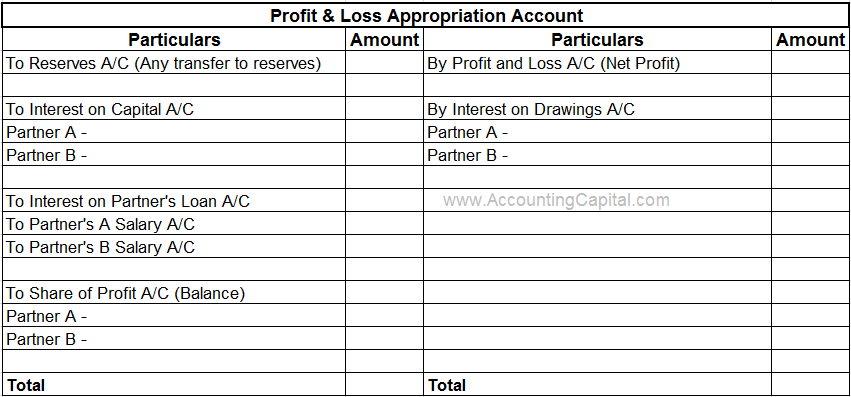

Smart Format Of P And L Appropriation Account

Basit and Laiba are partners in a firm sharing profit in the ratio of 32.

Format of p and l appropriation account. PL Appropriation account helps to show a clear distinction between the capital contribution of each partner and the changes thereafter. Tweet Append below are two snapshots of profit and loss appropriation account applicable to partnership and limited company. Drawing by the partners and the interest thereupon.

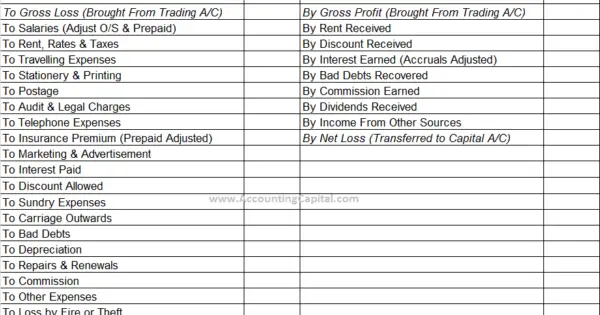

Profit and Loss Appropriation Account PL App. To Profit and loss account ac Being the accounts of all the incomes closed 3. To Expenses Ac individually Being the accounts of all the expenses closed 2.

Format of Profit and loss appropriation account The following is the format of profit and loss appropriation account. Profit and loss account ac. PL Appropriation AC for the Year Ended 3112XXXX Following are the adjustmentsitems included in this account.

PL account is prepared by all types of businesses. To Salaries to Partners. By Profit Loss Ac Profit transferred from P L Ac before charging Salary interest.

A Simple PL Appropriation Account. PL account is used to determine Net Profit or Net Loss of an organization for a given accounting period. To segregate charges and appropriations of profits being made to the profit and loss account the PL ac is divided into two by creating a new account by name Profit and Loss Appropriation ac.

To Commission to Partners. Study more about Profit and Loss Appropriation Account Problem 2. To Capital Ac Being net profit transferred 4.