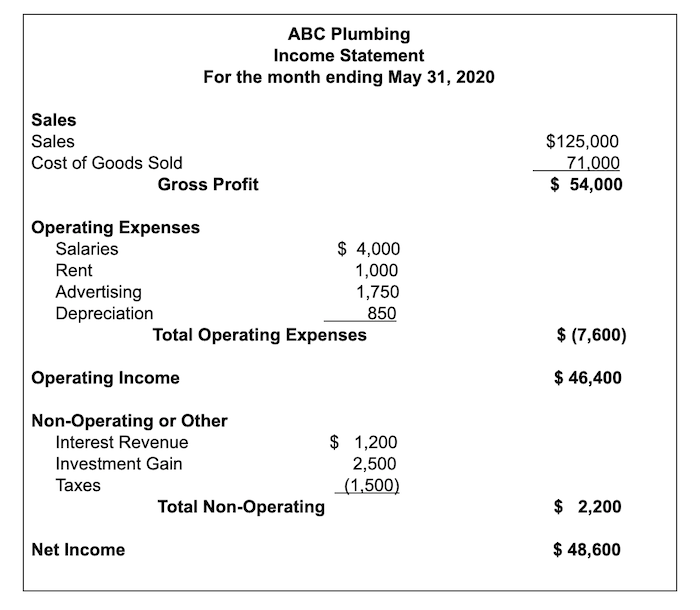

Contribution format income statement mcgraw hill. Prepare an income statement for the month using absorption costing. The traditional approach organizes costs by function. As explained in other modules mixed costs must be separated into their variable and fixed elements before a contribution margin income statement can be prepard.

In this article we shall discuss two main differences of two income statements the difference of format and the difference of usage. Contribution margin income statement takes the following form. The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses.

McGraw-Hill Global Education Intermediate Holdings LLC Files on this page are PDF. Contribution Format Income Statement - YouTube. Profit Sales Variable expenses Fixed expenses 13.

Form 10-K PDF 843 KB 2014. Assuming the sales mix above do the following. To determine the ratio.

Updated August 21 2019. 200000 in variable costs its contribution margin would be 300000. Contribution Margin Income Statement The contribution margin income statement separates expenses into fixed and variable categories.

Prepare a contribution format income statement for the year Complete this qetion by utering yor anwers in the tale belew Rqnd en 2 nt Asssme that the compy peodces and sells 83000 s daring the year atllng price of S1036 per nt Pepre aciin fwt incone tatemnt for the ye ences Harrig Company Contribution Format Income Statement. Form 10-K PDF 127 MB Follow McGraw Hill. Contribution Margin Net Sales Revenue Variable Costs.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)