Ace How Are Investments Presented On An Income Tax Basis Balance Sheet

The use of double-entry accounting or bookkeeping and.

How are investments presented on an income tax basis balance sheet. By keeping debt out of the consolidated balance sheet the company protects its credit rating. The accounting equation Assets Liabilities Owners Equity. The following items at a minimum are normally found in a balance sheet.

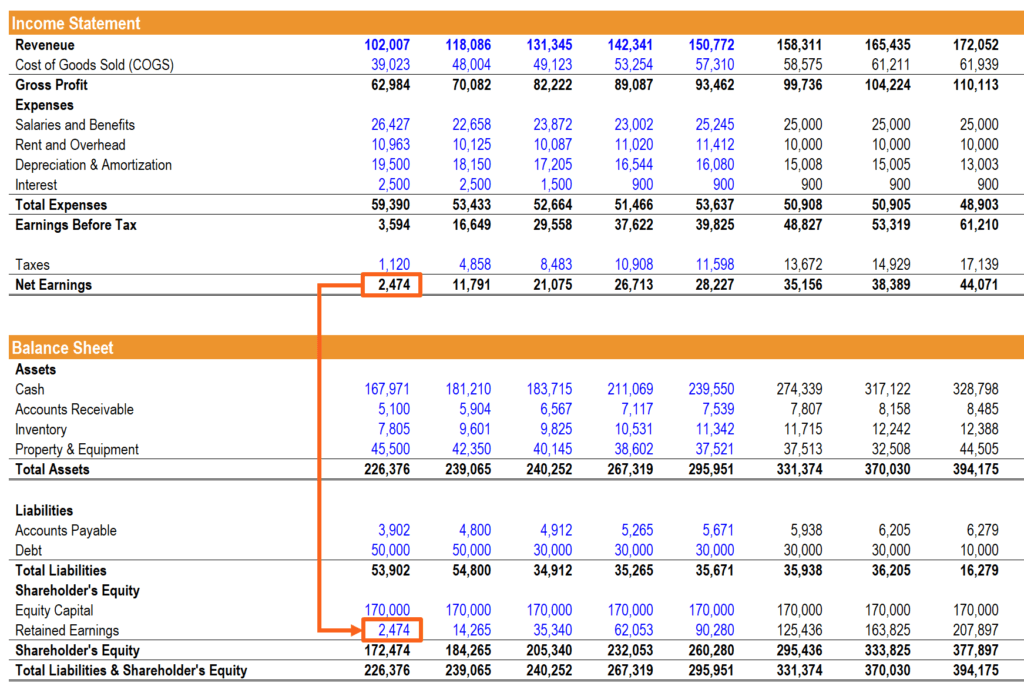

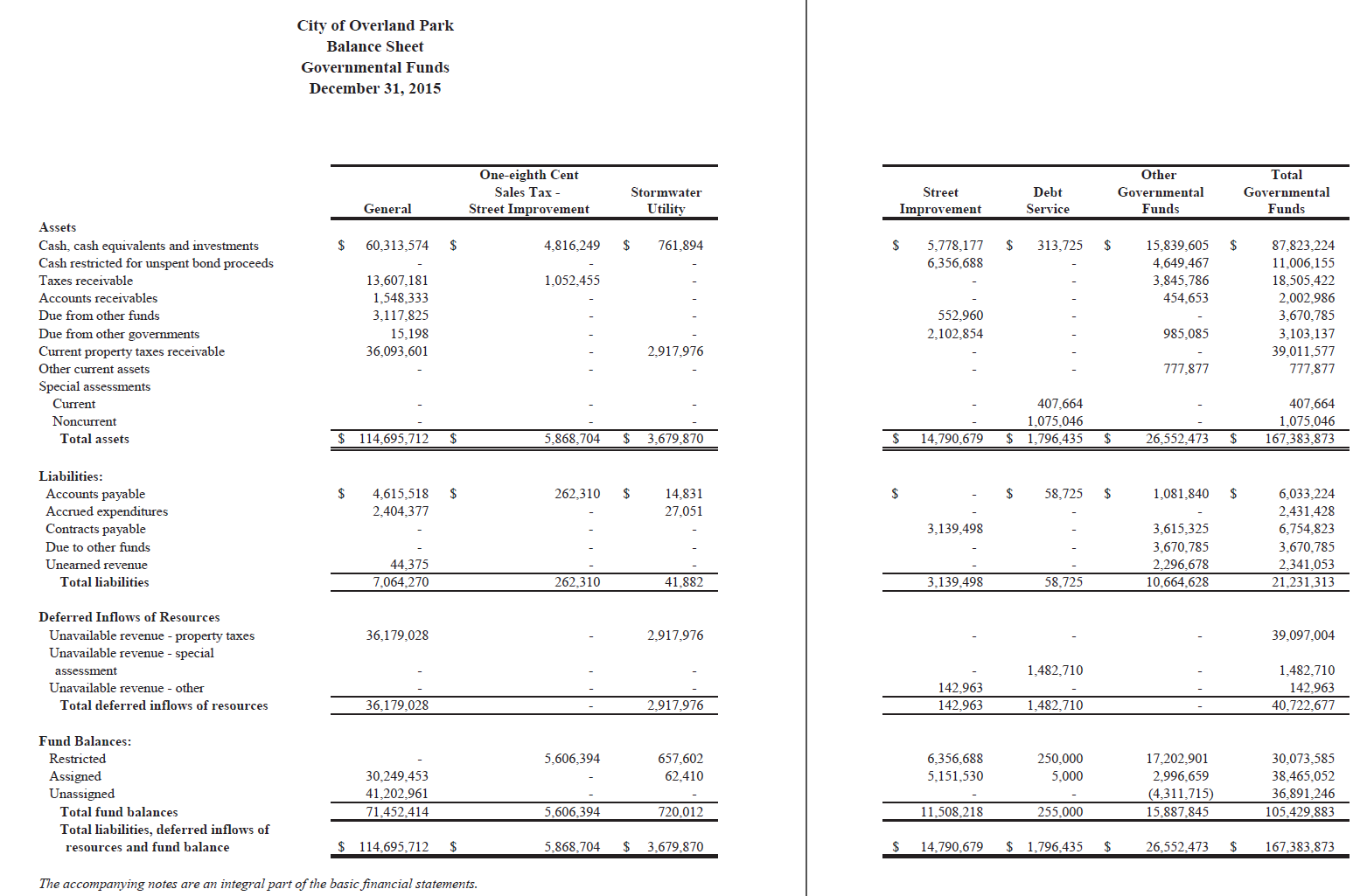

Cash and cash equivalents. Long-term investments on a balance sheet for instance are listed separately from short-term investments. The accounts that are reported on the Balance Sheet are shaded.

Look at our Balance Sheet below. For example a corporation may have its excess cash invested in an investment security that pays interest every six months. Assets held for sale.

Basically the income statement components have the following effects on owners equity. In general current deferred tax assets and liabilities should be combined together and presented as one net amount in the balance sheet. There is no specific requirement for the classifications to be included in the balance sheet.

Trade and other receivables. Debt and equity of the SPE from the consolidated balance sheet because such entities are typically designed with higher leverage ratios. The connection between the balance sheet and the income statement results from.

Investments are listed as assets but theyre not all clumped together. When leasing an asset it is recognized on the balance sheet at the present value of the future lease payments usually measured at the companys incremental borrowing cost. Therefore when negotiating operating agreements with investors or loan documents with lenders you may want to consider incorporating the option of using the income tax basis of accounting into these agreements.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)