Ideal Deferred Tax Calculation Example Excel Uk

The depreciation expense each year will be 3000 3 1000.

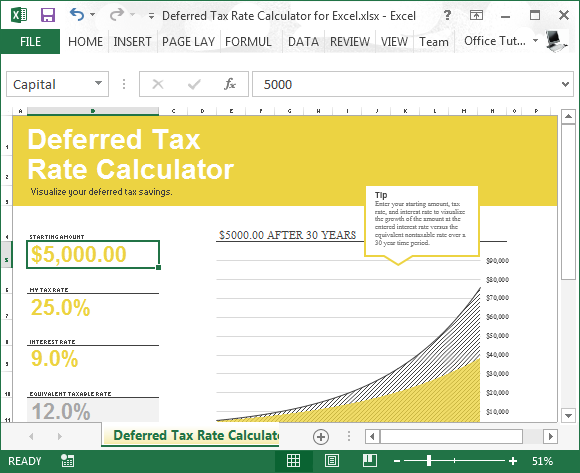

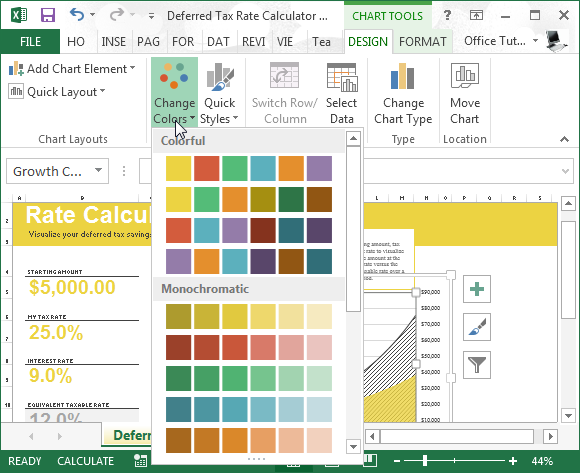

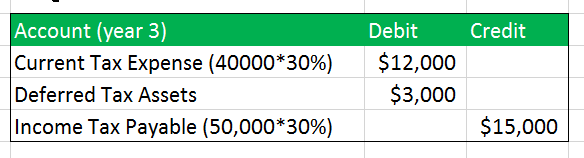

Deferred tax calculation example excel uk. Purpose of deferred tax. Would my deferred calculation be as follows. An excel sheet to better understand the deferred tax calc xls Submitted By.

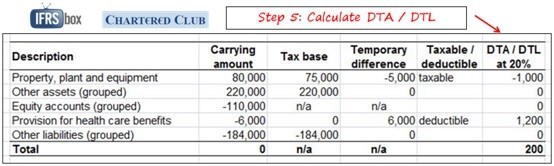

So at the year end the balance is 1700. The 122000 and 100000 reflect the erosion of the 11000 personal allowance by 1 for every 2 over 100000. Company A pays tax at 20.

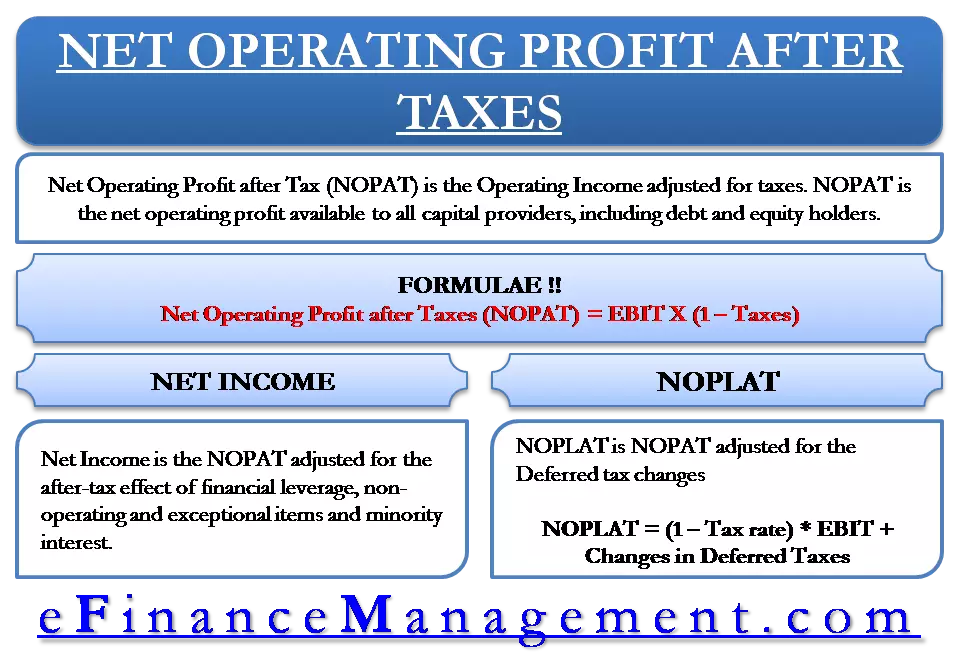

What is future taxable profit for the recognition test. Ps income tax rate for all. Excel Spreadsheet to calculate CT Frank Ahearn Wrote Following a large number of requests by email a copy of my spreedsheet has been sent to John Stokdyk of AccountingWEB.

Deferred tax simple example. Other files by the user. I am preparing a first years set of accounts.

Applying the IAS 12 amendments January 2016. An excel sheet to better understand the deferred tax calc. Ad Get MOT and Tax Information and Alerts For Up To 5 Vehicles.

They purchased 2000 worth of equipment with the depreciation policy being 15 SL. Suppose a business purchases equipment at a cost of 4000 which is subject to the following tax. Tax base 2000 less 2000 Nil.